Note: Click Figure images to enlarge.

CIRCULAR NO. A-76

REVISED

TO THE HEADS OF EXECUTIVE DEPARTMENTS AND ESTABLISHMENTS

SUBJECT: Performance of Commercial Activities

1. Purpose. This circular establishes federal policy for the competition of commercial activities.

2. Supersession. This circular supersedes Office of Management and Budget (OMB) Circular No. A-76 (Revised 1999), August 4, 1983; Circular No. A–76 Revised Supplemental Handbook (Revised 2000), March 1996; Office of Federal Procurement Policy Letter 92-1, “Inherently Governmental Functions,” September 23, 1992; and OMB Transmittal Memoranda 1 through 25, Performance of Commercial Activities.

3. Authority. Reorganization Plan No. 2 of 1970 (31 U.S.C. § 1111); Executive Order 11541; the Office of Federal Procurement Policy Act (41 U.S.C. § 405); and the Federal Activities Inventory Reform (FAIR) Act of 1998 (31 U.S.C. § 501 note).

4. Policy. The longstanding policy of the federal government has been to rely on the private sector for needed commercial services. To ensure that the American people receive maximum value for their tax dollars, commercial activities should be subject to the forces of competition. In accordance with this circular, including Attachments A-D, agencies shall:

a. Identify all activities performed by government personnel as either commercial or inherently governmental.

b. Perform inherently governmental activities with government personnel.

c. Use a streamlined or standard competition to determine if government personnel should perform a commercial activity. [See OMB Memorandum M-08-11 (February 20, 2008), number 4, when applying this provision.]

d. Apply the Federal Acquisition Regulation (FAR), 48 C.F.R. Chapter 1, in conjunction with this circular, for streamlined and standard competitions.

e. Comply with procurement integrity, ethics, and standards of conduct rules, including the restrictions of 18 U.S.C. § 208, when performing streamlined and standard competitions.

f. Designate, in writing, an assistant secretary or equivalent level official with responsibility for implementing this circular, hereafter referred to as the competitive sourcing official (CSO). Except as otherwise provided by this circular, the CSO may delegate, in writing, specified responsibilities to senior-level officials in the agency or agency components.

g. Require full accountability of agency officials designated to implement and comply with this circular by establishing performance standards in annual performance evaluations.

h. Centralize oversight responsibility to facilitate fairness in streamlined and standard competitions and promote trust in the process. Agencies shall allocate resources to effectively apply a clear, transparent, and consistent competition process based on lessons learned and best practices. Lessons learned and best practices resulting from a streamlined or standard competition process shall be posted on SHARE A-76!

i. Develop government cost estimates for standard and streamlined competitions in accordance with Attachment C using the COMPARE costing software. Agencies shall not use agency budgetary estimates to develop government cost estimates in a streamlined or standard competition.

j. Track execution of streamlined and standard competitions in accordance with Attachment B.

k. Assist adversely affected federal employees in accordance with 5 C.F.R. Parts 330 and 351. The statutory veterans' preference for appointment and retention (5 U.S.C. §§ 1302, 3301, 3302, 3502) applies to actions taken pursuant to this circular.

l. Not perform work as a contractor or subcontractor to the private sector, unless specific statutory authority exists or the CSO receives prior written OMB approval.

5. Scope.

a. Except as otherwise provided by law, this circular shall apply to executive departments named in 5 U.S.C. § 101 and independent establishments as defined in 5 U.S.C. § 104. These departments and independent establishments are referred to in this circular as “agencies”. Except as otherwise provided by law, this circular shall apply to military departments named in 5 U.S.C. § 102.

b. As provided by Attachment A, the CSO may exempt a commercial activity performed by government personnel from performance by the private sector.

c. The CSO (without delegation) shall receive prior written OMB approval to deviate from this circular (e.g., time limit extensions, procedural deviations, or costing variations for a specific streamlined or standard competition, or inventory process deviations). Agencies shall include any OMB approved deviations in the public announcement and solicitation for a streamlined or standard competition. Agencies are encouraged to use this deviation procedure to explore innovative alternatives to standard or streamlined competitions, including public-private partnerships, public-public partnerships, and high performing organizations.

d. A streamlined or standard competition is not required for private sector performance of a new requirement, private sector performance of a segregable expansion to an existing commercial activity performed by government personnel, or continued private sector performance of a commercial activity. Before government personnel may perform a new requirement, an expansion to an existing commercial activity, or an activity performed by the private sector, a streamlined or standard competition shall be used to determine whether government personnel should perform the commercial activity. [See OMB Memorandum M-08-11 (February 20, 2008), number 4, when applying this provision.]

e. The CSO shall identify savings resulting from completed streamlined and standard competitions in accordance with OMB Circular No. A-11, Preparation, Submission, and Execution of the Budget.

f. This circular shall not be construed to alter any law, executive order, rule, regulation, treaty, or international agreement.

g. Noncompliance with this circular shall not be interpreted to create a substantive or procedural basis to challenge agency action or inaction, except as stated in Attachments A and B.

h. The Department of Defense CSO (without delegation) shall determine if this circular applies to the Department of Defense during times of a declared war or military mobilization.

6. Effective Date. This circular is effective upon publication in the Federal Register and shall apply to inventories required, and streamlined and standard competitions initiated, after the effective date.

7. Transition. Agencies shall apply the following transition procedures to direct conversions and cost comparisons, including streamlined cost comparisons, initiated but not completed by the effective date of this circular.

a. Agencies shall convert initiated streamlined cost comparisons and direct conversions to streamlined or standard competitions under this revised circular.

b. Agencies shall convert initiated cost comparisons for which solicitations have not been issued prior to the effective date to standard competitions under this revised circular or, at the agency's discretion if permitted by this revised circular, to streamlined competitions.

c. The circular in effect prior to this revision shall govern cost comparisons for which solicitations have been issued, unless agencies, at their discretion, convert such cost comparisons to standard competitions under this revised circular, or, if permitted by this revised circular, to streamlined competitions.

d. In applying transition procedures, agencies shall not combine the requirements of this revised circular with those in the prior circular.

e. When complying with the transition procedures required by this paragraph, agencies shall make a public announcement within 30 days after the effective date of this revised circular pursuant to this transition paragraph. For conversions made at an agency's discretion, agencies shall make public announcement on the date the agency's decision takes effect.

8. Attachments.

Attachment

A -- Inventory Process

Attachment B -- Public-Private Competition

Attachment C -- Calculating Public-Private Competition

Costs

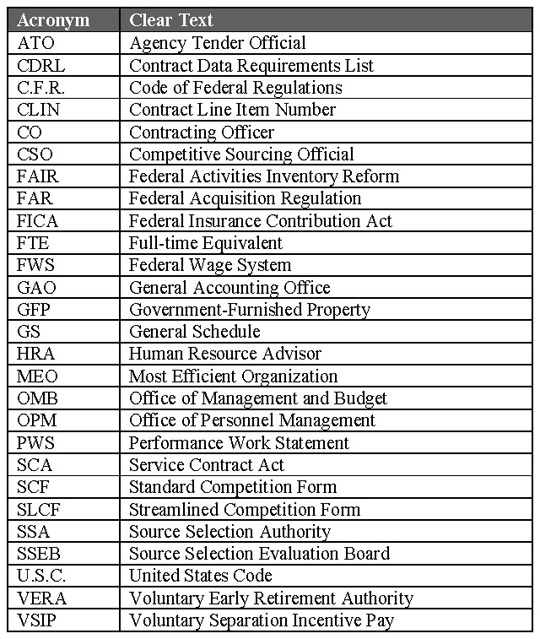

Attachment D -- Acronyms and Definitions

![]()

Mitchell E.

Daniels, Jr.

Director

1 This document reflects changes made by OMB Memorandum M-08-13, Update to Civilian Position Full Fringe Benefit Cost Factor, Federal Pay Raise Assumptions, and Inflation Factors used in OMB Circular No. A-76, “Performance of Commercial Activities" (March 11, 2008), and a technical correction made by OMB memorandum M-03-20, Technical Correction to OMB Circular No. A-76, "Performance of Commercial Activities” (August 15, 2003).

2 Please see OMB Memoranda M-04-12, Performance Periods in Public-Private Competitions (April 30, 2004), M-06-13, Competitive Sourcing under Section 842(a) of P.L. 109-115 (April 24, 2006), and M-08-11, Competitive Sourcing Requirements of Division D of Public Law 110-161 (February 20, 2008) when applying the following provisions of OMB Circular A-76: Paragraphs 4.c and 5.d; Attachment B, Paragraphs A.5, C.1.a, C.1.c, D.3.a(7), and D.5.b(3); Attachment C, Paragraphs A.5, A.12, C.3 and Section D.

