|

For Immediate Release

Office of the Press Secretary

January 25, 2007

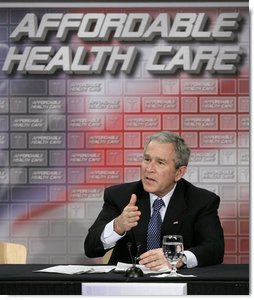

President Bush Participates in a Roundtable on Health Care Initiatives

Saint Luke's East -- Lee's Summit

Lee's Summit, Missouri

![]() Fact Sheet: Affordable, Accessible, And Flexible Health Coverage

Fact Sheet: Affordable, Accessible, And Flexible Health Coverage

![]() In Focus: Health Care

In Focus: Health Care

12:08 P.M. CST

THE PRESIDENT: Rich, thank you very much for inviting us here to St. Luke's. We had a fascinating tour of your facility. It is safe to say that St. Luke's hospital -- the St. Luke's Health System understands the power of technology to help compassionate doctors and nurses better do their job. And technology is a -- we saw unbelievably interesting medical programs, programs that enable doctors to better analyze disease and deal with disease before it becomes acute, which is important.

The reason why I emphasize the information technology aspects of this

hospital is that part of the role of the government is to encourage

people to make decisions to help hold the cost of health care down. And

when a hospital modernizes, and you go from files to electronics, it

helps hold the cost of health care down.

The reason why I emphasize the information technology aspects of this

hospital is that part of the role of the government is to encourage

people to make decisions to help hold the cost of health care down. And

when a hospital modernizes, and you go from files to electronics, it

helps hold the cost of health care down.

One of the interesting things about medicine is that medicine tends to have lagged behind the rest of our economy when it comes to information technology, and yet under Rich's leadership this facility and its sister facilities are doing some real interesting reforms, we'll talk about a little bit.

I want to thank George Pagels, who is the CEO of this facility. George, thank you. He's a doctor, and gave us the tour. Met a lot of really fine nurses and docs, by the way. I appreciate Senator Bond joining us. Thanks for coming. And of course our Secretary of Health and Human Services, who will say something here in a minute.

I want to talk a little bit about a comprehensive strategy to make health care available and affordable. There is no question in my mind that a proper role for the federal government is to help the poor and the elderly and the diseased get health care. We'll do that. And to the extent that these important programs need to be reformed and strengthened, we will do that, as well. Witness what we did with Medicare. Medicare was old and stagnant; it needed to be reformed. We reformed it through a generous prescription drug benefit that has actually worked -- it's helped our seniors.

And so we will do our duty at the federal level, and when we find deficiencies in federal programs we will work to correct them, for the good of the citizens and the taxpayers.

The second aspect of our responsibility is to work to make health care available and affordable for all our citizens, and the best way to do that is through private health insurance. Therein lies part of the debate we have in Washington. We believe the private sector is the best delivery of health care. We know there's a role for the federal government, but it's not to dictate, it's not to be the decision-maker. And so Mike and I and others in my administration have been strategizing on how best to make health care available and affordable.

Here are some ways: One, helping spread information technology. We're the biggest user of health care in the United States, and, therefore, we can help people understand the benefits of using information technology. Secondly, price transparency. One reason we came to this hospital is that under Rich's leadership, this hospital system has been willing to place its prices and its quality ratings out for consumers to see.

Health care is an interesting industry, isn't it, where a lot of times

you have no idea about the price of the service you're paying for. You

just assume it's okay. Somebody says, here's your price, and you say,

okay, I'll pay it. We believe that with price transparency and quality

assessments, consumers will have better decision-making process. And we

want consumers making the decision on health care.

Health care is an interesting industry, isn't it, where a lot of times

you have no idea about the price of the service you're paying for. You

just assume it's okay. Somebody says, here's your price, and you say,

okay, I'll pay it. We believe that with price transparency and quality

assessments, consumers will have better decision-making process. And we

want consumers making the decision on health care.

Think about a system where there's a third-party payer -- you've got your insurance, somebody pays your bills for you and you're not involved. You just kind of assume that the third- party payer is making a rational decision on your behalf. And our view is, is that in order to have -- to worry about health care costs, the more a consumer is involved, the more likely we'll be able to deal with the increasing cost of health care.

Another reform is medical liability reform. I'm walking around the hospital here; a professional comes up to me and says, we practice too much medicine for fear of lawsuits, which raises the cost of your bill. See, if the medical provider is worried about getting sued, they will make decisions on how to stay out of the court of law more than -- as important as decisions on how to keep you healthy. Medical liability is a real problem in a lot of states.

