- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

|

Home >

News & Policies >

January 2005

|

For Immediate Release

Office of the Press Secretary

January 11, 2005

President Participates in Conversation on Social Security Reform

Andrew W. Mellon Auditorium

Washington, D.C.

10:50 A.M. EST

THE PRESIDENT: Listen, thanks for coming today. As you can see, I am joined by some fellow citizens here on the stage who have come to talk about one of the great causes of our generation, and that is how to strengthen and save Social Security for generations to come.

I know this is an issue that some would rather not be talking about. It's an issue that is kind of -- I think some think has got too much political danger attached to it, and so, therefore, let's just kind of, maybe, move it down to the next group of people coming to Washington, or maybe things will get better by ignoring it. That's not what I think. And today I want to talk about why we have an issue with Social Security, why I believe those of us who have been elected to office have an obligation to do something about it, and then I want -- and give some ideas, some constructive ideas to Congress as to how to deal with the issue, and then I want others to share with me their ideas.

And we've got some people who have come a long way -- flown all the

way to Washington, D.C., to share some thoughts with the President.

And I think you'll find their stories interesting. I certainly did,

when we had a little discussion a little bit ago.

And we've got some people who have come a long way -- flown all the

way to Washington, D.C., to share some thoughts with the President.

And I think you'll find their stories interesting. I certainly did,

when we had a little discussion a little bit ago.

First, let me tell you how much, I understand, Social Security has meant for generations of Americans. I mean, Franklin Roosevelt, in thinking boldly, envisioned a Social Security system where Social Security would help seniors with their retirement. And the system worked for a lot of people. And it's been a -- an incredible achievement, if you think about a piece of legislation being relevant for nearly 70 years.

The problem is, is that times have changed since 1935. Then, most women did not work outside the house, and the average life expectancy was about 60 years old -- which for a guy 58 years old, must have been a little discouraging. (Laughter.) Today, Americans, fortunately, are living longer and longer. I mean, we're living way beyond 60 years old, and most women are working outside the house. Things have shifted.

The Social Security system is not a personal savings account. The Social Security system is not an account where money is earned. The Social Security system is an account where money comes out to pay for retirees and is put in the system by people who are working. And that's changed. More and more retirees have taken out money relative to the number of people putting money in. In the '50s, there were 16 workers for every beneficiary. So the system was in pretty good shape. Today, there's three workers for every beneficiary. Relatively quickly, there's going to be two workers for every beneficiary. And that's a problem. And that's a problem because in the year 2018, in order to take care of baby boomers like me and -- (laughter) -- some others I see out there -- (laughter) -- the money going out is going to exceed the money coming in.

That's not a good thing. It means that you're either going to have

to raise the taxes of people, or reduce the benefits. And the longer

you wait, the more severe the pain is going to be to fulfill the

promise for a younger generation of workers coming up. As a matter of

fact, by the time today's workers who are in their mid-20s begin to

retire, the system will be bankrupt. So if you're 20 years old, in

your mid-20s, and you're beginning to work, I want you to think about a

Social Security system that will be flat bust, bankrupt, unless the

United States Congress has got the willingness to act now. And that's

what we're here to talk about, a system that will be bankrupt.

That's not a good thing. It means that you're either going to have

to raise the taxes of people, or reduce the benefits. And the longer

you wait, the more severe the pain is going to be to fulfill the

promise for a younger generation of workers coming up. As a matter of

fact, by the time today's workers who are in their mid-20s begin to

retire, the system will be bankrupt. So if you're 20 years old, in

your mid-20s, and you're beginning to work, I want you to think about a

Social Security system that will be flat bust, bankrupt, unless the

United States Congress has got the willingness to act now. And that's

what we're here to talk about, a system that will be bankrupt.

Now, I readily concede some would say, well, it's not bankrupt yet; why don't we wait until it's bankrupt? The problem with that notion is that the longer you wait, the more difficult it is to fix. You realize that this system of ours is going to be short the difference between obligations and money coming in, by about $11 trillion, unless we act. And that's an issue. That's trillion with a "T." That's a lot of money, even for this town.

And so I'm looking forward to working with Congress to act. We've got an expert from the Social Security system that will talk about "the problem." And I'm going to talk about "the problem." You know, the problem is that some in Congress don't see it as the problem. They just kind of think that maybe things will be okay. But the structure of Social Security is such that you can't avoid the fact that there is a problem. And now is the time to get something done.