INVENTORY PROCESS

A. INVENTORY REQUIREMENTS.

1. Agency Inventories. An agency shall prepare two annual inventories that categorize all activities performed by government personnel as either commercial or inherently governmental.

2. Annual Requirement. By June 30 of each year, an agency shall submit the following by electronic mail (e-mail) to OMB (a) an inventory of commercial activities performed by government personnel; (b) an inventory of inherently governmental activities performed by government personnel; and (c) an inventory summary report. An agency may provide aggregate data for uniformed services personnel and foreign nationals performing inherently governmental activities. For annual inventories, an agency shall use the format and data requirements found at the OMB web site (www.omb.gov).

3. OMB Review and Consultation. OMB shall, on an annual basis, review both agency inventories and consult with the agency regarding the content of both agency inventories.

4. Congressional and Public Notification. After OMB review and consultation, an agency shall make both inventories available to Congress and the public unless the inventory information is classified or otherwise protected for national security reasons. OMB shall publish a notice of availability in the Federal Register.

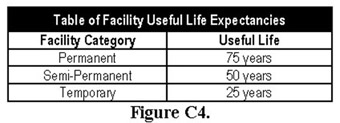

5. Inventory Summary Report. An agency shall submit an annual inventory summary in the format in Figure A1. to identify aggregate data. The total of the two agency inventories shall reasonably equate to an agency’s authorized personnel requirements. An agency shall make the annual inventory summary report available to the public unless the inventory information is classified or otherwise protected for national security reasons.

Fiscal Year XXXX Annual Inventory Summary |

|||||||||

Agency: |

Commercial Activity Inventory |

Inherently Governmental Inventory |

|||||||

FAIR |

Uniformed Services |

Foreign |

Other |

TOTAL |

Inherently |

Uniformed |

Foreign |

TOTAL |

|

Agency |

|||||||||

| Agency Component B |

|||||||||

| AGENCY TOTAL |

|||||||||

*Minus uniformed services personnel and foreign nationals |

|||||||||

Figure A1. |

|||||||||

B. CATEGORIZING ACTIVITIES PERFORMED BY GOVERNMENT PERSONNEL AS INHERENTLY GOVERNMENTAL OR COMMERCIAL.

1. Inherently Governmental Activities. The CSO shall justify, in writing, any designation of government personnel performing inherently governmental activities. The justification shall be made available to OMB and the public upon request. An agency shall base inherently governmental justifications on the following criteria:

a. An inherently governmental activity is an activity that is so intimately related to the public interest as to mandate performance by government personnel. These activities require the exercise of substantial discretion in applying government authority and/or in making decisions for the government. Inherently governmental activities normally fall into two categories: the exercise of sovereign government authority or the establishment of procedures and processes related to the oversight of monetary transactions or entitlements. An inherently governmental activity involves:

(1) Binding the United States to take or not to take some action by contract, policy, regulation, authorization, order, or otherwise;

(2) Determining, protecting, and advancing economic, political, territorial, property, or other interests by military or diplomatic action, civil or criminal judicial proceedings, contract management, or otherwise;

(3) Significantly affecting the life, liberty, or property of private persons; or

(4) Exerting ultimate control over the acquisition, use, or disposition of United States property (real or personal, tangible or intangible), including establishing policies or procedures for the collection, control, or disbursement of appropriated and other federal funds.

b. While inherently governmental activities require the exercise of substantial discretion, not every exercise of discretion is evidence that an activity is inherently governmental. Rather, the use of discretion shall be deemed inherently governmental if it commits the government to a course of action when two or more alternative courses of action exist and decision making is not already limited or guided by existing policies, procedures, directions, orders, and other guidance that (1) identify specified ranges of acceptable decisions or conduct and (2) subject the discretionary authority to final approval or regular oversight by agency officials.

c. An activity may be provided by contract support (i.e., a private sector source or a public reimbursable source using contract support) where the contractor does not have the authority to decide on the course of action, but is tasked to develop options or implement a course of action, with agency oversight. An agency shall consider the following to avoid transferring inherently governmental authority to a contractor:

(1) Statutory restrictions that define an activity as inherently governmental;

(2) The degree to which official discretion is or would be limited, i.e., whether involvement of the private sector or public reimbursable provider is or would be so extensive that the ability of senior agency management to develop and consider options is or would be inappropriately restricted;

(3) In claims or entitlement adjudication and related services (a) the finality of any action affecting individual claimants or applicants, and whether or not review of the provider’s action is de novo on appeal of the decision to an agency official; (b) the degree to which a provider may be involved in wide-ranging interpretations of complex, ambiguous case law and other legal authorities, as opposed to being circumscribed by detailed laws, regulations, and procedures; (c) the degree to which matters for decisions may involve recurring fact patterns or unique fact patterns; and (d) the discretion to determine an appropriate award or penalty;

(4) The provider’s authority to take action that will significantly and directly affect the life, liberty, or property of individual members of the public, including the likelihood of the provider’s need to resort to force in support of a police or judicial activity; whether the provider is more likely to use force, especially deadly force, and the degree to which the provider may have to exercise force in public or relatively uncontrolled areas. These policies do not prohibit contracting for guard services, convoy security services, pass and identification services, plant protection services, or the operation of prison or detention facilities, without regard to whether the providers of these services are armed or unarmed;

(5) The availability of special agency authorities and the appropriateness of their application to the situation at hand, such as the power to deputize private persons; and

(6) Whether the activity in question is already being performed by the private sector.

2. Commercial Activities. A commercial activity is a recurring service that could be performed by the private sector and is resourced, performed, and controlled by the agency through performance by government personnel, a contract, or a fee-for-service agreement. A commercial activity is not so intimately related to the public interest as to mandate performance by government personnel. Commercial activities may be found within, or throughout, organizations that perform inherently governmental activities or classified work.

C. REASON CODES FOR COMMERCIAL ACTIVITIES.

1. Annual Procedures. An agency shall use reason codes A-F, identified in Figure A2. below, to indicate the rationale for government performance of a commercial activity. Annual supplemental procedures for the use of these reason codes may be found at the OMB web site.

| The commercial activity is not appropriate for private sector performance pursuant to a written determination by the CSO. | |

| The commercial activity is suitable for a streamlined or standard competition. | |

| The commercial activity is the subject of an in-progress streamlined or standard competition. | |

| The commercial activity is performed by government personnel as the result of a standard or streamlined competition (or a cost comparison, streamlined cost comparison, or direct conversion) within the past five years. | |

| The commercial activity is pending an agency approved restructuring decision (e.g., closure, realignment). | |

| The commercial activity is performed by government personnel due to a statutory prohibition against private sector performance. | |

2. Reason Code A. The CSO may use reason code A to exempt commercial activities performed by government personnel from private sector performance. The CSO shall provide sufficient written justification for reason code A exemptions. These written justifications for the use of reason code A shall be available to OMB and the public, upon request.

D. INVENTORY CHALLENGE PROCESS. An agency shall implement the following inventory challenge process.

1. Designation of Inventory Challenge and Appeal Authorities. The head of the agency shall designate inventory challenge authorities and inventory appeal authorities as follows:

a. Inventory Challenges. Inventory challenge authorities shall be agency officials at the same level as, or a higher level than, the individual who prepared the inventory. Inventory challenge authorities shall review and respond to challenges of agency inventory decisions.

b. Inventory Appeals. Inventory appeal authorities shall be agency officials who are independent and at a higher level in the agency than inventory challenge authorities, and shall review and respond to appeals of inventory challenge decisions made by inventory challenge authorities.

2. Submission of an Inventory Challenge. After publication of OMB’s Federal Register notice stating that an agency’s inventories are available, an interested party shall have 30 working days to submit a written inventory challenge. The inventory challenge shall be limited to (a) the classification of an activity as inherently governmental or commercial, or (b) the application of reason codes. Function codes shall not be subject to the inventory challenge process. A written inventory challenge shall be submitted to agency inventory challenge authorities and shall specify the agency, agency component, agency organization, function(s), and location(s) for the activities being challenged.

