|

For Immediate Release

Office of the Press Secretary

May 6, 2003

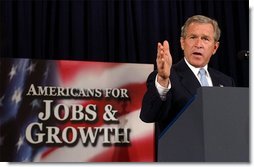

President Addresses Tax Relief Coalition

The United States Chamber of Commerce

Washington, D.C.

|

|||||

10:31 A.M. EDT

THE PRESIDENT: Thank you all. Good to see you. Thanks for coming. Thank you all. Thanks for coming. I heard you were in the neighborhood -- (laughter) -- so I decided to drop by and say hello. Thanks for your interest in your country. Thanks for your concern about the future. Thanks for worrying about somebody who is wondering whether he or she are going to be able to put food on the table, to find work. And that's what we're here to talk about.

The Tax Relief Coalition is a broad group, united by the commitment

to the spirit of risk-taking. You understand the free enterprise makes

this economy go. You understand the role of government is not to

create wealth, but an environment in which the entrepreneur can

flourish. (Applause.) You understand that our duty here in Washington

is to set pro-growth policies in place that reward and respect

Americans who work hard and take risks. That's what you understand.

(Applause.)

The Tax Relief Coalition is a broad group, united by the commitment

to the spirit of risk-taking. You understand the free enterprise makes

this economy go. You understand the role of government is not to

create wealth, but an environment in which the entrepreneur can

flourish. (Applause.) You understand that our duty here in Washington

is to set pro-growth policies in place that reward and respect

Americans who work hard and take risks. That's what you understand.

(Applause.)

I appreciate your understanding, and I'm glad you're here because you're here at just the right time. (Laughter.) You see, Congress is now considering what to do. Congress is debating the package. They're trying to figure out what course to take. And I'm glad you're bringing your voices to the halls of Congress, and can be a loud voice, as both the Secretary and I understand, and that's going to be important in the halls of Congress. (Laughter.)

Last Friday, we received some troubling economic news. The unemployment rate is now at 6 percent. The news ought to serve as a clear signal to members of the United States Congress that we need a bold economic recovery plan. (Applause.) Congress will hear from me. Congress will hear from the Secretary. Congress needs to hear from you. We need tax relief that creates the greatest number of jobs. (Applause.) The goal is to create a million new jobs by the end of next year. I've submitted a good, strong plan that will help meet that goal. The United States Congress must not only listen to your voice, but must listen to the voice of somebody looking for work. We need aggressive action out of the United States Congress now. (Applause.)

I want to thank our Secretary of Treasury, John Snow. He's experienced; he's capable; he's able. He just as -- he could easily have looked me in the eye and said, no, I don't want to serve my country. I think I'm kind of happy where I am in the private sector. But, no, he said, Mr. President, I want to serve the country. And our country is better off because John Snow said yes. Mr. Secretary, thank you. (Applause.)

I want to thank my friend Dirk Van Dongen, who's been a tireless advocate for policies that help people looking for work. He's the President of the Tax Relief Coalition. I want to thank all the members of the Tax Relief Coalition who are here, who have joined us, who realize that democracy can work if you work at it. And I appreciate you coming. (Applause.)

I want to thank Tom Donohue, who is the President and CEO of the Chamber, for lending this fantastic hall and this beautiful building for -- lending us this for the purposes of making a statement to the country about our mutual desire to help people find a job.

I want to thank all the entrepreneurs who are with us today, the risk-takers, the -- really, truly the engine of growth for the American economy. We've got the Brindley boys here from Vienna, Virginia. I'm going to say something about them a little later on. They started what they call Jammin' Java. (Laughter.) The good news is, Jammin' Java is succeeding. I had a chance to visit with them before we came in, as I did with the Rickards, as well, who have got their own business. I'm going to say something about them a little later on.

The reason I point them out is there are people in this audience who own their own business, who are part of the ownership society in America, who are creating new jobs. So, for all the entrepreneurs who are here with us and all across America, thank you -- thank you for working hard to realize your dreams. (Applause.)

America is a strong and confident nation. And those qualities are seeing us through some challenging times. For nearly 20 months we have waged a relentless campaign against global terror. For 20 months, we have done what the American people expect, and that is to hunt down the killers, one at time, so that America is more secure. We are winning the war on terror. (Applause.)