Now, I've talked about this, and I want the people to clearly understand, if you're a senior receiving your Social Security check, nothing is going to change. Those days of politicizing Social Security, I hope, are in the past. A lot of people who ran for office and if they even mentioned the word, Social Security, there would be TV ads and flyers and people knocking on doors saying, so-and-so is going to ruin Social Security for you. There is plenty of money in the system today to take care of those who have retired or near retirement. The issue really is for younger folks.

That's why we've got some younger folks up here. Not all of us are younger folks, are we? (Laughter.) Most of them are younger folks. I no longer qualify. (Laughter.) But younger people are listening to this issue. You know, I've traveled a lot. I campaigned on this issue of Social Security, and the need to strengthen it and reform it. I didn't shy away from it in 2000; I certainly didn't shy away from it in 2004. I laid it out there for the people to hear. I said, vote for me, and I'm going to work with Congress, see if we can't get something done to solve the system.

This is part of what -- this is part of fulfilling a campaign pledge. I wouldn't be sitting here if the people said, we don't want anybody to touch it; we think it's okay. Most younger people in America think they'll never see a dime. That's probably an exaggeration to a certain extent, but a lot of people who are young, who understand how Social Security works, really do wonder whether they'll see anything. My attitude is, once we assure the seniors who will receive Social Security today that everything is fine, I think we've got a shot to get something done, because younger Americans really want to see some leadership.

I said we're not going to run up the payroll taxes. I think running up payroll taxes will slow down economic growth. This economy is beginning to kick in, it's beginning to make sense. I think we can solve the problem without increasing payroll taxes. (Applause.)

I also threw out another interesting idea -- it's certainly not my idea, because others have talked about it, and that is to allow younger workers, on a voluntary basis, to take some of their own money and set it aside in the form of a personal savings account -- a personal savings account which is their own; a personal savings account which would earn a better rate of return than the money -- their money currently held within the Social Security trust; a personal savings account which will compound over time and grow over time; a personal savings account which can't be used to bet on the lottery, or a dice game, or the track. In other words, there will be guidelines. There will be certain -- you won't be allowed just to take that money and dump it somewhere. In other words, there will be a safe way to invest, to be able to realize the compounding rate of interest.

I've heard some say, well, this is risky to allow people to invest their own money. It's risky to let people say, you can take your money that's supposed to be for a retirement account and put it on the lottery, I realize that. But it's not risky. Federal employees -- the Thrift Savings plans invest under certain guidelines, and I don't hear them screaming it's risky. It makes sense to try to get a better rate of return on your money, if you expect there to be a Social Security system which is going broke. And that's what we're talking about.

Owning your own personal savings account does two other things. One, it allows you to pass on your savings to whoever you choose. You can't do that in Social Security today. If you pass away earlier than expected, that money that you put in the system is gone. And at the same time that you manage your own account, you own your own account. I love promoting ownership in America. I like the idea of encouraging more people to say, I own my own home, I own my own business, I own and manage my health accounts, and now I own a significant part of my retirement account. Promoting ownership in America makes sense to me to make sure people continue to have a vital stake in the future of our country.

And so I want to thank you all for coming today to give me a chance to address the Social Security issue. I plan on talking about it a lot. This isn't the first time I've talked about it since the campaign is over, and it's certainly not going to be the last, because I believe it is a vital issue. And I know that if we don't address the problem now, it will only get worse with time. And I believe there is a fundamental duty, for those of us who have been given the honor of serving the American people, to solve problems before they become acute, and not to pass them on to future Presidents and future generations.

Now, I want to talk to Andrew Biggs. He is the Associate Commissioner for Retirement Policy at the Social Security Administration. To me, that says, expert. (Laughter.) I don't know if that's fair to call you an expert or not.

* * * * *

THE PRESIDENT: Yes, that's good. How old are you?

MR. BIGGS: I'm 37.

THE PRESIDENT: Man, I wish I was 37. (Laughter.) Thirty-seven, talking to the President. That's great. (Laughter.) You ought to be concerned. I mean, you're one of these people -- yes, good. Well, I appreciate you helping.

You see, what he just said is, there is a problem. I happen to believe people who have been elected to office who ignore problems will face the price at the ballot box. I think more and more people recognize we have a problem. We've got a 37-year-old person here describing a problem. More and more people understand we have a problem. And the more people see it, the more it's expected we do something about it. And as Andrew said, he said, we better start now. That's why it's important that we have this dialogue. And that's why I'm going to continue dialoguing and talking to the leadership in Congress about, let's solve it now, let's do our duty.