3. Inventory Challenge Decision. Within 28 working days of receiving the inventory challenge, inventory challenge authorities shall (a) validate the commercial or inherently governmental categorization or reason code designation of the activity, in a written inventory challenge decision; and (b) transmit the inventory challenge decision, including the rationale for the decision, to the interested party. Inventory challenge authorities shall include an explanation of the interested party’s right to file an appeal in any adverse challenge decision.

4. Submission of an Appeal of an Inventory Challenge Decision. Upon receipt of an adverse inventory challenge decision, an interested party shall have 10 working days to submit a written appeal of this decision to inventory appeal authorities.

5. Inventory Appeal Decision. Within 10 working days of receipt of the appeal, inventory appeal authorities shall issue and transmit a written inventory appeal decision to the interested party. This inventory appeal decision shall include the rationale for the decision.

6. Inventory Changes. When the inventory challenge process results in a change to an agency inventory, the agency shall (a) transmit a copy of the change to OMB and Congress; (b) make these changes available to the public; and (c) publish a notice of public availability in the Federal Register.

PUBLIC-PRIVATE COMPETITION

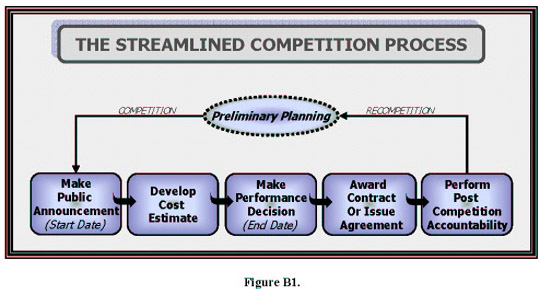

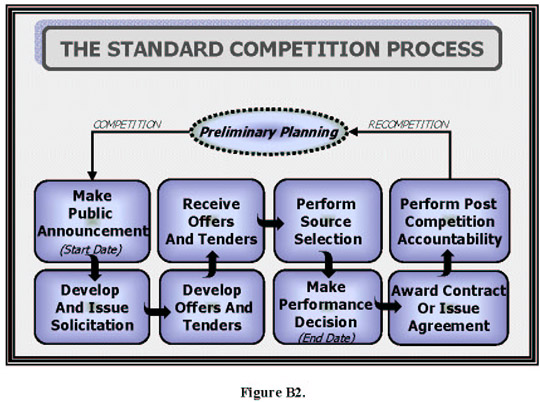

A. PRELIMINARY PLANNING. Before the public announcement (start date) of a streamlined or standard competition, an agency shall complete, at a minimum, the following steps:

1. Scope. Determine the activities and full time equivalent (FTE) positions to be competed.

2. Grouping. Conduct preliminary research to determine the appropriate grouping of activities as business units (e.g., consistent with market and industry structures).

3. Workload Data and Systems. Assess the availability of workload data, work units, quantifiable outputs of activities or processes, agency or industry performance standards, and other similar data. Establish data collection systems as necessary.

4. Baseline Costs. Determine the activity’s baseline costs as performed by the incumbent service provider.

5. Type of Competition. Determine the use of a streamlined or standard competition.

a. An agency shall use a standard competition if, on the start date, a commercial activity is performed by:

(1) The agency with an aggregate of more than 65 FTEs; or

(2) A private sector or public reimbursable source and the agency tender will include an aggregate of more than 65 FTEs.

b. An agency shall use either a streamlined or standard competition if, on the start date, a commercial activity is performed by:

(1) The agency with an aggregate of 65 or fewer FTEs and/or any number of military personnel; or

(2) A private sector or public reimbursable source and the agency cost estimate (for a streamlined competition) or the agency tender (for a standard competition) will include an aggregate of 65 or fewer FTEs.

6. Schedule. Develop preliminary competition and completion schedules.

7. Roles and Responsibilities of Participants. Determine roles and responsibilities of participants in the process and their availability for the duration of the streamlined or standard competition.

8. Competition Officials. Appoint competition officials. The CSO shall appoint competition officials for each standard competition, and, as appropriate, may appoint competition officials for streamlined competitions. The CSO shall appoint all competition officials, in writing, and shall hold these competition officials accountable for the timely and proper conduct of streamlined or standard competitions through the use of annual performance evaluations.

a. Agency Tender Official (ATO). The ATO shall (1) be an inherently governmental agency official with decision-making authority; (2) comply with this circular; (3) be independent of the contracting officer (CO), source selection authority (SSA), source selection evaluation board (SSEB), and performance work statement (PWS) team; (4) develop, certify, and represent the agency tender; (5) designate the most efficient organization (MEO) team after public announcement of the standard competition; (6) provide the necessary resources and training to prepare a competitive agency tender; and (7) be a directly interested party. An agency shall ensure that the ATO has access to available resources (e.g., skilled manpower, funding) necessary to develop a competitive agency tender.

b. Contracting Officer (CO). The CO shall (1) be an inherently governmental agency official; (2) comply with both the FAR and this circular; (3) be independent of the ATO, human resource advisor (HRA), and MEO team; and (4) be a member of the PWS team.

c. PWS (Performance Work Statement) Team Leader. The PWS team leader shall (1) be an inherently governmental agency official; (2) comply with both the FAR and this circular; (3) be independent of the ATO, HRA and MEO team; (4) develop the PWS and quality assurance surveillance plan; (5) determine government-furnished property (GFP); (6) assist the CO in developing the solicitation; and (7) assist in implementing the performance decision.

d. Human Resource Advisor (HRA). The HRA shall (1) be an inherently governmental agency official and a human resource expert; (2) comply with this circular; (3) be independent of the CO, SSA, PWS team, and SSEB; (4) participate on the MEO team; and (5) be responsible for the following:

(1) Employee and Labor-Relations Requirements. The HRA shall, at a minimum, perform the following (a) interface with directly affected employees (and their representatives) from the date of public announcement until full implementation of the performance decision; (b) identify adversely affected employees; (c) accomplish employee placement entitlements in accordance with 5 C.F.R. Part 351 (reduction-in-force procedures); (d) provide post-employment restrictions to employees; (e) determine agency priority considerations for vacant positions and establish a reemployment priority list(s) in accordance with 5 C.F.R. Part 330; and (f) provide the CO with a list of the agency’s adversely affected employees, as required by this attachment and FAR 7.305(c) regarding the right of first refusal for a private sector performance decision.

(2) MEO Team Requirements. The HRA shall assist the ATO and MEO team in developing the agency tender. During development of the agency tender, the HRA shall be responsible for (a) scheduling sufficient time in competition milestones to accomplish potential human resource actions in accordance with 5 C.F.R. Part 351; (b) advising the ATO and MEO team on position classification restrictions; (c) classifying position descriptions, including exemptions based on the Fair Labor Standards Act (d) performing labor market analysis to determine the availability of sufficient labor to staff the MEO and implement the phase-in plan; (e) assisting in the development of the agency cost estimate by providing annual salaries, wages, night differentials, and premium pay; (f) assisting in the development of the timing for the phase-in plan based on MEO requirements; and (g) developing an employee transition plan for the incumbent agency organization early in the standard competition process.

e. Source Selection Authority (SSA). The SSA shall (1) be an inherently governmental agency official appointed in accordance with FAR Part 15.303; (2) comply with both the FAR and this circular when performing a streamlined and standard competition; and (3) be independent of the ATO, HRA, and MEO team. The SSA shall not appoint an SSEB until after public announcement.

9. Incumbent Service Providers. Inform any incumbent service providers of the date that the public announcement will be made.

B. PUBLIC ANNOUNCEMENTS.

1. Start Date (Public Announcement Date). An agency shall make a formal public announcement (at the local level and via FedBizOpps.gov) for each streamlined or standard competition. The public announcement shall include, at the minimum, the agency, agency component, location, type of competition (streamlined or standard), activity being competed, incumbent service providers, number of government personnel performing the activity, name of the CSO, name of the contracting officer, name of the ATO, and projected end date of the competition. The public announcement date is the official start date for a streamlined or standard competition.

2. End Date (Performance Decision Date). An agency shall make a formal public announcement (at the local level and via FedBizOpps.gov) of the streamlined or standard competition performance decision. The performance decision date is the official end date for a streamlined or standard competition. The end date of a streamlined competition shall be the date that all SLCF certifications are complete, signifying a performance decision. The end date of a standard competition shall be the date that all SCF certifications are complete, signifying a performance decision.

