|

Economic Growth & The President's Tax Relief One Year Later

Today marks the one-year anniversary of the tax relief that

President Bush promised the American people and delivered in full -- the

largest tax reduction in a generation.

One year after President Bush signed the tax cut into law, the

economy is growing, consumer spending is up and America is on the path

to economic recovery. The tax cut provided a much needed boost to our

economy at just the right time by giving Americans more of their own

money to spend, boosting investment and creating jobs. The economy is

much stronger one year after the tax cut but there is still more work

to be done to ensure long-term growth, a job for every American worker

and a return to budget surpluses. And, to keep us on the path to long

term recovery, Congress should make the tax cuts permanent; give the

President Trade Promotion Authority, a comprehensive energy bill and a

terrorism bill; and hold spending down.

Tax Relief Came At Just the Right Time.

-

President Bushs tax cut came at just the right time to help American

families and workers. Workers started getting checks in late July,

2001, pumping $40 billion back into the economy and boosting consumer

spending at a critical time. The tax cut will help create 800,000

jobs by the end of 2002. When the Presidents plan is fully phased in:

-

104 million individuals and families will receive an average tax cut

of $1,040.

- Nearly 43 million married couples will receive an average

income tax cut of about $1,720.

- Over 38 million parents with children

will receive an average income tax cut of $1,460.

- Over 10 million

single mothers will be able to keep, on average, $770 more of their

income.

- About 13 million seniors will see their taxes reduced, on

average, by $915.

- 33 million business owners who pay business income

taxes at individual rates could benefit.

-

President Bushs tax cut came at just the right time to help a slowing

economy. The tax cut helped shorten the duration and impact of the

recession. Had it not been for the September 11th attacks, many

economists believe our economy would have already recovered. While

there is still more to do to ensure that we have a robust recovery

with job creation, the tax cut has put the nation on the path to

long-term recovery.

The Tax Cuts Put The Economy On The Path to Recovery.

Theres Still More To Be Done To Create Jobs And Ensure Long-term

Growth.

- To keep America on the path to economic recovery, Congress should make

the tax cut permanent. Unfortunately, the tax cuts we put in place

last year are scheduled to expire in 2011. To ensure a robust

economy, to give every worker a job and to provide American families

and businesses the security and certainty needed to make long-term

savings and investment decisions, the tax cut must be made permanent.

Otherwise, the tax increases that will occur in 2011 will be an

ongoing drag on our economy:

- The tax rate on low income families would jump 50% (from 10% to 15%)

- The child tax credit would be cut in half (from $1,000 per child to

$500)

- Marriage penalties would be restored.

- Education savings taxes

would skyrocket (withdrawals for certain savings plans will be taxed)

- Retirement savings and IRA contribution limits would shrink by more

than 60%.

- The death tax would be restored.

- To ensure job creation

and a robust recovery, Congress should give the President Trade

Promotion Authority, a comprehensive energy plan and a terrorism

insurance bill. While the economic signs are encouraging,

unemployment is still too high and business investment is not where it

should be. To speed the recovery and guarantee jobs for all American

workers, Congress should give the President Trade Promotion Authority,

a comprehensive energy plan and a terrorism insurance bill.

- To

guarantee long-term growth and future prosperity, Congress must

exercise fiscal discipline. When the federal government overspends,

it has a serious effect on the long-term growth of our economy. The

President has submitted a responsible budget that focuses on our

nations priorities: ensuring economic recovery, winning the war on

terror, and protecting our homeland. If Congress holds spending to

the Presidents budget, we will return to a budget surplus by 2005. As

the President has shown by issuing a stern warning in the SAP for the

Supplemental Bill, he will enforce fiscal discipline.

The War and

Recession -- Not the Tax Cuts -- Drained the Budget Surplus

- While some in Washington want to blame the tax cut for the declining

surplus, the facts tell a different story:

- The Recession Erased Two-Thirds of the Surplus: The recession and

declining tax revenues drained roughly two-thirds of the budget

surplus.

- Homeland Security and War Spending Used 19% of the Surplus:

Immediately following the terrorist attacks, President Bush and

Congress rightly passed significant spending increases for the war

against terrorism, homeland security, airline security, and emergency

response. This necessary spending accounted for approximately 19% of

the surplus.

- The Tax Cut Only Used 15% of the Surplus: Despite the

claims of some in Washington, the tax cut used less than 15% of the

surplus.

- Economic growth and job creation are the key to future surpluses. Tax

increases do not create surpluses.

|

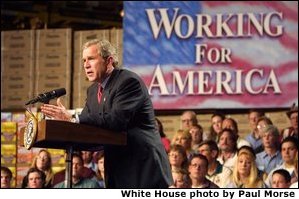

President George W. Bush addresses folks at a General Mills plant in Cedar Rapids, Iowa, Monday, April 15. Taking to the podium on tax day, the President discussed last year's tax cut that and stated that such cuts for the American people should be permanent.

President George W. Bush addresses folks at a General Mills plant in Cedar Rapids, Iowa, Monday, April 15. Taking to the podium on tax day, the President discussed last year's tax cut that and stated that such cuts for the American people should be permanent.