And we are trying to get the United States Congress to hear that same call. And I'll keep working on medical liability reform. Why? To help make health care more affordable. But also, when you've got a lawsuit, it causes good docs to quit the practice of medicine. There are a lot of counties in the country that do not have OB/GYN because these lawsuits have run them out of practice. And it's not right, and it's not fair.

And so we need to -- need to have the political will in Washington to take on a very powerful lobby, which is the trial lawyers, and prevent these frivolous lawsuits from running up the cost of your medicine, and running good docs out of practice.

A couple of other points I want to make before we talk to the -- talk

about this new initiative I laid out to the country. I think it's very

important to help develop plans that make the consumer in charge of as

much of the health care decision as possible. These are called -- one

idea is health savings accounts, which basically says that there is a

product available for you to use where you're the decision maker, and

you're able to contribute tax free, earn money in your account tax free,

take money out tax free on medicine. If you don't spend the money in

your account one year, you can roll it over. It becomes a savings

account. It's an incentive for you to make good decisions about your

life, and it also provides catastrophic care in case something bad

happens to you. We'll talk about health savings accounts here in a

minute, and their effect on enabling people who do not have insurance to

have health care available and affordable for them.

A couple of other points I want to make before we talk to the -- talk

about this new initiative I laid out to the country. I think it's very

important to help develop plans that make the consumer in charge of as

much of the health care decision as possible. These are called -- one

idea is health savings accounts, which basically says that there is a

product available for you to use where you're the decision maker, and

you're able to contribute tax free, earn money in your account tax free,

take money out tax free on medicine. If you don't spend the money in

your account one year, you can roll it over. It becomes a savings

account. It's an incentive for you to make good decisions about your

life, and it also provides catastrophic care in case something bad

happens to you. We'll talk about health savings accounts here in a

minute, and their effect on enabling people who do not have insurance to

have health care available and affordable for them.

Finally, small businesses need help. I mean, it's hard to be able to buy insurance when you're a stand-alone company. And insurance is basically a spreading of risk through pooling of risk, and we just need to allow small businesses to be able to buy insurance at the same discounts that big companies can by pooling risk.

In other words, a restaurant in Missouri ought to be able to have their employees insured with a restaurant in Texas. In other words, put them all in the same pool so they can get the benefits of spreading risk. Now these are practical things to get done. And they're hard to get done in Washington because people in Washington have a different view. They want the government basically making decisions for health care. The view of the people here is that you ought to be making those decisions.

One way to encourage you to make the right decisions when it comes to health care is to take the inequities out of the tax code. If you work for a company, you pay -- you get your health care free, in essence. It's part of the benefit package. If you're a stand-alone person, you pay your health care on an after-tax basis. In other words, there's discrimination in the tax code based upon who you work for. It makes it harder for people to be able to -- individuals or small company employees to be able to buy health care.

And so what we've said, and Michael spent a little time describing this, we've said that all Americans who have health care ought to be allowed to have a $15,000 deduction on your income taxes if you're a married couple -- if you're married, and if you're not, $7,500. In other words, the benefits you receive from your company become part of your taxable income, offset by a $15,000 deduction. And so if the benefits you get from your company are $11,000, you'll have $4,000 deducted from your income. And that's important.

It also will help people who are uninsured or on the verge of being

uninsured. In other words, it encourages the development of an

individual market. It makes it more likely an individual will be able

to afford health care. If you've got a family of four with $60,000

income, you get a substantial tax savings, which will then enable your

health insurance to be more affordable. And we'll talk about that.

It also will help people who are uninsured or on the verge of being

uninsured. In other words, it encourages the development of an

individual market. It makes it more likely an individual will be able

to afford health care. If you've got a family of four with $60,000

income, you get a substantial tax savings, which will then enable your

health insurance to be more affordable. And we'll talk about that.

The point I'm trying to make to you is the system is geared toward enabling the individual to have more control over his or her decision-making and make the tax code fair for the individual.

And finally, I've instructed Michael to work with states. We believe that there's been some very innovative policy that takes place at the state level to cover the uninsured, to help the sick, to help those who are poor be able to get insurance. And so we're going to have flexibility with federal money that goes to states, and all we request is the states develop a basic health insurance plan that becomes more affordable. Oftentimes the plan that is only available for the individual is priced out of their control because of mandates and add-ons. And Michael is going to say to governors, look, we're going to help you. You got some interesting ideas, we think it makes sense to use federal money to help you with those ideas, but you need to develop a basic plan so that health care is affordable for more of our citizens.