Let me talk to Scott Ballard. He is from the great state of Washington. That's a long way away.

MR. BALLARD: That's right.

THE PRESIDENT: Brought your lads with you, I noticed.

MR. BALLARD: Yes.

THE PRESIDENT: Your sons. Yes, they had never been to Washington -- I said, have you ever been to Washington? He said, I live in Washington. (Laughter.)

MR. BALLARD: Yes. (Laughter.)

THE PRESIDENT: Pretty good line, you know? I meant, the District of Columbia, Washington. So what do you do, Scott?

MR. BALLARD: Well, my brother and I own and operate a private ambulance service. It was started by our parents in 1967. And my brother and I purchased it from them in 1986.

THE PRESIDENT: And why are you here? Besides bring your lads to the other Washington?

MR. BALLARD: Right. Well, first of all, I'm in a fairly unique situation, in that probably two-thirds of our customers are on Social Security. Yet the majority of my work force are in their early 20s, some of them are in their early 30s. So we have a lot of people that I work with currently who are on Social Security, and a lot of younger employees who will be impacted by these proposed changes.

THE PRESIDENT: So, like, if they were here, what would your younger employees say about Social Security? Do they ever talk about it? Do they ever think about it, do they ever --

MR. BALLARD: Not really. They don't talk about it too much, but I think if some of the changes that you are proposing are implemented, I think they will talk about it a lot more, and I think they'll take a much greater interest in it. We've seen that with our company 401(k) plan. Most of them, they don't talk about retirement at all, but once they start seeing something on paper, saying, oh, that's mine, and it's been in there a few years and they start to see it build, they become more interested in it, and they start doing whatever they can to manage it and make it grow so it's there when they retire.

THE PRESIDENT: That's kind of an interesting thought, isn't it -- when you see it on paper, the value of something, you begin to actually pay attention to what causes values to go up -- good policies that enhance growth. And what Scott just said is, he talked about the first change in retirement in America was the movement toward defined contribution plans, which 401(k)s, which really has promoted an ownership society, hasn't it? I mean, people wake up and they look at their account, and say, I'm so sure this person's policies are beneficial to my being able to earn a better rate of return. You pay attention because it's their own money. It's one of the benefits of a personal account in Social Security.

* * * * *

THE PRESIDENT: Right. Good. I appreciate you sharing that. (Applause.) Make sure you tell your customers -- tell your customers, nothing changes with Social Security for them. And tell your younger workers, they can do something about it. They can write their senators, they can write their congresspeople. You can let them know you expect the members of the United States Congress to hear the fact that there's a problem, and then to do something about it. That's what they can do.

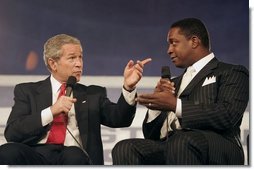

We've got with us Bob McFadden. Looking sharp. (Laughter.) I didn't come close, I know. (Laughter.) Thanks for coming. I appreciate you taking time to be here. You are from Medford, New Jersey.

MR. McFADDEN: Yes, sir.

THE PRESIDENT: And why have you come from Medford, New Jersey to share some thoughts?

* * * * *

THE PRESIDENT: The 1 or 2 percent that the money inside the Social Security trust now earns -- is that right? Is he right at -- is it even as high as 1 percent?

MR. BIGGS: No, it's -- right now it is low because interest rates are low. Over the long-term, we're looking at around 3 percent. So you still do have a --

THE PRESIDENT: So it's more than double. But right now, it's, like -- yes, never mind. (Laughter.) Don't worry about it. (Laughter.) You can still keep your job. (Laughter.) Go ahead. Seven and a half percent since 1924. That's a great rate of return. Imagine if you're 50 years old and you start -- if you start -- if you hold that money for 50 years at that rate, it compounds and grows and ends up being a lot of money, is what you're saying.

MR. McFADDEN: Yes, sir.

THE PRESIDENT: Yes, okay. I'm glad I invited you. (Laughter.)

* * * * *

THE PRESIDENT: Let me say this. You brought up a very interesting point. There's kind of an assumption that only a certain group of people at a certain income can manage an account. It's -- it's as if you've got to have a net worth of "X" before savings becomes a real part of your life. I reject that. Bob rejects that.

