- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

- President's Cabinet

- USA Freedom Corps

- Faith-Based & Community Initiatives

- Office of Management and Budget

- National Security Council

- USA.gov

|

Home >

Government >

Council of Economic Advisers

|

Council of Economic Advisors

Conference on Corporate Income Taxation and the U. S. Economy

Prepared Remarks by Edward P. Lazear

Chairman, Council of Economic Advisers

For the Public Conference on Corporate Income Taxation and the U. S. Economy

at The American Enterprise Institute

June 2, 2006

![]() Full PDF Document (42K)

Full PDF Document (42K)

Thank you Glenn for that kind introduction and for the American Enterprise Institute hosting this excellent event. I am pleased to be here.

Economic Growth and Productivity Growth

Economic growth is the key to increasing living standards. Our economy has been growing strongly with real GDP increasing at a 5.3 percent annual rate in the first quarter of 2006. Growth means higher productivity, and higher productivity translates directly into higher wages. Productivity has also grown strongly, with the most recent numbers showing 3.5 percent annual growth since the business cycle peaked in the first quarter of 2001.

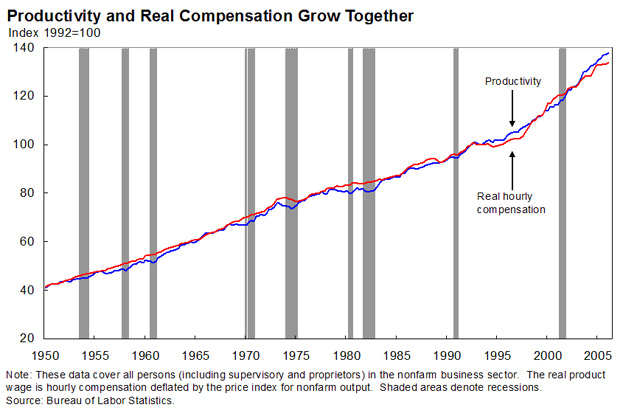

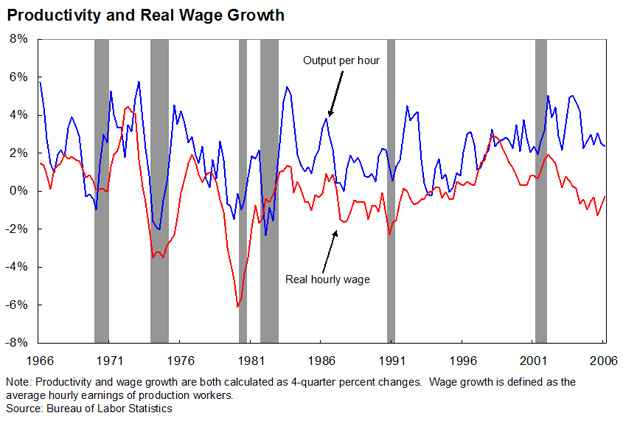

To get a sense of why economic growth is so important, look at Figure 1. In Figure 1 the relationship between compensation and productivity is plotted over about a 55-year period. The compensation series used here is called the real product wage, which is a comprehensive measure of total compensation. Although these curves do not line up on a yearly basis, it is quite clear that wages and productivity are highly linked. A related measure of compensation, real after-tax income has also increased substantially, rising by a total of 12.9 percent since January 2001, and $2,140 per person. Figure 2 makes the point even more dramatically. In Figure 2 production worker wages are plotted against productivity growth. As one can see, when productivity growth is high, real wage growth tends to be high. The point is that if we are interested in raising the wages of the average American, the way to do it is to ensure that productivity grows at a rapid rate.

There is evidence of beneficial effects in the labor market. Job growth is very strong, the economy has added 5.3 million new jobs since August 2003. This morning’s jobs numbers showed continued strength in the labor market. Employment rose, unemployment fell, and the labor force increased. Unemployment is now down to 4.6%.