And here's a comprehensive strategy. A lot of times in Washington, they say, well, let's just design it there in the federal government, it will all work. It won't, in my judgment. It will become bureaucratic, it will become costly, it won't empower individuals, it will make it harder to get affordable health care.

And so here's a strategy, a multiple-pronged strategy, a strategy that says there's a lot of things we need to do to help our American citizens be able to buy private health insurance.

Leavitt is in charge. Michael is the Secretary of Health and Human Services. He's spent a lot of time on the subject. You might want to add a few comments, and then we can hear from some of our citizens here.

SECRETARY LEAVITT: Thank you. There is a wide aspiration held in this

country for everybody to have the basic affordable policy available to

them. You pointed out there are two diverging points of view right now;

one, some people would say, look, let's have the federal government

insure everybody

SECRETARY LEAVITT: Thank you. There is a wide aspiration held in this

country for everybody to have the basic affordable policy available to

them. You pointed out there are two diverging points of view right now;

one, some people would say, look, let's have the federal government

insure everybody

and basically take over health care. And then there are those who would say, let's have the states create partnerships with the federal government and the private sector and we'll use innovation and market forces to make things better. You made very clear how you stand on that subject.

Today, Governor Blunt is excused from our gathering because he is out having -- yesterday, made his State of the State address with health care being the primary -- the primary point of that address. He's out talking to the people of this state about it, as are governors all over the country.

Now, I've been through a lot of these efforts to help people acquire basic insurance, and you always run into one very serious road block, and that is a person who works in a restaurant, a person who is a service provider with a small business. When they buy insurance, if they have to buy it after they've paid taxes, it's just too heavy a lift. They can't get there, particularly if there isn't a basic plan.

So what you suggested and what we'll be doing with states all over the country is we want to help them do two things. One is we want to remove a just undefendable part of the tax code that really started in the 1940s, not by a law, but just by a set of circumstances that happened when they passed wage and price controls, they just started allowing people to get tax deductible health insurance. Nobody ever designed this system, and it doesn't make sense that the states haven't been able to come up with plans that were affordable because people like Esmerelda and Dan haven't been able to pay for their health insurance in dollars that were pre-tax. They had to pay their taxes first.

On the other hand, people like Jim, or people like Martha, have been in a business and they are able to do it. And it's just indefensible that we would provide it to Jim and to Martha, but not to Esmerelda and Dan. And you've taken that fight on, and I believe we'll undoubtedly solve that problem.

The second dilemma you also put well, and that is creating a basic, affordable plan. But there will be people who, even after the plan is basic and affordable, and even after they have the tax benefit that everyone else gets, will still need some help. And so that's what the President has suggested. We want to create a pool of money that we can partner with states to do that.

Here's the principle. Right now in this country we're spending more than $35 billion perpetually paying the health care bills for a lot of people who are uninsured. Wouldn't it make more sense if we could use some of that money to just help them get insurance? Then if we treat them in the same way we do those who buy it from business, we really are within reach of being able to meet this national aspiration we all feel of having every person have access to an affordable basic insurance policy.

I think, Mr. President, you'll get a lot of interesting perspective --

THE PRESIDENT: Leavitt, one thing before you get -- I see we've got some cameramen here. Why don't you give them the cameraman story.

SECRETARY LEAVITT: I had a terrific conversation yesterday.

THE PRESIDENT: For all you cameramen out there.

SECRETARY LEAVITT: Someone asked me -- actually, it was a news organization here in Missouri, anticipating our trip, asked me, what are you going to talk about? And I said, essentially, we've got this problem that we're trying to solve of people who work in restaurants or in daycare centers, or are self-employed, and it's unfair that they should be treated in a way -- and I could see the cameraman --

THE PRESIDENT: He's an independent contractor, he's on his own, basically.

SECRETARY LEAVITT: But he was behind the camera doing this, which is unusual. (Laughter.)

THE PRESIDENT: Because he wants to be treated just like the person who works for big corporate America, and he wants to be able to have that deduction.

SECRETARY LEAVITT: So before we were even off the satellite, he's saying, and you should have said independent cameramen. (Laughter.) He said, do you know how much I pay for insurance? He says, it's $1,350 a month, and I have to pay it after I pay my taxes, and it's just not fair.