3. Cancellations.

a. Cancellation of a Streamlined or Standard Competition. The CSO (without delegation) may approve, in writing, the cancellation of a streamlined or standard competition. After approval by the CSO, the CO shall publish a cancellation notice that includes rationale for the cancellation at FedBizOpps.gov and the HRA shall notify directly affected employees and their representatives of the cancellation. No cancellation is necessary prior to public announcement of a streamlined or standard competition.

b. Cancellation of a Solicitation. The CO shall be responsible for canceling a solicitation in accordance with the FAR, and shall publish a cancellation notice at FedBizOpps.gov. The HRA shall notify directly affected employees and their representatives of the cancellation. The cancellation of a solicitation does not result in the cancellation of a streamlined or standard competition.

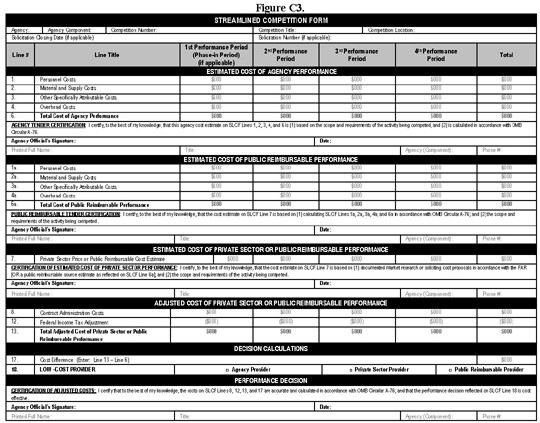

C. STREAMLINED COMPETITION PROCEDURES.

1. Streamlined Competition Form (SLCF). After public announcement, an agency shall calculate, compare, and certify costs based upon the scope and requirements of the activity to determine and document a cost-effective performance decision by completing the SLCF as follows:

a. Cost of Agency Performance. An agency shall calculate and certify the cost of performing the activity with government personnel in accordance with Attachment C for a minimum of three performance periods by completing SLCF Lines 1, 2, 3 (limited to awarded contracts supporting agency performance of the activity), 4, and 6. An agency may base the agency cost estimate on the incumbent activity; however, an agency is encouraged to develop a more efficient organization, which may be an MEO. [See OMB Memoranda M-08-11 (February 20, 2008), number 3, and M-06-13 (April 24, 2006) when applying this provision.]

b. Cost of Private Sector/Public Reimbursable Performance. An agency shall determine an estimated contract price for performing the activity with a private sector source, using documented market research or soliciting cost proposals in accordance with the FAR. An agency may also determine an estimated cost for performing the activity with a public reimbursable source by calculating (or requesting that a public reimbursable source calculate) SLCF Lines 1a, 2a, 3a (limited to awarded contracts), 4a, and 6a. An agency shall enter and certify an estimated contract price or public reimbursable cost on SLCF Line 7 in accordance with Attachment C for a minimum of three performance periods.

c. Adjusted Cost Estimate. An agency shall calculate and certify the adjusted costs for SLCF Lines 8, 12, 13, and 17 to determine and certify a cost effective source as reflected on SLCF Line 18 in accordance with Attachment C. An agency shall not calculate any other SLCF lines for a streamlined competition. [See OMB Memoranda M-08-11 (February 20, 2008), numbers 1 (with Attachment B, number 3) and 3, and M-06-13 (April 24, 2006) when applying this provision.]

d. Cost Estimate Firewalls. An agency shall ensure that the individual(s) preparing the agency cost estimate and the individual(s) preparing the private sector/public reimbursable cost estimate shall be different, and shall not share information concerning their respective estimates.

2. Time Limit. A streamlined competition shall not exceed 90 calendar days from public announcement (start date) to performance decision (end date) unless the CSO grants a time limit waiver. Before the public announcement of each streamlined competition, the CSO may grant a time limit waiver, in writing, allowing a specific streamlined competition to exceed the 90 day time limit by no more than 45 calendar days, for a maximum of 135 calendar days from public announcement (start date) to performance decision (end date). The CSO may only grant a time limit waiver if the CSO expects the agency to create an MEO or issue a solicitation for private sector offers. If an agency cannot complete an announced streamlined competition within the time limit, the agency shall either convert the streamlined competition to a standard competition or request an additional extension of time from OMB using the deviation procedure in paragraph 5.c. of this circular.

3. Performance Decision in a Streamlined Competition.

a. SLCF Certifications. An agency shall make three certifications on the SLCF in accordance with Attachment C to determine a performance decision. A different individual shall make each of these certifications.

b. SLCF Review. Consistent with procurement integrity, ethics, and standards of conduct rules, including the restrictions of 18 U.S.C. § 208, agencies shall allow incumbent service providers to review the SLCF prior to the public announcement of a performance decision.

c. Public Announcement. The agency shall make a formal public announcement (at the local level and via FedBizOpps.gov) of the performance decision. The SLCF shall be made available to the public, upon request. If the agency cost estimate includes any support contracts, the agency shall not release proprietary information contained in these contracts.

d. Implementing the Streamlined Performance Decision. An agency shall implement the performance decision resulting from a streamlined competition as follows:

(1) Private Sector or Public Reimbursable Performance Decision. The CO may issue a solicitation to determine a private sector or public reimbursable service provider. For a private sector performance decision, the CO shall award a contract in accordance with the FAR and shall implement FAR 7.305(c), the right of first refusal. For a public reimbursable performance decision, the CO shall execute a fee-for-service agreement with the public reimbursable source.

(2) Agency Performance Decision. The CO shall execute a letter of obligation with an official responsible for performing the commercial activity.

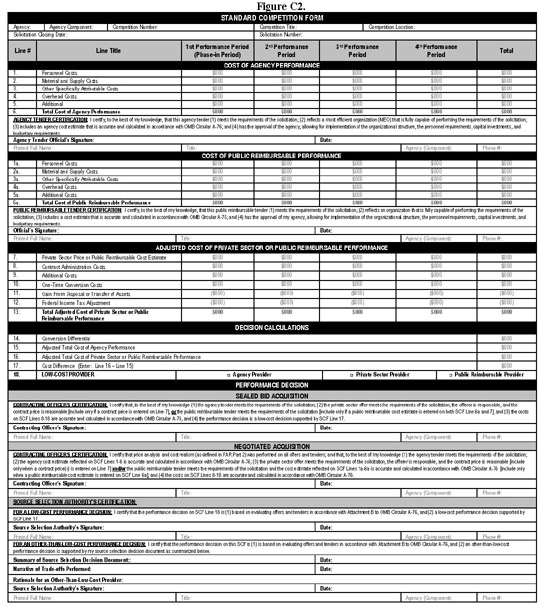

D. STANDARD COMPETITION PROCEDURES.

1. Time Limit. A standard competition shall not exceed 12 months from public announcement (start date) to performance decision (end date) unless the CSO (without delegation) grants a time limit waiver. Before the public announcement of each standard competition, the CSO may grant a time limit waiver, in writing, allowing a specific standard competition to exceed the 12 month time limit by no more than 6 months, for a maximum of 18 months from public announcement (start date) to performance decision (end date). The CSO may only grant a time limit waiver if the CSO (a) expects the standard competition to be particularly complex; (b) signs the time limit waiver before public announcement; and (c) provides a copy of the time limit waiver to the Deputy Director for Management, OMB, before public announcement. If an agency exceeds these time limits, including any extension that is the subject of the CSO’s waiver, the CSO (without delegation) shall notify the Deputy Director for Management, OMB, in writing.