And as a part of the war against terror, we removed Saddam Hussein from power in Iraq. (Applause.) Thanks to the skill and courage of our military and other coalition forces, America is more secure, the world is more peaceful, and the Iraqi people are now free. (Applause.)

We will continue to meet our responsibilities to secure America. We will continue to dismantle the al Qaeda network. We will continue to promote the peace. We will continue to promote freedom, because we know a free society is one that is more likely to be a peaceful society. We assume those responsibilities. We'll follow through on our responsibilities.

And here at home, we have responsibilities. As we press forward on national security, we must promote job security here in America. (Applause.) Our goal is a vibrant and growing economy. That's our goal -- in which the entrepreneur can find new opportunities, in which every person who wants to work can find a job. That's the stated goal of this administration. It's I know a goal that you share, as well.

The American economy has faced one challenge after another over the past several years. The stock markets peaked in early 2000. The economy began to slow in the summer of that year. In early 2001, our economy was in recession. And then we got attacked by the terrorists, and that affected our capacity to grow. And we've endured the uncertainty of war. We've seen failures in corporate responsibility across America. Unfortunately, some of our citizens forgot what it means to be a responsible citizen of this country. They didn't tell the truth. (Applause.) They didn't tell the truth to their employees and their shareholders. They self-enriched at the expense of small investors and public interests. In every case, we've taken action to confront these challenges.

Our economy is growing. We've got many strengths in our economy. First, the economy is growing because interest rates are low. I want you to know that in spite of all the hurdles and the challenges we faced, we're still growing faster than nearly all the industrialized countries. (Applause.) And interest rate -- low interest rates help because it helps Americans buy a home, or refinance, or remodel a home. And that helps. That helps create employment opportunity. Inflation is low, and that helps. Energy prices are now falling. That's like tax relief on a daily basis when you go to the pumps. (Applause.)

We've got two great strengths even better than the statistics I just cited -- one, the entrepreneurial spirit is strong. (Applause.) And secondly, we've got the best workers in the world in America. (Applause.) Last year, productivity growth in America was about 4.8 percent. That's the best annual increase since 1950.

When you're talking about productivity increases, you're really talking about technology, and more importantly, the human capacity of the work force. Our workers are great. The best in the world. But even with the strengths I just outlined, it's important for members of Congress to hear from you that we've got more work to do, that's there unmet potential in this economy. It's not growing fast enough. In spite of the strengths, there's still people looking for work, and we've got to do more. And that's the message I want you to take to the halls of the United States Congress. (Applause.)

This isn't the first time I've been talking about this subject. (Laughter.) Four months ago I sent a jobs and growth package to the Congress. That was four months ago. And we've seen some progress since then, and that's good news. First of all, both parties, in both Houses of Congress, now recognize that tax relief helps create jobs. (Applause.)

That's important, that both Houses understand that when somebody keeps more money, they're likely to demand a good or a service, when they have more of their own money to spend. By the way, when you're up there, remind them something that you and I know is true; the money we talk about in Washington D.C. is not the government's money, it is the people's money. (Applause.)

And so the debate is not if there is going to be tax relief, the debate now is how much tax relief. And when they ask you, how much do you think, citizen, what you ought to say is, enough to make sure that we create a million new jobs by the end of 2004. That's the definition of the right amount. (Applause.)

The definition of the right amount is not some theory, is based upon theory, it's based upon the practical application of tax cuts, and it ought to be based in human terms. The right answer for how big the tax cut ought to be is a million jobs. That's the right answer. And that's the package I submitted to the United States Congress. (Applause.)

The good news is many in this room have already been through the tax relief exercise in recent history. Many of you in this room were involved in the spring of 2001 to convince Congress to pass tax relief. And it's a good thing you were involved, and it's a good thing they did, because the tax relief helped make the 2001 recession one of the shortest and shallowest in America history. (Applause.)

The issue we now face results from the fact that Congress phased in tax relief over 10 years. In other words, they passed tax relief, but it was going to be incremental. My proposal would get the tax relief into effect this year. (Applause.) Our motto is this: If tax relief is good for Americans years from now, it is even better when the American economy needs it today. (Applause.)

Instead of lowering all tax rates little by little, the Congress needs to do it all at once, and needs to do it now. (Applause.) Instead of gradually reducing the marriage penalty, we should do it now. (Applause.) Instead of slowly raising the child credit from $600 to $1,000, we ought to do it now. And we should send the extra $400 per child to American families this year. (Applause.)