It isn't fair. This is the right thing to be doing.

THE PRESIDENT: Thank you.

Rich, thanks for having us. Appreciate you inviting -- letting us tour your hospital here.

MR. HASTINGS: Well, we really are grateful that you came, and we've had a great experience with the White House. Actually, Laura -- this tie that I have on actually was part of her "Red Dress" campaign. And so we have been very blessed in your administration, and we thank you so very much.

And we are grateful to all of you to come to St. Luke's, because this particular facility is one of the very few digital hospitals in the country, and the President has had a chance to see some of that technology. Even our ability to monitor hospitals as far away as Hays, Kansas, we actually monitor their ICU from Lee's Summit, Missouri. And that's where health care is going.

And, Secretary Leavitt, if there is any way that we're going to be able to provide health care for the future, IT will be principal to our ability to do it. The good news is, at least here in Kansas City, St. Luke's is already doing it. But I want to tell you it's very expensive, and yet, just the savings alone -- we reported some EICU savings that we have with a mortality rate that is about 20 percent less than the national average for ICU treatment. And at the same time, our cost is about 25 percent.

The initial cost is high, but in the vision, sometimes it's hard to get everybody to buy into it. But one of the things we talked about earlier is that this hospital, if you want to be a member of the medical staff, you have to learn how to use the computer. It is very computer-centric in what we do.

And so we're so grateful that you came here. And I thank Secretary Leavitt, as well, because I think we'll be able to help interact as you continue your program. Because on the hospital side to save costs, to reduce the costs for the consumer, it's really going to be from the IT side. And the IT side on quality -- one of the programs we have here that we've talked about is Priceline. If you're a patient of any insurance plan, you can actually contact St. Luke's and we can go to your plan. We just require four pieces of information and we can go to your plan and we can tell you how much your health care costs, your out-of-pocket cost is going to be. And it takes us about 45 minutes. But it is being computerized as we speak. Now about half of it is not; it's still manual.

But it is the wave of the future. You have to have that information if you're going to make the decision. And any health plan that is developed will require that the consumer has a chance to decide where do I want to go based on quality and based on price. You have that capability with IT.

THE PRESIDENT: The other thing that's interesting what Rich is doing, availability of health care, they've got like a specialist sitting in Kansas City capable of analyzing somebody's graphs in a remote region, which, again, remember it's affordability and availability for health care. And information technology is able to make medicine available throughout rural Missouri or rural Kansas, for example. And it's very exciting. And I appreciate what you're doing.

SECRETARY LEAVITT: I want to make certain you all understand here three things that are happening that need to happen all over the country -- the first is, you're a connected system. If a patient wants to get their medical records, they can do it in a convenient way. People need to have access to their own records in a way that will be convenient to them. And this idea that a patient then can have an independent assessment of the quality of the care that their provider is giving them is revolutionary and very important.

But then you combine that with the ability for people to know what it costs. Once you have the cost and the quality, you're now making decisions based on value. That's what we hope in the future. The whole system will become a connected system that has competition based on value, where consumers -- where consumers are making decisions, as opposed to someone other than the consumer.

THE PRESIDENT: Dr. Jim Kelly. Why don't you tell people what you do, Doctor?

DR. KELLY: Thank you, Mr. President.

THE PRESIDENT: Let me guess. (Laughter.)

DR. KELLY: I'm an anesthesiologist at St. Luke's Hospital downtown on the Plaza campus. And I'm happy to report that what you are trying to do at the federal level as far as tort reform, through an unfortunate set of circumstances in Missouri, it's not something we wanted to do, but we were faced with a crisis. And the physicians -- many left. Some had -- people who were going to stay wanted to make the practice of medicine and patient care first. And in the early 2000's, we were faced with malpractice premiums for orthopedists, neurosurgeons, trauma doctors, OBs that had been in the $20,000 range and had gone up to the $100,000 range -- $150,000, $180,000 range. And that was just not sustainable.

And so the physicians banded together and elected that they wanted to work on this. And we became involved in the system under cook (phonetic) education efforts. And we're involved in Jefferson City, and got tort reform passed, in both '03 and '04. The governor at that time vetoed the -- vetoed both proposals and an override failed.

During that time, the physicians -- some were defeatist but many stayed energized -- got involved in a governor's election, and elected a -- or worked to elect a governor that understood our issues. And I'm pleased to report that in 2005, we had tort reform not only passed by the legislature, but also signed by the governor, became law. The day before it became law, phenomenal amounts of lawsuits were filed. Those are still all out there. And I'd like to tell you that our malpractice premiums have decreased. They have not, but they have stabilized. And when the actuaries get done taking care of the risk that's out there, I think our premiums will stabilize.