Economic growth and productivity growth are also important to the government’s budget. With strong growth in revenues we are ahead of pace to meet the President’s goal of cutting the deficit in half by 2009. To date this year tax receipts are up 11% compared to a year ago, reflecting an economy that is growing, expanding, and creating jobs. Significantly, the CBO is now projecting the 2006 budget deficit to be down to $350 billion or perhaps as low as $300 billion or about 2.3 percent of GDP. (Treasury estimates will come out after the Mid-Session Review.) These numbers are encouraging, particularly since this is a year during which the Federal budget is strained by the fact that we are fighting a war and rebuilding after unanticipated natural disasters on a major scale. Indeed the evidence suggests that strong economic performance is improving revenues. Economic growth and spending restraint are the solution to reducing the deficit, not higher taxes.

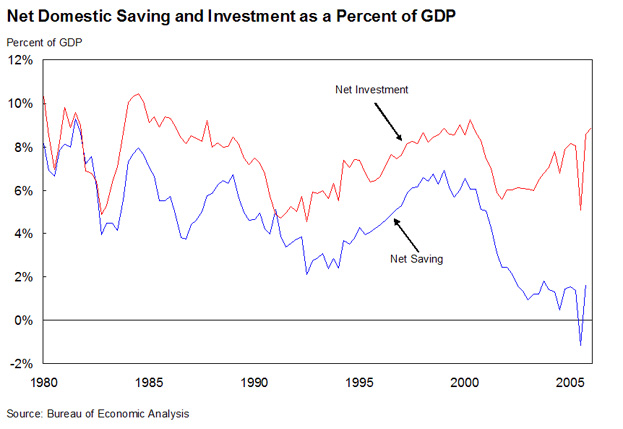

In order to continue the above benefits, it is essential to encourage investment and saving. Because we have a global capital market, investment and saving are distinct. We are able to finance high levels of investment despite our low saving rate because others are willing to invest in us (See Figure 3), but they will not be willing to continue to do that if the after-tax rate of return to that investment is reduced to levels that are not internationally competitive. In order to remain internationally competitive, it is important for our government to focus on changes to our tax system that will encourage both domestic saving and also encourage global investment.

Tax System Principles

The goal of a tax system is to raise the money that is necessary to run government, and to do so in the most efficient way possible with the minimum amount of economic distortions so our economy is allowed to grow. Although you may be aware of the many principles of minimizing tax distortions, I would like to just run through a few of the ones that motivate my thinking about our tax system.

First, an efficient tax system should not favor current consumption over future consumption. In plain English, that means that it should not discourage saving. The current tax system, by taxing the return on capital either in the form of interest taxation or capital gains and dividend taxation, biases the system toward present consumption over saving. The personal saving rate in the United States is negative, although there is some disagreement over whether it is truly negative when capital gains in housing and the stock market are taken into account. Still, it is hard to argue that our saving rate is commensurate with what one would expect in a country as rich as ours. Indeed, one of the anomalies that we observe in the world is that the very poor countries which should be borrowing from us to finance current consumption given their high rates of growth and prospects for a rich future, are instead the lenders. We, who are at the top of the world income distribution, are the borrowers. Our tax system does not help that situation.

Second, all forms of capital investment should be treated similarly. There is no reason to favor one type of investment over another. A study on effective tax rates across different asset types by the Congressional Budget Office shows that our tax code treats these assets differently. The CBO study shows that effective rates on capital assets for corporations range from a low of 9.2 percent for petroleum and natural gas structures up to 36.9 percent on computers and peripheral equipment.

Third, the tax system should not push any particular form of corporate governance. Instead, such decisions should be made on the basis of business considerations. The same CBO study mentioned before shows that the effective tax rate on capital income for corporate business is 26.3 percent, while being only 20.6 percent for non-corporate businesses.

Fourth, the tax system should not discourage investment in human capital, which is so essential to economic growth.

Recent Extension of Reductions in Dividends and Capital Gains Tax Rates

The financing of investment is also an issue. Firms generally have the choice of funding investment through borrowing (debt) or the use of retained earnings (equity). The tax system can influence their choice. To the extent that businesses can deduct interest payments on their debt while dividends and capital gains are taxed, firms have an incentive to finance through debt rather than equity. For example, the CBO estimates that the effective tax rate on debt-financed corporate capital is -6.4%, whereas the effective tax rate on equity-financed corporate capital is +36.1%.