2. Team Designations, Responsibilities, and Restrictions.

a. Performance Work Statement (PWS) Team. After public announcement, the PWS team leader shall appoint a PWS team comprised of technical and functional experts. The PWS team shall comply with the FAR and this circular, and assist the PWS team leader with (1) developing the PWS including supporting workload data, performance standards, and any information relating to the activity being competed; (2) determining GFP; (3) assisting in the CO’s development of the solicitation; (4) developing a quality assurance surveillance plan and, as required, updating this plan based on the performance decision; and (7) implementing the performance decision. The PWS team leader shall make all final management decisions regarding the PWS, GFP, and the quality assurance surveillance plan. Other individuals with expertise in management analysis, work measurement, value engineering (see OMB Circular A-131), industrial engineering, cost analysis, procurement, and the technical aspects of the activity may also assist this team. Directly affected government personnel (and their representatives) may participate on the PWS team; however, to avoid any appearance of a conflict of interest, members of the PWS team (including, but not limited to, advisors and consultants) shall not be members of the MEO team.

b. Most Efficient Organization (MEO) Team. After public announcement, the ATO shall appoint an MEO team comprised of technical and functional experts. The MEO team shall comply with this circular and assist the ATO in developing the agency tender. The ATO shall make all final management decisions regarding the agency tender. Other individuals with expertise in management analysis, position classification, work measurement, value engineering (see OMB Circular A-131), industrial engineering, cost analysis, procurement, and the technical aspects of the activity may also assist this team. Directly affected government personnel (and their representatives) may participate on the MEO team; however, to avoid any appearance of a conflict of interest, members of the MEO team (including, but not limited to, the ATO, HRA, advisors and consultants) shall not be members of the PWS team.

c. Source Selection Evaluation Board (SSEB). After public announcement of a standard competition that will be a negotiated procurement, the SSA shall appoint an evaluation team (referred to as the SSEB) in accordance FAR Subpart 15.303. The SSA shall ensure that the SSEB complies with the source selection requirements of the FAR and this attachment. PWS team members who are not directly affected government personnel may participate on the SSEB. Directly affected personnel (and their representatives) and any individual (including, but not limited to, the ATO, HRA, MEO team members, advisors, and consultants) with knowledge of the agency tender (including the MEO and agency cost estimate) shall not participate in any manner on the SSEB (e.g., as members or advisors).

3. The Solicitation and Quality Assurance Surveillance Plan.

a. Solicitation.3 An agency shall not issue a solicitation that places any prospective provider at an unfair competitive advantage. When developing and issuing a solicitation for a standard competition, the CO shall comply with the FAR and the following:

(1) Review and Release of Information. An agency is encouraged to post a draft of the PWS or solicitation for public review and comment, including review and comment by directly affected employees and representatives of directly affected employees. All releases of the PWS and solicitation, including drafts, shall be by the CO. Information that is developed by the ATO or MEO team shall be considered procurement sensitive. With the exception of information related to the performance or productivity of the incumbent agency organization, historical data or other existing information that is available to the ATO or MEO team shall be made available to all prospective providers.

(2) FAR Provisions. The CO, in consultation with the PWS team, shall determine the acquisition strategy in accordance with FAR Part 7, which may include the use of FAR Parts 6, 14, 15, or 36. When the agency is the incumbent service provider, the CO shall comply with FAR 7.305(c) regarding the right of first refusal. The CO shall comply with FAR Subpart 22.10 to obtain the applicable wage determinations from the Department of Labor.

(3) Acquisition Process and Source Selection Provisions. The CO shall identify in the solicitation whether the acquisition procedures will be sealed bid or negotiated procedures. If negotiated procedures will be used, the CO shall identify in the solicitation the type of source selection process (i.e., lowest price technically acceptable, phased evaluation, tradeoff).

(a) Evaluation Factors. All evaluation factors shall be clearly identified in the solicitation. To the extent practicable, evaluation factors shall be limited to commonly used factors (e.g., a demonstrated understanding of the government’s requirements, technical approach, management capabilities, personnel qualifications, manufacturing plan, facilities and equipment). No solicitation shall include evaluation factors that could provide an unfair advantage for or inherently benefit a prospective provider, public or private.

(b) Tradeoff Source Selection Solicitation Provisions. [See OMB Memoranda M-08-11 (February 20, 2008), number 3, and M-06-13 (April 24, 2006) when applying this provision.] For tradeoff source selections, the solicitation shall identify the specific weight given evaluation factors and sub-factors, including cost or price. The specific weight given to cost or price shall be at least equal to all other evaluation factors combined unless quantifiable performance measures can be used to assess value and can be independently evaluated. The quality of competition will be enhanced by using, to the extent practicable, evaluation factors and sub-factors susceptible to objective measurement or evaluation. To encourage prospective providers to submit offers and tenders that fall within budgetary constraints, an agency may include a not-to-exceed cost clause in the solicitation.

(4) Solicitation Provisions Unique to the Agency Tender. A solicitation shall state that the agency tender is not required to include (a) a labor strike plan; (b) a small business strategy; (c) a subcontracting plan goal; (d) participation of small disadvantaged businesses; (e) licensing or other certifications; and (f) past performance information (unless the agency tender is based on an MEO that has been implemented in accordance with this circular or a previous OMB Circular A-76).

(5) Solicitation Closing Date. The date for delivery of offers and tenders shall be the same.

(6) Compliance Matrix. To decrease the complexity of performing source selections, the CO may include a cross-reference compliance matrix in section L of the solicitation (see Figure B3. below). A compliance matrix should clearly identify proposal reference information as it relates to the PWS, contract line item numbers (CLIN), solicitation sections L and M, proposal volume and section, and, if appropriate, contract data requirements list (CDRL) references. This matrix should be modified to account for proposed performance standards that differ from the requirements in a solicitation.

| This matrix is included in the solicitation with the following sections completed. | ||||||

| Administrative Support | (optional) | 1.1 | 4.3 | F1, 1.5.1 | ||

| Records Management | 1.1.1 | 4.3.1 | F1, SF1 | |||

| Forms and Publications | 1.1.2 | 4.3.2 | F1, 1.5.1.2 | |||

| Operations & Maintenance | 1.2 | 4.4 | F2 1.5.2 | |||

| Equipment Records | 1.2.1.1 | 4.4.2 | F2, SF2 | |||

| Maintenance Analysis | 1.2.2 | 4.4.3 | SF3 1.5.2.3 | |||

| Data Base Management | 1.2.2.1 | 4.4.4 | SF4, 1.5.2.4 | |||

| Price | 5.0 | 1.5.3 | ||||

| Performance Risk Assessment | 7.0 | 1.5.4 | ||||

(7) Performance Periods. An agency shall use a minimum of three full years of performance, excluding the phase-in period, in a standard competition. An agency shall not use performance periods for the agency tender that differ from performance periods for private sector offers and public reimbursable tenders. The CSO shall obtain prior written approval from OMB to use performance periods that exceed five years (excluding the phase-in period). [See OMB Memorandum M-04-12 (April 30, 2004) when applying this provision.]

(8) Government-Furnished Property (GFP). The PWS team shall be responsible for determining whether the agency will make government property available to all prospective providers. Agency determinations to provide or not provide GFP shall be justified, in writing, and approved by the CSO. Consistent with FAR 45.102 and FAR Subpart 45.3, solicitations may offer the use of existing government facilities and equipment and may make such use mandatory. The determination to provide government property shall not be used to influence the outcome of the competition. The ATO, MEO team, and any individual assisting in the development of the agency tender, shall not be involved in the determination to provide GFP.

(9) Common Costs. The CO shall identify common costs in the solicitation.

(10) Performance Bond. If an agency requires a private sector source to include a performance bond, the CO shall obtain prior written approval from the CSO. The CO shall include in the solicitation a separate CLIN for the cost of the performance bond. The CO shall exclude the cost of the performance bond from the contract price before entering the contract price on SCF Line 7.

(11) Incentive Fee. In a solicitation for an incentive fee contract, the CO shall require the private sector offeror to propose a target cost and target profit or fee. The CO shall include the target cost and target profit or fee on SCF Line 7.

(12) Award Fee. For solicitations with an award fee for all prospective providers, including the agency tender, the CSO shall determine if procedures are in place permitting an agency tender to receive such an award fee.

(13) Phase-in Plan. The CO shall include in the solicitation a separate CLIN for a phase-in plan. Private sector, public reimbursable and agency sources shall propose a phase-in plan to replace the incumbent service provider. The CO shall designate the phase-in period as the first performance period (see Attachment C). The CLIN is limited to the phase-in costs associated with phase-in actions as documented in the phase-in plan. Phase-in plans shall include details to minimize disruption and start-up requirements. The phase-in plan shall consider recruiting, hiring, training, security limitations, and any other special considerations of the prospective providers to reflect a phase-in period of realistic length and requirements.

(14) Quality Control Plan. The CO shall include in the solicitation a requirement for prospective providers to include a quality control plan in offers and tenders.

b. Quality Assurance Surveillance Plan. The PWS team shall develop the quality assurance surveillance plan, which identifies the methods the government will use to measure the performance of the service provider against the requirements of the PWS.

c. Competition File. An agency shall retain the documents created for the standard competition. This competition file shall be included in the government contract files in accordance with FAR Subpart 4.8, regardless of the performance decision.

4. The Agency Tender, Private Sector Offers, and Public Reimbursable Tenders.

a. Agency Tender. The agency tender is the agency’s response to the solicitation.