And it's through the work of a Missouri physicians that we have been able to do this. And it allows us to work, to take care of the patient first, not always be concerned about the defensive medicine.

THE PRESIDENT: I don't think people know what you mean by defensive medicine. Why don't you describe that?

DR. KELLY: Well, you're always concerned. One, we're here to take care of patients, and that's our primary objective. But if you are told that you do a poor job or go -- everybody lives in fear of being sued, and they will go to extreme lengths to document that everything they're doing is the right thing. If any of us were so unfortunate to fall down right now and bump our head, it would be hard to get out of this hospital, if you tell the emergency room physician that you hit your head, without a CT scan, maybe even an overnight stay in the ICU. They want to make sure that they're okay and not just trust their clinical skills, that it's a little bump on the head.

THE PRESIDENT: In other words, practicing maybe too much medicine --

DR. KELLY: Too much medicine -- and extra tests.

THE PRESIDENT: It actually costs the federal government something like $23 billion a year.

DR. KELLY: This is something that we have seen -- as an anesthesiologist, we had a malpractice crisis in the mid-'80s. And our rates -- at that time, the anesthesiologists were the most costly to gain liability insurance. And we took a method where we hired systems engineers and actually founded the first patient safety foundation so we could look at where through the whole process do things go wrong and make differences.

And that time the risk of a death from an anesthetic was one in 10,000. Right now I'm happy to tell you that it's one in about 300,000. And a lot of that work is due to the American Society of Anesthesiologists taking a look at the patient first and seeing what we can do to make things better.

THE PRESIDENT: Well, I appreciate you. I happen to believe this is a federal issue. When I first came to Washington, I said, we ought to allow these -- each state to determine their own medical liability reform. I believe it's -- and I chose to make it a Washington issue because it's costing our taxpayers so much money. When I say costing, we're a big consumer of health care through Medicare, Medicaid, veterans' benefits. And when doctors' premiums go up, they charge more. And with doctors in fear of being sued, they practice more medicine than is necessary.

I don't know if $20 billion is the right number, but it is a lot. I think it is something like that. And that's extra money for the taxpayers, and I'd like to get it done in Washington, D.C., frankly. And I believe medical liability is -- I know it's a huge issue in a lot of states. And we'd like to help you. Thanks for working on it. Appreciate you being involved.

Jim Henderson.

MR. HENDERSON: Thank you, Mr. President.

THE PRESIDENT: President --

MR. HENDERSON: Not like you, but thank you very much. (Laughter.)

THE PRESIDENT: -- of Dynamic Sales, Inc. Where are you based and what do you do?

MR. HENDERSON: St. Louis, Missouri. We're a construction and industrial supply company.

THE PRESIDENT: Great. How are you doing?

MR. HENDERSON: A second-generation owner. It's been very good. The economy has been very good to us, and the business has been booming. We're on our 11th record year.

THE PRESIDENT: Good.

MR. HENDERSON: So we've very pleased.

THE PRESIDENT: All because of good management.

MR. HENDERSON: From the top down. (Laughter.)

THE PRESIDENT: That's right. How many employees?

MR. HENDERSON: We have seven employees, five full-time, two part-time.

THE PRESIDENT: Right, and your issue with health care?

MR. HENDERSON: Escalating costs. I'm glad to see everybody in the country is getting excited about it, but we've been dealing with it for over 17 years. Back in that day we had 100 percent coverage. We didn't have to worry about deductibles. We didn't have to worry about a PPO or what doctor or hospital we went to. We could just go anywhere, get treated, and it was taken care of.

The carrier we were with at that time said they didn't want us to have that program anymore. They wanted us to get off of that program, they didn't like it, but they couldn't take it from us, but they could raise rates to where we would buckle and ask them for something else. And it didn't take them long to do that.

So then we moved into the PPO plan, and then we had to go to a zero deductible to a $100 deductible. And we also had to go from paying 98 percent of our employees' premium and their dependents to doing a 70-30 split with the employee-only. And they can add their dependents, but they have to pay for their dependents. And that's not real attractive.