You'll hear all kinds of rhetoric about how this plan is not fair. Well, let me just describe to you what it means to the family of four making $40,000 a year. It means their taxes would go from $1,178 a year to $45 a year. (Applause.) That's what that means. That sounds fair to me. (Applause.) And it will sound really fair to the family making $40,000 a year. You see, that's $1,000 not just one year, but for every year. It's $1,000 of that family's own money coming back into their personal treasury, so they get to decide what to do with the money. They get to decide whether to save for a college tuition. They get to decide whether to prepare for retirement. They get to decide how to make their family stronger with their own money. (Applause.)

It's also important for your message to understand -- it's important for your message to understand that this tax relief will help 23 million small businesses create new jobs. Any good tax relief plan must understand the role of the small business in American economy. (Applause.)

This plan says loud and clear to the Congress, we understand the role of the entrepreneur; we understand most new jobs are created by small business owners. And this plan directly affects small business, because most small businesses pay taxes at the individual tax rates. You know why? Because they're either a sole proprietorship, or a limited partnership, or a Subchapter S corporation. All three of those entities pay tax at the individual tax rates. So when we reduce individual tax rates, we help the bottom line of every mom-and-pop business in America. (Applause.) When we accelerate the tax rate reduction, it really means we're putting capital into the treasuries of the small businesses all across America. More capital means more investment. More investment means more jobs. If Congress is interested in job creation, if you want to join us in creating a million new jobs, cut the tax rates on the small businesses all across the country. (Applause.)

Our tax code should also support small business owners who want to invest in the future. So today, a small business can deduct $25,000 for investment in new equipment. The proposal that you're advocating there in the halls of Congress, the proposal I have submitted, says that we would triple the amount of expensing new equipment, from $25,000 to $75,000 per year, and index that to inflation. (Applause.)

I mentioned the Brindley boys were with us today, from Vienna. They -- let me talk about -- they help define the entrepreneurial spirit in America. They started their business right after September the 11th, 2001. Those are confident people. (Laughter.) Those are people that said, we're not going to allow a terrorist attack to diminish our dreams to have our own business. I appreciate not only the courage, but I appreciate this -- that they have gone from five employees to 25 employees. (Applause.)

Here's what Luke says. Luke says, "Buying equipment is something we need to do in order to grow the business, in order to stay up with competition. Any break we get obviously encourages us to hire more people and buy equipment." In other words, tax relief will be used by the Brindleys to buy new equipment. And when they buy new equipment, it means their work force becomes more productive. It means they can compete better in the marketplace. It also means that somebody has got to make that equipment. And when somebody makes the equipment, somebody is finding work. In other words, good tax policy ripples throughout our economy. (Applause.)

And Randy and Harriet Rickard are with us. I cite these examples because Congress must understand that behind the numbers is just people that are taking risks for the sake of creating jobs. The Rickards are here; they started their own business three years ago. It's a home remodeling business. Randy runs a tight ship. He's got -- he's got four employees, and he's one of them. He comprises 25 percent of his work force. (Laughter.) But that's the nature of most small businesses. People who are working hard, people who are expanding, people who are providing a good or a service.

This proposal that we've proposed will save him nearly $2,400 every year. That's enough to help pay health insurance for employees, or it's enough to add a new truck, to make sure his business is competitive. He says, anything is helpful. "If the economy does well, I do well." Well, Randy, this plan is all aimed at making sure the economy does well, so you can do well. And when you do well, somebody is going to work. That's the whole basis of the plan. (Applause.)

The jobs and growth plan would encourage investment by ending the double-taxation on dividends. (Applause.) Taxing profits at the corporate level is fair. That's fair. Somebody makes a profit, that profit ought to be taxed. However, when the profits get distributed to the shareholders, and it gets taxed again, that's unfair. It's counterproductive. (Applause.) Ending the practice makes the tax code fair. It makes it fair especially for our seniors, who receive more than half of all taxable dividend income.

Economists say that this move will boost the stock market. That's what the economists say. Not all, but a lot of the smart ones say that. (Laughter and applause.) In other words, there's a wealth effect that will take place. An increasing stock market means a lot for many of our fellow citizens, because we are becoming an ownership society. Many people own stocks directly. Many people own stocks through their pension plans. Many people will be directly affected by an increasing stock market. And so getting rid of the double-taxation of dividends will help an ownership society realize more wealth. Getting rid of the double -taxation of dividends will be good corporate reform.