Recently, Congress voted to extend the rate cuts on dividends and capital gains that were enacted by the Jobs and Growth Tax Relief Reconciliation Act of 2003. That was very good news. The President was delighted to sign the tax reconciliation bill making those lower tax rates effective through 2010. Lower tax rates on dividends and capital gains are playing an important role in encouraging investment and economic growth in the United States. In a time when many people are concerned about our international competitiveness, hiking these taxes would have taken us in the wrong direction.

The record on the capital gains and dividends tax cuts is impressive. They moved us in the direction of a more efficient tax system. Most of the evidence, especially that on firm behavior and the dividends and capital gains tax changes, suggests that the 2003 Tax Act did stimulate economic growth. Since the tax cuts, fixed investment has increased in every quarter, and most recently those increases in investment have spread broadly to include very high levels of investment across the board. The strength of the economy confirms that low tax rates help to stimulate investment, create jobs, and support economic growth.

For all these reasons, the reduction in taxation of dividends and capital gains were important. But there are some additional and more subtle tax effects. First, reducing capital gains and dividends taxation also mitigates the push toward debt financing over equity. The overuse of debt relative to equity increases the chance of bankruptcy, which leads to worker displacement, lost jobs and lower wages.

Second, encouraging dividend payouts means a more efficient capital market. Although not a necessity, there seems to be a tendency for retained earnings which are encouraged by high dividend taxation to be invested in larger firms rather than smaller ones. The lower tax rates may be an indirect stimulus to entrepreneurship by making capital more available to small firms.

Finally, and not to be ignored, keeping the money in the hands of the people rather than in the hands of government is a good thing. The public invests its money efficiently because the costs and returns are borne by the investors themselves. All 57 million American families who own stock directly or indirectly benefit from the tax cuts on capital. It is estimated that around 35 million taxpayers - about one-fourth of whom are elderly - will benefit directly from lower taxes on their dividend income. Among that group of the elderly, the tax saving relative to taxes that would be paid under the old structure would mean about $1,100 average to each.

Other Ongoing Efforts

The President has placed his recent focus on capital taxation and reducing dividends taxes in particular. To promote economic growth, it was particularly important to initially push extensions of the capital gains and dividend tax cuts as part of the President’s agenda. In general, economists believe that taxation of capital gains and dividends impedes growth because capital investment elasticities tend to be high. In other words, small changes in tax rates can significantly affect the amount of investment that occurs.

The President has advanced a number of additional proposals that are improvements in the tax system. Two important policies to highlight in this regard are the proposed tax-exempt health savings accounts (HSA’s) and permanent repeal of the estate tax. HSA’s are designed to remedy a bias in current tax law that favors employer-provided health insurance benefits. With HSA’s people will be encouraged to choose more consumer directed health plans and combine the financial protection of catastrophic coverage with out-of-pocket payment for normal health expenditures. Permanent repeal of the estate tax will also help to reduce tax distortions biased against investment and saving.

Reducing dividends and capital gains taxation, eliminating the estate tax, and expanding HSA’s and other kinds of plans that remove the disincentive to save are all important components of an efficient tax structure, but it is also necessary to keep the marginal rates on wage income low. Here again President Bush has moved the ball down the field by working with Congress in 2001 to reduce individual income tax rates across-the-board. Not only is this a fairness consideration, but it is important for the most significant kind of investment for an economy, which is investment in human capital. Virtually all studies of economic growth show that education specifically, but human capital in general is the most important component in ensuring that an economy grows at high rates. To further investment in human capital, it is necessary to keep marginal tax rates on upper income taxpayers low also. If high incomes are taxed at too high a rate relative to lower incomes, the incentives to invest in human capital decline.

Conclusion

We have already taken a number of steps toward more efficient taxation since 2001. The effects have already panned out in high economic growth and growing wages. The 2003 Growth and Jobs bill produced the desired effects. It stimulated dividend payout, investment, and economic activity. The extension of the low rates on capital is a step in the right direction. Additionally our marginal rates on wages are down to reasonable levels, although of course, lower is always better. And our deficits are coming down. It is important that we continue to maintain low taxation so that the United States remains the best place in the world in which to invest in both human and physical capital.