But then we went from that zero deductible to a $100 deductible, our rates continued to increase at an average of about 9 percent a year until 1998 -- I'm sorry until 2003, then we were faced with a 25 percent increase. And we had no major losses. We had the same type of census. So it wasn't a big change in our census to worry about. But we were faced with that kind of increase. We asked what we were going to do and their suggestion was raise your deductible to a thousand dollar deductible, we can keep your premium at the same level, and then you just have a higher deductible. And that way you're not spending more money for health care.

Well, maybe not as a company, but now we're asking the individual families, hey, now you've gone from zero to $100, now we're up to $1,000, and your doctor's visit is going to be more expensive, your drugs are going to be more expensive, and just right up the line.

That continued and continued. And every year, we saw another increase -- 13 percent, 14 percent. And it continued until this year, we were given another increase of 13 percent, again, for the same program, the same census, no major losses incurred. This year, we're looking at a 13 percent increase. The response was, well, raise your deductible to $2,000 and then you won't have to face that 13 percent. So, the company's premium doesn't go up, but the individual is now paying $1,000.

We've done that, but we've also initiated health reimbursement accounts. So the company has set that up, which of course is a cost to the company, but we've set that up to kind of pool that risk for the employees. So they are still responsible for the first $1,000 like they've been for years, but now the company will reimburse anything over that $1,000 up to the $2,000 level.

If everything goes well and we fall within the statistics of Missouri, the 20 percent range, we will end up "saving" $3,300. I say the word "saving" in quotes because we raised our deductible. We are now, as a company, taking a risk, which is what I thought insurance was supposed to do for us. But now as a company, we're taking a calculated risk that only 20 percent of our employees will hit us up for that extra money. If something goes wrong and they all hit us up for it, we're going to lose an additional $4,400.

So when they say, well, we can keep your premiums the same, they're not really saving us anything, because we're having to pass that along to the employees, of which I am an employee of the corporation. So now my health insurance costs just went up, too. And it's just a vicious cycle that we've been dealing with for several years.

THE PRESIDENT: This is probably the biggest problem we hear from small businesses around the country. And in that small businesses create most new jobs in America, it makes sense to come up with plans to help small businesses thrive.

Mike, I don't know if you want to comment on this --

SECRETARY LEAVITT: I'd be --

THE PRESIDENT: -- deductibility plan because I think it's going to save your employees a lot of money and make it easier for you to be in a position to do what you want to do, which is be -- to see yourself a good employer.

MR. HENDERSON: Well, that's the hard thing, is when you're trying to hire more people, health insurance is really important. And if you're telling people, well, we've got a $2,000 deductible and a 70/30 split, but, hey, we're a good company to work for, well, you might be a nice family company to work for, but I can't afford to work here.

THE PRESIDENT: Have you looked at this deal that I proposed?

MR. HENDERSON: Yes, sir, I have. And from what I've looked at, off of the information you've sent to me, I think that it's going to be very attractive.

THE PRESIDENT: And how does it help you?

SECRETARY LEAVITT: Jim could describe it, or I -- well, Jim is like a lot of other small businesses. If he and his employees had this ability to have this standard exemption -- in Jim's case, personally, he'd have the exemption, he'd get the tax savings. It would be -- he could have about a $2,183 increase in his take-home pay. The value of the actual deduction, then, would be $7,200, which would go a long ways to helping defer some of those costs.

When you look at that example -- and take Martha, for example. Martha had a similar problem as Jim did, and chose to go to a health savings account. When you combine these two, it becomes well within the grasp of almost any employee to have an affordable, basic health insurance. Martha, maybe you could --

THE PRESIDENT: Just one point before you go. I think it's very important for our citizens to know that as we level the playing field between employees of little companies and big companies, it makes it easier for small companies to stay in business. The tax code, it treats a certain group of people in the United States unfairly when it comes to health care. People who work for big businesses get their health care on a -- with no -- they pay no taxable income on it. Small companies who are having trouble staying in business because of the nature of their size or the company pass on the increased cost to their employees, and we've got to level the playing field, from a taxes perspective. It is by far the most hopeful and fair option of any medical health care option out there today, unless, of course, you want the federal government providing it all, saying, okay, we'll provide you insurance, but we'll provide everybody insurance, which would be a mistake.

Anyway, listen to health savings accounts, but I don't want to be Mr. Lecturer. But she is -- it's an interesting option for you.

MR. HENDERSON: I did look at those, but for our employees, they weren't as attractive, because our employees said, if I can set aside $2,000 a year or whatever to put into a health savings account, I'd be doing it anyway.

SECRETARY LEAVITT: So they'll be able to -- with this tax change they'll now have the money that can go to do just that.