Secondly, the interesting -- there's a -- African American males die sooner than other males do, which means the system is inherently unfair to a certain group of people. And that needs to be fixed. It's not a -- (applause.)

MR. McFADDEN: I agree, Mr. President, because from the minimal research that I've done, the average African American male right now is -- the life expectancy is 69, and I may be off a little bit. But if you're telling me that it's 69, and the age is going to go to 67, you do the math. (Laughter.)

THE PRESIDENT: Right.

MR. McFADDEN: That's two years. (Laughter.)

THE PRESIDENT: Glad you came. Thanks. Welcome, girls. Glad you all came. (Applause.)

Okay, I thought we would try to find somebody who represents the youth movement. I'm not saying you all are old, but we have found us a dairy farmer from the great state of Utah, Josh Wright. Welcome, Josh. Thanks for coming. He asked me if I could fix the BCS -- (laughter and applause.) No, I'm not going there, Josh. I'm staying on Social Security. It may be a little easier to fix, anyway. (Laughter.)

MR. WRIGHT: But he said that they wouldn't be able to take Texas, and --

THE PRESIDENT: Wait a minute. You don't need to talk about private conversations. (Laughter.) Okay, you're a dairy farmer?

MR. WRIGHT: That's correct.

THE PRESIDENT: Good. Milking those cows.

MR. WRIGHT: Yes. Not today, obviously. I made my dad stay home and do it. But we have a dairy farm in central Utah, and you can fit the whole town in this building here.

THE PRESIDENT: Kind of like Crawford.

MR. WRIGHT: There's a lot more cows than there are people, so I spend a lot of time talking to animals. (Laughter.)

THE PRESIDENT: Are they talking back yet? (Laughter.) When they start talking back, give me a call. (Laughter.)

MR. WRIGHT: Not when I have a stick in my hand, they don't say a lot. (Laughter.)

* * * * *

THE PRESIDENT: Do you think he's listening? Have they got C-SPAN out there in Utah?

MR. WRIGHT: I don't know. (Laughter.)

THE PRESIDENT: See that red dot? That's him, if he's listening.

MR. WRIGHT: He's probably watching the horse channel. He loves that channel. (Laughter.)

THE PRESIDENT: I appreciate you coming.

MR. WRIGHT: Thank you for letting me.

THE PRESIDENT: If nothing happens, at your age, it will be bust by the time it comes time for you to retire. That's why we have a person in the mid-20s here -- besides the fact the guy's got a pretty good sense of humor. (Laughter.) If nothing takes place, if Congress says, oh, don't worry, we'll just push it down the road; why do we need to deal with it, there's no crisis -- if nothing happens, and we don't start moving on it now, by the time Josh gets to retirement age, the system will be flat broke.

And that's not right, it doesn't seem like to me. It seems like people who have been elected to office must say, we want it to be wholesome and healthy, like it has been for other generations. Oh, I know there's a lot of politics here in Washington, and people are -- some are afraid to touch it, some don't want to touch it, some provide excuses not to touch it. I know, I've heard it before. But I believe that the President has a responsibility for setting the agenda, and I believe people who have been elected to the House of Representatives and the United States Senate has an obligation to confront problems head on. (Applause.)

By the way, tell the old man, 1946 was a great year.

MR. WRIGHT: It was a great year.

THE PRESIDENT: You wouldn't be sitting here if it wasn't, you know. Anyway. (Laughter.)

We've got a mom and her daughter with us. I'm so glad you both came. Thanks for being here. Sonya is the daughter. Rhoda is the mom. And I want the Stone women to talk about their lives and how it relates to Social Security. If you don't mind, Sonya, why don't you start? What do you do?

MS. STONE: Sure. I'm a chief financial officer for a firm here in Washington. But I'm really here as a mom. I happen to be a divorced mom, raising three children -- two wonderful boys, Jeff and Eric, that are here with me -- and I have a beautiful daughter, Emily, who is also here with me. She's nine years old. Emily has been severely disabled since birth, both mentally and physically, and she will be dependent on Social Security for her lifetime. And I would like to make sure that Social Security is going to be there for her as its been for my mother.

THE PRESIDENT: Good. A CFO, like, you know something about numbers?

MS. STONE: I know a little bit about numbers, and I --

THE PRESIDENT: I presume you've looked at the numbers.