(1) Developing the Agency Tender. The ATO shall develop an agency tender that responds to the requirements of the solicitation, including section L (Instructions, Conditions, and Notices to Offerors or Respondents) and section M (Evaluation Factors for Award). In addition to the requirements of the solicitation, the agency tender shall include the following (a) an MEO; (b) a certified agency cost estimate developed in accordance with Attachment C (the agency’s cost proposal); (c) the MEO’s quality control plan; (d) the MEO’s phase-in plan; and (e) copies of any existing, awarded MEO subcontracts (with the private sector providers’ proprietary information redacted). The ATO shall provide the certified agency tender in a sealed package to the CO by the solicitation closing date. If the solicitation states that prospective providers may propose alternate performance standards that differ from the solicitation’s performance standards, the ATO may propose alternate performance standards in the agency tender.

(a) Most Efficient Organization (MEO). The MEO is an agency’s staffing plan as identified in the agency tender. The MEO is not usually a representation of the incumbent organization, but is the product of management analyses that include, but are not limited to, activity based costing, business case analysis, consolidation, functionality assessment, industrial engineering, market research, productivity assessment, reengineering, reinvention, utilization studies, and value engineering. The HRA shall develop and classify new position descriptions based on the MEO, but the agency shall not hire employees to staff these positions unless the agency is the selected provider. An MEO may be comprised of either (1) government personnel or (2) a mix of government personnel and MEO subcontracts (see Attachment D). Agencies shall not include new MEO subcontracts that would result in the direct conversion of work performed by government employees. Other elements of the MEO include an organization chart reflecting the MEO; position descriptions classified by the HRA for positions projected to be in the MEO; a description of the organization that will execute the quality control plan; MEO equipment, supplies, material, and facilities; and specific details of MEO subcontracts.

(b) Agency Cost Estimate. The ATO shall develop and certify the agency cost estimate (the agency’s cost proposal) in accordance with Attachment C, using the COMPARE costing software. The ATO shall not make changes to the agency cost estimate except as provided in paragraph, “Changes to the Agency Tender,” below.

(c) Quality Control Plan. The ATO shall include a quality control plan in the agency tender, as required by the solicitation. The quality control plan shall, at a minimum, include (1) an MEO self-inspection plan; (2) MEO internal staffing (which shall be included in the agency cost estimate for personnel costs on SCF Line 1); and (3) procedures that the MEO will use to meet the quality, quantity, timeliness, responsiveness, customer satisfaction, and other requirements of the solicitation.

(d) Phase-in Plan. The ATO shall include a phase-in plan in the agency tender, as required by the solicitation, to replace the incumbent service provider with the MEO, even if the agency is the incumbent service provider. The ATO shall include phase-in costs for the agency tender on SCF Lines 1-6.

(2) Submission of the Agency Tender. The ATO shall deliver the agency tender to the CO in a sealed package by the solicitation closing date. If the ATO does not anticipate submitting the agency tender to the CO by the solicitation closing date, the ATO shall notify the CO as soon as possible before the solicitation closing date. The CO, in consultation with the CSO, shall determine if amending the solicitation closing date is in the best interest of the government.

(3) Changes to the Agency Tender. After the solicitation closing date, only the ATO may make changes to the agency tender, and such changes shall only be in response to the following (a) a solicitation amendment issued in accordance with the FAR; (b) the CO’s request for final proposal revisions to offers and tenders in accordance with FAR 15.307; (c) official changes to the standard cost factors identified in Attachment C; (d) version upgrades to the COMPARE costing software issued by the Department of Defense; or (e) resolution of a contest challenging a performance decision as provided by this attachment. The CO shall retain documentation regarding any changes to the agency tender as part of the competition file and in a form suitable for audit.

(4) Procurement Sensitivity. After resolution of a contest (see paragraph on “Release of the Certified SCF and Tenders” in this attachment), or the expiration of the time for filing a contest, an agency tender shall be made available to the public, upon request. If an agency tender includes any subcontracts, the agency shall not release proprietary information contained in these MEO subcontracts.

b. Private Sector Offers. Private sector offers respond as required by the solicitation.

c. Public Reimbursable Tenders. When responding to another agency’s solicitation, a public reimbursable source shall develop a public reimbursable tender that responds to the requirements of the solicitation, including section L (Instructions, Conditions, and Notices to Offerors or Respondents) and section M (Evaluation Factors for Award). In addition to the requirements of the solicitation, the public reimbursable tender shall include the following (1) a certified cost estimate developed in accordance with Attachment C (the public reimbursable source’s cost proposal); (2) a quality control plan, (3) a phase-in plan, and (4) copies of any existing, awarded contracts that are included in the tender (with the private sector provider’s proprietary information redacted). A public reimbursable tender may be comprised of either (1) government personnel or (2) a mix of government personnel and existing, awarded contracts. Submission of, and changes to, a public reimbursable tender, as well as the procurement sensitivity of the public reimbursable tender, shall be subject to the corresponding provisions of this attachment applicable to the agency tender (see above).

d. No Satisfactory Private Sector or Public Reimbursable Source. If an agency attempts to perform a standard competition, but does not receive private sector offers or public reimbursable tenders, determines that all offers and public reimbursable tenders are non-responsive, or determines that prospective providers are not responsible, the agency shall take the following actions:

(1) Determine Reasons. The CO shall consult with private sector sources to identify (a) restrictive, vague, confusing, or misleading portions of the solicitation; (b) the reasons provided by sources for not submitting responses; and (c) possible revisions to the solicitation to enhance competition. The CO shall, in writing, describe the results of these consultations and propose a course of action to the CSO.

(2) Required Action. The CSO shall evaluate the CO’s written documentation and make a written determination to either (a) revise the solicitation or (b) implement the agency tender. If revising a solicitation would result in exceeding the established time limit for the standard competition, the CSO (without delegation) shall consult with the Deputy Director for Management, OMB. The CO’s written documentation, as well as the CSO’s decision to either revise the solicitation or implement the agency tender, shall be retained as part of the competition file.

(a) Revise the Solicitation. Before revising or reissuing the solicitation, the CO shall return the sealed agency tender to the ATO. The CO shall then revise and reissue the solicitation.

(b) Implement the Agency Tender. If the CSO decides to implement the agency tender, the CO shall proceed to evaluate the agency tender as required by this attachment and the solicitation. The agency shall complete the SCF, leaving Line 7 blank, omit the costs on lines 8-12 and annotate “agency” on Line 18. The SSA shall state, in the certification on the SCF, that the CSO implemented the agency tender because (1) the agency received no offers or tenders in response to the solicitation; (2) no offers or tenders received were responsive; or (3) no prospective providers were responsible. The SSA and CO shall sign the SCF to certify the performance decision and retain the SCF and agency tender with the competition file. The agency shall make a public announcement of the performance decision (at the local level and via FedBizOpps.gov). The CO shall make the SCF (including the documentation of no satisfactory private sector source) available to the public, upon request. The CO shall notify the ATO of the performance decision and the HRA shall notify directly affected employees (and their representatives).

5. The Source Selection Process and Performance Decision. An agency shall select one of the procedures described below to conduct a standard competition and shall not employ any other procedure in conducting the standard competition.

a. Sealed Bid Acquisition. An agency shall conduct a sealed bid acquisition in accordance with FAR Subparts 14.1 through 14.4 and this attachment. On the solicitation closing date, the CO shall open the agency tender, private sector bids, and public reimbursable tenders. The CO shall enter the price of the apparent lowest priced private sector bid or public reimbursable tender on SCF Line 7, to complete the SCF calculations. The CO shall then evaluate private sector bids for responsiveness and responsibility in accordance with the FAR and determine if SCF Lines 8-18 have been prepared in accordance with Attachment C. The CO shall certify the SCF in accordance with Attachment C. The CO makes the performance decision by certifying the SCF.

b. Negotiated Acquisition.

(1) Lowest Price Technically Acceptable Source Selection. An agency shall conduct a lowest price technically acceptable source selection in accordance with FAR 15.101-2 and this attachment. During the source selection process, the CO shall open and evaluate all offers and tenders (including the agency tender) to determine technical acceptability. The performance decision shall be based on the lowest cost of all offers and tenders determined to be technically acceptable. The CO shall conduct price analysis and cost realism as required by this attachment. The CO may conduct exchanges, in accordance with FAR Subpart 15.306 and this attachment, to determine the technical acceptability of each offer and tender. The CO shall enter the lowest contract price or public reimbursable cost on SCF Line 7 to complete the SCF calculations. The CO shall sign the SCF, and the SSA shall certify the SCF, in accordance with Attachment C. The SSA makes the performance decision by certifying the SCF.