MR. HENDERSON: That's been what's so frustrating about this, is each year those costs go up, we want to make it affordable for our employees, the companies pay more for the insurance that they're receiving. We don't get to turn around and say to our customers, hey, we're raising your prices 25 percent because our insurance went up. And when we ask the insurance, why is it going up, we haven't had these major losses, their reply is, because we can. That's what I was told, because we can. I'd like to tell all my customers that -- hey, I'm raising your prices 25 percent because I can.

THE PRESIDENT: That's a problem, and the reason I've come here to discuss this with a frustrated small business owner like you is because we believe that we've designed a solution that will help a lot.

Martha. Why don't you tell everybody what you do? Are you as passionate about your employees as my man Jim?

MS. GELENCHER: Yes, I am.

THE PRESIDENT: That's good.

MS. GELENCHER: I've been in the business for 30-plus years, and having health insurance has always been a big issue. I think we as employees -- individuals are now facing what Jim said is -- the individual and the employer are facing the same problem right now.

THE PRESIDENT: Let me ask you something. How many employees do you have?

MS. GELENCHER: Thirty, of which six are full-time.

THE PRESIDENT: So you started getting squeezed.

MS. GELENCHER: Yes, from the very beginning. In fact, no one -- for many years, no one wanted to insure someone that had only 30 employees.

THE PRESIDENT: Yes, or six full-timers.

MS. GELENCHER: Yes. It's like, well, you're just not --

THE PRESIDENT: It's one reason why you don't have a lot of leverage.

MS. GELENCHER: Right.

THE PRESIDENT: People don't want to insure you.

MR. HENDERSON: If we drop below five, we've been told --

THE PRESIDENT: Yes. So you're at six full-time, 24 part-time. And you start looking at options, and what happens?

MS. GELENCHER: Well, we went with the HSAs; we've been with them for two-and-a-half years. We were able to give more full-time people insurance. We save 40 percent of what we had been paying.

THE PRESIDENT: Yes, see, that's why I think -- get somebody to -- HSAs really do hold the cost down for small businesses.

MS. GELENCHER: They really do. They really do.

THE PRESIDENT: A little difficult to get the employee to sign on at first, right? It's a novel concept, as opposed to somebody paying your bills. An HSA basically says you're in charge of your own health care.

MS. GELENCHER: Right, and it gives the small business person a little advantage over the larger business person, because they have their own savings account --

THE PRESIDENT: That's right.

MS. GELENCHER: -- and they can -- it grows and it's theirs and they become more responsible for how they spend their health care.

THE PRESIDENT: A high deductible catastrophic care plan with the company and/or the individual contributing tax-free the amount of the deductible into a savings account. The person owns their savings account. In other words, it's beneficial to small business because it's cheaper to buy the HSA than it is normal insurance that you're battling for. Have you found that to be true?

MS. GELENCHER: Yes. And our employees are very pleased. And I mean, really it was a life-saver for us because it just became such a big problem as we see all across-the-board now with individuals -- low income, middle income -- most of our people are middle income, so that's to their advantage.

THE PRESIDENT: See, the problem with small businesses and individuals is that there's no market relative to -- like big companies. There just isn't. We need to help establish a market. Demand will yield the supply of insurance policies, so long as states enable there to be the development of a basic plan, without mandates and things added on to it. And that's really one of the benefits of the HSAs, by the way. It's like a basic health care plan.

Let me ask you something. Do your employees like the idea of being able to -- of course they like the idea -- your employees are able to take their health care with them from job to job -- take the savings account aspect.

MS. GELENCHER: Exactly.

THE PRESIDENT: It's theirs, not yours.

MS. GELENCHER: Right.

SECRETARY LEAVITT: May I ask Martha a question?

THE PRESIDENT: Sure.

SECRETARY LEAVITT: Martha, I have an HSA, so I have some experience with this, but I'm curious as to your experience with them. Did it -- did it cause you to be more interested in what things were costing than when you just the insurance card?

MS. GLENCHER: Exactly.

SECRETARY LEAVITT: I remember the first time I walked into a drug store with my HSA and presented them with my new card. And I knew I was -- that my savings -- my health savings account would be paying part of it. And they -- this prescription I had was going to be $379. And I'd been getting this prescription for quite awhile, and I had no idea what it was going to cost. And I said to the druggist, is there a generic version of this? It was -- it changed my way of thinking about this completely. Did you have that experience?

MS. GELENCHER: Exactly the same.