We went through a period where people said, invest in my company because I happen to have a good story; I may not have any cash flow, but I've got a good tale to tell. (Laughter.) The problem -- the new economics sometimes overlooked old accounting. And that is, when you run out of cash, it doesn't matter what the story is like. (Laughter.) A dividend-paying society is one that says, I've got a good story, and oh, by the way, is I'm going to distribute on a regular basis cash out of my treasury in the form of a dividend. (Applause.)

Getting rid of the double-taxation of dividends will be good corporate reform. It will make our balance sheets more reliable. It will be better for small investors. It will also help create new jobs. We estimate that 400,000 new jobs will be created when we get rid of the double-taxation of dividends. So when you hear people say the proposal only helps a certain investor class, they're not telling the whole story. Ending the double-taxation of dividends will help 400,000 people find work by the end of next year. (Applause.)

The House of Representatives is considering a proposal that would include all the elements of the growth plan which I just described to you. It would also significantly reduce the double-taxation on dividends. It's a positive step. And they're making progress. I'm going to continue to work both with the House and the Senate, with the goal of making sure as many people can find work as possible. But the more the members of Congress here from you, the more likely it is that this plan is going to pass.

What you need to do is tell them what tax relief will do for our country; if you own your company, how much it will help your company grow; how many jobs that you'll be able to create with tax relief. That's what you need to tell them.

You'll also hear talk about the deficit. And, yes, we've got a deficit because we went through a recession. You see, a recession means you get less money coming into your treasury. When the economy goes down, there's less tax revenues coming to the Treasury.

Secondly, we've got a deficit because we're at war. And one thing is for certain about this Commander-in-Chief, we will spend whatever is necessary to win the war. (Applause.) We owe it to every soldier in the American military to make sure they've got the best pay, best equipment, best possible training. We owe it to the families of the military to make sure that they're as well protected as possible. So our expenditures went up because of the emergency in war, and revenues went down. That's the ingredients for what they call a deficit.

And there's two ways to deal with that deficit, in my judgment. One is to hold the line on spending. I submitted a bill to the -- I submitted a budget to the United States Congress which holds the discretionary spending to 4 percent. That's a reasonable level. We, of course, will work with Congress to make sure they stick to that budget -- control spending on the one hand, and on the other hand, in order to get rid of the deficit, you boost revenues coming into the Treasury by encouraging economic growth and vitality. (Applause.)

I'm concerned about the deficit, but not as concerned about the deficit as I am about people trying to find work. I'm more worried about the person looking for work. And, therefore, we've got a plan that is robust and strong, that encourages economic vitality and growth, so our fellow citizen can get to work and get to work soon. (Applause.)

You all can make a difference in this debate. Not only the people present in this room can make a difference, but people who are listening across the country can make a difference. That's why they've got emails -- (laughter) -- or telephones, or in some cases, buses. (Applause.) People on the Hill are responsive to the voice of their fellow citizens.

So thanks for coming, to be a part of a process that distinguishes -- that really distinguishes us in many ways from many parts of the world, a process in which the citizen can make a difference. Part of the process that says democracy is by far the fairest way for people to live. And that's what we believe.

We believe strongly in certain principles. We believe in the dignity of every single human being. (Applause.) That's why we want to make sure -- that's why we care when we hear somebody can't find a work. That's why we grieve when a fellow citizen who wants to work can't find a job, and that's why we've put policies out there that promote growth and economic vitality. But we not only believe in the dignity of every American, we believe in the dignity of every person. See, we believe that freedom is the Almighty God's gift to each and every person on this -- who lives on this globe. That's what we believe. (Applause.)

You're representing the best of a free society. The willingness to speak out really does speak to the great freedoms of America. And we hold those freedoms dear. We believe in freedom not only for our own people, but we believe in freedom for those who are enslaved. We believe so strongly in freedom that we're willing sometimes to take risk for not only our own freedoms, but the freedoms of others. That's the great thing about our country. We're a strong country; we're a confident country; but we're also a compassionate country that believes in values and principles that will endure the test of time.

Thank you for coming to Washington to exercise your freedom. (Applause.) May God bless you all, and may God bless America. (Applause.)

END 11:04 A.M. EDT