(2) Phased Evaluation Source Selection Process. An agency shall conduct a phased evaluation source selection in accordance with FAR Part 15 and this attachment. In the phased evaluation process, an agency shall evaluate technical capability in phase one and cost in phase two. The performance decision shall be based on the lowest cost of all technically acceptable offers and tenders from all offerors, public reimbursable sources, and the ATO. The solicitation shall require the submission of complete offers and tenders, including separate technical proposals and cost proposals/estimates, by the solicitation closing date. The solicitation shall permit submission of alternate performance standards that differ from the solicitation’s performance standards. To differentiate between the alternate standards and the solicitation’s standards, the solicitation shall require that offers and tenders include a compliance matrix specifying (a) the alternate performance standards; (b) an explanation of how the alternate standards differ from the solicitation standards; (c) the cost of meeting each alternate standard; (d) the cost difference between the alternate and solicitation standard; (e) a cost-benefit analysis explaining the rationale for each alternate standard; and (f) proposed language to include alternate performance standards in an amended solicitation. If the agency receives no alternate performance standards, or does not accept any of the alternate standards, then the SSA shall determine a performance decision based on the solicitation’s performance standards.

(a) Phase One. In phase one, the CO shall open and evaluate the technical proposals (submitted by private sector offerors, public reimbursable sources, and the ATO). The CO shall not open or evaluate agency or public reimbursable cost estimates or private sector price proposals during phase one. The CO may conduct exchanges, in accordance with FAR Subpart 15.306 and this attachment, to determine the technical acceptability of each offer and tender. If an agency receives offers and tenders that include alternate performance standards, the CO shall (1) evaluate each alternate performance; (2) consider the discrete cost or price difference associated with the alternate standard; (3) determine, in consultation with the requiring activity, whether an alternate standard is necessary and, if so, within the agency’s budget limitations; and (4) document, in writing, the evaluation of each alternate performance standard. If the SSA accepts an alternate performance standard, the CO shall issue an amendment to the solicitation to (1) identify the specific change to the solicitation’s performance standard, without conveying proprietary information about technical approaches or solutions to meet the new performance standard; and (2) request the resubmission of offers and tenders in response to the amended solicitation. Upon receiving revisions to offers and tenders, the CO may conduct exchanges, in accordance with FAR Subpart 15.306 and this attachment, to determine the technical acceptability of each offer and tender.

(b) Phase Two. In phase two, the CO shall perform price analysis and cost realism of private sector cost proposals, public reimbursable cost estimates, and the agency cost estimate, in accordance with this attachment, on all offers and tenders determined to be technically acceptable at the conclusion of phase one. The CO then shall enter the lowest contract price or public reimbursable cost on SCF Line 7 to complete the SCF calculations. The SSA shall certify the SCF and the CO shall sign the SCF in accordance with Attachment C. The SSA shall make the performance decision by certifying the SCF, which is the performance decision document.

(3) Tradeoff Source Selection Process. [See OMB Memorandum M-06-13 (April 24, 2006) when applying this provision.] A tradeoff source selection may be appropriate in a standard competition when an agency wishes to consider award to other than the lowest priced source. An agency may use the tradeoff processes under FAR Subpart 15.101-1 in a standard competition of (a) information technology activities (as defined in Attachment D); (b) commercial activities performed by a private sector source; (c) new requirements; or (d) segregable expansions. An agency also may use a tradeoff source selection process for a specific standard competition if prior to the public announcement of the competition, the CSO (without delegation) (a) approves, in writing, the use of the tradeoff source selection process; and (b) notifies OMB of the approval by forwarding a copy of the written approval. An agency shall not use a tradeoff source selection process for activities currently performed by government personnel except as provided in this paragraph. When an agency uses a tradeoff source selection process in a standard competition, an agency shall comply with FAR Part 15 unless otherwise noted in this attachment. Under a tradeoff source selection process, an agency may select an offer or tender that is not the lowest priced offer or tender only if the decision is within the agency’s budgetary limitation. An agency shall not use a tradeoff source selection to justify increases in the agency’s budgetary authorization. Prospective providers may propose alternate performance standards that differ from the solicitation’s performance standards. The CO shall conduct price analysis and cost realism as required by this attachment. The CO may conduct exchanges, in accordance with FAR Subpart 15.306 and this attachment. The CO’s rationale for tradeoffs shall be (a) documented, in writing; (b) attached to the SCF; and (c) retained with the competition file for the standard competition. The CO shall enter the contract price and public reimbursable cost estimate, for each offer and tender determined to be technically acceptable, on SCF Line 7. The CO then shall sign the SCF. The SSA may decide to award to the low-cost provider, or other than the low-cost provider, as follows:

(a) Low Cost Performance Decision. For a decision to award to the low-cost provider, the SSA shall certify the SCF in accordance with Attachment C. The SSA makes the performance decision by certifying the SCF, which is the performance decision document.

(b) Other Than Low Cost Performance Decision. For a decision to award to other than the low-cost provider, the SSA shall certify the SCF, in accordance with Attachment C, and shall document the following on the SCF (1) a summary of the source selection decision document; (2) a narrative explanation of the tradeoffs performed; and (3) a rationale for the decision to award to other than the low-cost provider. The SSA makes the performance decision by certifying the SCF. The SCF, combined with the source selection decision document, is the performance decision document.

c. Special Considerations.

(1) Evaluation of Private Sector Offers, Public Reimbursable Tenders, and Agency Tender. The CO shall not evaluate the private sector offers separately from the agency tender. The CO, SSA, and SSEB shall not (a) convey, require, make, direct, or request adjustments to a tender or offer that would identify any proprietary or procurement sensitive information from another offer or tender; or (b) require, direct, or make specific changes to an offer or tender, including the approach and staffing requirements (e.g., adding a specific number of employee positions to the MEO). The CO shall ensure that oral presentations do not provide an unfair advantage for or inherently benefit a prospective provider, public or private.

(2) Exchanges with Private Sector, Public Reimbursable, and Agency Sources. If the CO conducts exchanges with private sector offerors, public reimbursable sources, and the ATO, during the course of the standard competition, those exchanges shall be in accordance with FAR 15.306, with the following exceptions. For an agency tender, the CO shall correspond with the ATO, in writing, and shall maintain records of all such correspondence as part of the competition file. The CO and ATO shall include clear, sufficient, and unambiguous information in the correspondence to adequately convey concerns, responses, or information regarding the agency tender.

(3) Deficiencies in an Offer or Tender. If the CO perceives that a private sector offer, public reimbursable tender, or agency tender is materially deficient, the CO shall ensure that the ATO, private sector offeror, or the public reimbursable tender official receives a deficiency notice. The CO shall afford the ATO, the private sector offeror, or the public reimbursable tender official a specific number of days to address the material deficiency and, if necessary, to revise and recertify the tender or offer. If the ATO is unable to correct the material deficiency, the CSO shall determine if a commitment of additional resources will enable the ATO to correct the material deficiency within the specified number of days. If the CSO determines that the ATO cannot correct the material deficiency with a reasonable commitment of additional resources, the CSO may advise the SSA to exclude the agency tender from the standard competition. If the CO determines that a private sector offeror or public reimbursable tender official has not corrected a material deficiency, the SSA may exclude the private sector offer or public reimbursable tender from the standard competition. If the agency tender is excluded from the standard competition, an agency shall calculate the SCF as required by Attachment C and the SSA shall make the performance decision based upon the source selection decision document and shall document the reason for elimination of the agency tender on the SCF.

(4) Price Analysis and Cost Realism of Private Sector Cost Proposals, Public Reimbursable Cost Estimates and Agency Cost Estimates.

(a) General. Regardless of the contract type stated in the solicitation, the CO shall perform price analysis and cost realism (as defined in FAR Part 2) on all private sector cost proposals, public reimbursable cost estimates (SCF Lines 1a-6a), and the agency cost estimate (SCF Lines 1-6). Cost analysis (in accordance with FAR Part 15) is not required for a standard competition but may be performed at the discretion of the SSA.

(b) Agency and Public Reimbursable Cost Estimates. The CO shall ensure that the agency and public reimbursable cost estimates (1) are calculated in accordance with Attachment C; (2) are based on the standard cost factors in effect on the performance decision date; and (3) use the version of the COMPARE costing software that is in effect on the performance decision date.