MS. STONE: I have looked at the numbers. And I would very much like to see the current Social Security system improved with the establishment of personal accounts, so that families could harness the power of the capital markets to allow them to build a nest egg over the course of their lifetimes that could then be passed on to their families. And I know that if my father, who paid in for over 40 years, had had the opportunity to establish an account like that, that would then have grown and survived him, and been available to not only provide for my mom, but ultimately for his grandchildren and his granddaughter, who he never knew, I think that would have made him very happy.

THE PRESIDENT: Sure. I think it's important for people to understand compounding rate of interest. In other words, if you take a dollar, set it aside and it grows at three percent over 30 years or 40 years, and compare that to the same dollar that grows at 7 percent on an average basis over 30 years, there is a huge difference in money.

So it matters how much money -- how much interest, or how much rate of return your money earns. We're kind of throwing around these words as if everybody understands compounding rate of interest and rate of return, but what people need to understand is that the money that's now -- your money in the government is earning much less than it's capable of generating under safe conditions. Safe conditions -- I think that's what you're saying.

MS. STONE: That's what I'm saying. And I would just add that, as a mom, I know what it's like to lay awake at night and worry about the future of your children. And I know one thing about moms, they know how to make tough choices; we make them every day, on everything from health care to education to which bill to pay next. And I think we understand that whenever you're faced with a difficult problem, the sooner you start and the more honest you are about the nature of the problem, the greater chance you have of success. So I'm very hopeful that we would get started.

THE PRESIDENT: Good, thanks. Well done. (Applause.) Now what about your -- introduce your mom.

MS. STONE: I would like to introduce my mom. This is my mother, Rhoda Stone. And she is grandmother of three, and originally from Helsinki, Finland, and has been here over 40 years.

THE PRESIDENT: Fantastic. Same age as my mother.

MS. STONE: Just turned 80.

THE PRESIDENT: Is she still giving you instructions?

MS. STONE: Every day, and I do my best.

THE PRESIDENT: It never stops, does it? (Laughter.) No.

MRS. STONE: It shouldn't stop.

THE PRESIDENT: That's right. (Laughter.) Let her rip.

* * * * *

THE PRESIDENT: Thank you for saying that. Good job.

Yes, I think one of the interesting things that Rhoda talked about is the need for people to understand that Social Security is a part of retirement income. That's why it was created, and therefore, the idea of developing the habits early -- necessary to make sure you've got that which is necessary to live on, such as saving money, is important. I happen to believe that once personal savings accounts are part of the Social Security system, that it will encourage other savings to take place, as well. People will be able to see the benefits of savings, understand how important it is as a dad to, say, two beautiful little girls, to start setting aside money for college education is a way to save, not necessarily for retirement in this case, but to be a good -- to be a good dad and do your duty as a father.

And so I appreciate that point. In other words, it's a point that says that people have got to understand you have a responsibility to set aside money so that you can live comfortably. And it worked in your case. Thankfully you had a wise husband.

MS. STONE: I wish we would have had a chance to put --

THE PRESIDENT: As additional -- as addition to the savings you set aside out of the personal savings accounts. I agree.

And that's -- so it's a -- this is a -- I hope you've -- I hope you have come away with a better understanding of the importance of this issue. I mean, we've got people of all generations here, people who say, look, this is an issue. And the fundamental question confronting the people elected to the United States Congress is, will they act? I will assure you, I'm going to ask them to act. I think that one of the reasons I'm sitting here is because I said to the people of the country, we have an issue with Social Security, we have a problem, I think it's important to be a problem solver; give me four more years, and I intend to work with people of both parties and solve problems. And there is a problem with Social Security. (Applause.)

I see a problem. I also see a solution. And I realize that it's going to require bipartisan cooperation. And I look forward to working with members of both political parties in both Houses, to come together and do our duty. (Applause.) I realize it's not going to be easy. This isn't easy. If it were easy, it would have already been done. It kind of makes it fun, though, doesn't it? Take on the tough jobs.

Members who will work -- constructively work with us will be able to look back and say, I did my duty. I came to Washington to be more than just a place holder. I came to Washington to analyze a problem, to deal with a problem, and to leave a legacy behind of fixing the problem. And so I'm looking forward to working with the members of Congress.

I want to thank our panelists who are here. I want to thank our audience for coming. May God bless you all. (Applause.)

END 11:33 A.M. EST