(c) Conversion Differential. All standard competitions shall include the conversion differential. The CO shall ensure that the conversion differential is calculated in accordance with Attachment C and reflected on SCF Line 14. The conversion differential is a cost that is the lesser of 10 percent of the MEO’s personnel-related costs (reflected on SCF Line 1) or $10 million over all the performance periods stated in the solicitation. This conversion differential is added to the cost of performance by a non-incumbent source. If the incumbent provider is a private sector or public reimbursable source, the conversion differential is added to the cost of agency performance. If the agency is the incumbent provider, the conversion differential is added to the cost of private sector or public reimbursable performance. The conversion differential precludes conversions based on marginal estimated savings, and captures non-quantifiable costs related to a conversion, such as disruption and decreased productivity.

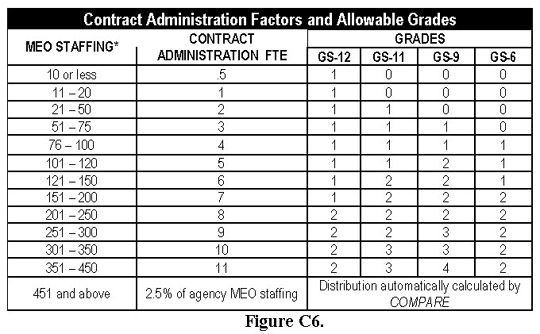

(d) SCF Overview. As part of the requirement to conduct price analysis and cost realism, the CO shall ensure that the SCF has been prepared in accordance with Attachment C and that the required signatures and certifications are on the SCF. Figure B4. provides an overview of the detailed guidance for developing the agency and public reimbursable cost estimates in Attachment C.

| SCF Line 1: Personnel Costs. Agency labor costs for direct and indirect labor necessary to meet the requirements in the solicitation. |

| SCF Line 2: Material and Supply Costs. Agency cost of materials and supplies such as office supplies, including handling and inflation. |

| SCF Line 3: Other Specifically Attributable Costs. Other agency costs such as the cost of capital, depreciation capital assets, rent, utilities, insurance, and MEO subcontracts. |

| SCF Line 4: Overhead Costs. Twelve percent of agency personnel costs reflected on SCF Line 1. |

| SCF Line 5: Additional Costs. Agency costs not otherwise accounted for on SCF Lines 1-4, such as phase-in costs and one-time conversion costs for an expansion, new requirement, or conversion from a private sector or public reimbursable provider to agency performance. |

| SCF Line 6: Total Cost of Agency Performance. The sum of SCF Lines 1-5. |

| The guidance for a public reimbursable source to complete SCF Lines 1a-6a is the same as the guidance to complete SCF Lines 1-6. |

| SCF Line 7: Contract Price or Public Reimbursable Cost Estimate. The contract price (based on the type of acquisition, source selection process, and contract type required by the solicitation), or the public reimbursable cost on SCF Line 6a. |

| SCF Line 8: Contact Administration Costs. Costs for administering the contract. |

| SCF Line 9: Additional Costs. Costs incurred by the agency that are added to the private sector or public reimbursable provider’s price/cost. |

| SCF Line 10: One-time Conversion Costs. Costs based on 5% of Line 1, incurred by the agency as a result of awarding a contract. |

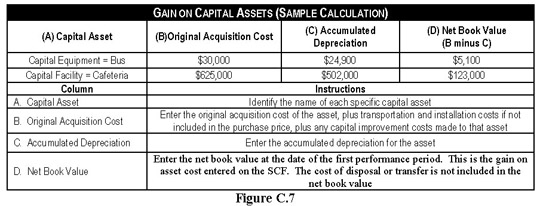

| SCF Line 11: Gain on Assets. Revenue generated from the sale/transfer of agency assets when converting from agency performance. |

| SCF Line 12: Federal Income Tax Adjustment. Revenue for the government when a private sector provider pays federal income tax. |

| SCF Line 13: Total Adjusted Cost of Private Sector or Public Reimbursable Performance. The sum of Lines 7-12. |

| SCF Line 14: Conversion Differential. The lesser of 10% of agency labor costs or $10 M is added to the non-incumbent provider. |

| SCF Line 15: Adjusted Total Cost of Agency Performance. If a private sector or public reimbursable source is the incumbent provider, the conversion differential is added to the cost of agency performance (SCF Line 6) and the sum is the “adjusted total cost of agency performance” on SCF Line 15. |

| SCF Line 16: Adjusted Total Cost of Private Sector or Public Reimbursable Performance. If the agency is the incumbent provider, the conversion differential is added to SCF Line 13 and the sum is the “adjusted total cost of private sector or public reimbursable performance” on SCF Line 16. |

| SCF Line 17: Cost Difference. SCF Line 15 is subtracted from SCF Line 16 to reflect the “cost difference” on SCF Line 17. A positive number indicates performance decision for agency performance and a negative number indicates a performance decision for a private sector or public reimbursable provider. |

| SCF Line 18: Low-Cost Provider. The low-cost provider based on the calculations on the SCF. |

6. Performance Decision in a Standard Competition.

a. Certification. To certify a performance decision in a standard competition, the SSA and CO shall sign the SCF.

b. End Date. The end date of a standard competition shall be the date that all SCF certifications are complete, signifying a performance decision. An agency shall not make any changes (including corrections) to the SCF, agency tender, or public reimbursable tender after this date, except in response to a contest under paragraph F of this Attachment.

c. Public Announcement of the Performance Decision. An agency shall make a formal public announcement (at the local level and via FedBizOpps.gov) of the performance decision. In the announcement of a performance decision for a sealed bid acquisition, the agency shall include the information made public at bid opening, under FAR Subpart 14.4. In the announcement of a performance decision for a negotiated acquisition, the agency shall include the information regarding offers and tenders identified in FAR 15.503(b). If an agency tender includes any MEO subcontracts, the agency shall not release proprietary information contained in these subcontracts.

d. Debriefing. The SSA shall ensure that the CO offers a debriefing to all private sector offerors, public reimbursable sources, the ATO, and directly affected government personnel (and their representatives), in accordance with FAR 15.503.

e. Release of the Certified SCF and Tenders. An agency shall release the certified SCF, agency tender, and public reimbursable tenders, only as provided in this paragraph. Until resolution of any contest under paragraph F. of this Attachment, or expiration of the time for filing a contest, only legal agents for directly interested parties shall have access to the certified SCF, agency tender, and public reimbursable tenders. The agency shall require, as a condition of access, that a legal agent of a directly interested party sign a non-disclosure agreement. The agreement shall provide that a signatory may share the information covered by the agreement only with other signatories, and only for purposes of challenging the performance decision. Upon resolution of a contest challenging a performance decision (i.e., when the agency renders a written decision in compliance with FAR Subpart 33.103, as required by paragraph F.1.b. of this Attachment), or expiration of the time for filing such a contest, the certified SCF, agency tender, and public reimbursable tenders, shall be available to the public, upon request. Proprietary information of private sector providers of sub-contracts included in agency or public reimbursable tenders shall not be released.

f. Implementing a Performance Decision. An agency shall implement the performance decision resulting from a standard competition as follows:

(1) Private Sector Provider.

(a) Awarding the Contract. For a performance decision favoring a private sector source, the CO shall award a contract in accordance with the FAR.

(b) Right of First Refusal. When the agency is the incumbent service provider, the CO shall comply with FAR 7.305(c) regarding the right of first refusal. The HRA shall provide the CO with a list of adversely affected employees as soon as possible after the performance decision is made.

(2) Public Reimbursable Provider. For a performance decision favoring a public reimbursable source, the CO shall develop a fee-for-service agreement with the public reimbursable source. The CO shall incorporate appropriate portions of the solicitation and public reimbursable tender into the fee-for-service agreement and distribute the agreement to the appropriate individuals.

(3) Agency Provider. For a performance decision favoring the agency, the CO shall establish an MEO letter of obligation with an official responsible for performance of the MEO. The CO shall incorporate appropriate portions of the solicitation and the agency tender into the MEO letter of obligation and distribute the letter to appropriate individuals including the ATO.

E. POST COMPETITION ACCOUNTABILITY FOR STREAMLINED AND STANDARD COMPETITIONS.

1. Best Practices and Lessons Learned. Agencies shall post best practices and lessons learned resulting from a streamlined or standard competition process on SHARE A-76! at http://sharea76.fedworx.org/sharea76/Home.aspx. An agency shall main tain the accuracy and currency of their agency’s information, including links, on SHARE A-76!