SECRETARY LEAVITT: Have you seen any kind of change in the way your employees have thought about this as a result?

MS. GELENCHER: Well, in a middle income, you don't have people that take for granted their insurance or -- people that have their own business, they're not out there looking for someone to hand them something. They're willing to work to get to the place where they can afford health insurance. It's a privilege.

I think people think -- everyone expects that it's something that should be there, and where's the money going to come from? They all just think that it's all there. But the federal government, that's not their responsibility. And I feel like it's our responsibility to do our part. Each one does their own part, it will help to carry the load -- you just can't expect the federal government or the state. Each one has to do their own part, I believe, and this helps each one do their own part and feel responsible and carry the load.

SECRETARY LEAVITT: Something that Rich said and that Martha said that was important, one of the things they are doing here at St. Luke's is that they are allowing people to know what the prices are in advance. A lot of people go to hospitals and they say, I'd like to know how much this costs. And the hospital just isn't equipped to answer that question, or the doctor just doesn't think about what the cost is because usually it's just about processing the insurance.

This very -- this gets at the heart of how we keep costs down. Suddenly people begin to ask themselves, is there a generic version of this; how much should this cost? Those are the kinds of questions that begin to create small businesses with a competitive product. And hospitals like the one we're in today have led in that transparency, knowing the quality, knowing the cost, being involved in the decision, a very important way to keep costs down.

THE PRESIDENT: Yes, that's why the best health care system is one that recognizes that decisions made by doctors and patients are the best decisions. It's best to hold down costs. It's best to enhance quality. It is really what happens in most other aspects of our market. It doesn't happen -- happening in health care. And the policies that we're detailing are trying to encourage more consumer involvement in order to hold down costs. And it's a foreign concept for a lot of people because it hasn't been happening for years. And it's a concept that, frankly, some in Washington don't like because it runs contrary to a philosophy that basically says the federal government is a better decision-maker.

Anyway, thanks for joining us. Thanks for being an innovator. The tax deduction is going to help your folks.

MS. GELENCHER: Yes, very much so.

THE PRESIDENT: $15,000, $7,500 for a single person.

MS. GELENCHER: And I can't imagine why someone would not --

THE PRESIDENT: Be for it?

MS. GELENCHER: -- think it would. (Laughter.)

THE PRESIDENT: It's an interesting question, particularly since it's a revenue-neutral proposal, which is important. Cost money or lose money -- according to the experts, it's revenue-neutral.

Jones -- Dan Jones, where do you live?

MR. JONES: In St. Louis, Missouri.

THE PRESIDENT: Home of the mighty Cardinals?

MR. JONES: Yes, sir. Yes, Mr. President.

THE PRESIDENT: They came to the White House recently.

MR. JONES: Yes. I am a small business employee of a computer company outside of St. Peters, Missouri, specializing in computers, hardware, software, maintenance consulting. And your health care proposal looks very profitable to me. If I'm going to make, say, we'll give a rough estimate, $600 a week, and I can save $7,500 off my taxes, get a tax deduction for $7,500, doing the math, I save about $2,300 a year. Well, since I don't have insurance, that $2,300 a year can be put towards insurance, you know?

Being a former -- I've had insurance, and when I had it, it just kept raising up and up and up and up. It started at $170 and when to $190, $200, $220, $230 and finally got to $400. Well, $400 a month is $4,800. That's a large chunk of money out of my pay, plus after taxes. That $4,800 can be put towards a car, a house. I had to cut it because you look at what you have and your decisions to make as a life person.

You've got your cell phone. I can't get rid of my cell phone for what I do. The customers need to be able to contact me. It's stated in my contracts. Can I get rid of my electric? If I like spoiled milk, sure. Do I want to get rid of my car? I got to be able to get around. You just have to make those decisions and look at those decisions.

THE PRESIDENT: Here's the classic guy -- young guy in the marketplace, basically priced out of the individual market.

MR. JONES: Yes, sir.

THE PRESIDENT: And the plan helps him. Matter of fact, what they were telling me coming in that you could buy a good health care plan for about $1,350.

MR. JONES: Yes, we were looking at that. And within the state of Missouri I can get about $1,300 for a really nice health care for the year.

THE PRESIDENT: Save $2,270 in taxes.

MR. JONES: Over the year.

THE PRESIDENT: So you put $929 in your pocket.

MR. JONES: Absolutely.

THE PRESIDENT: Does it make sense to do that? I think it does.

MR. JONES: What could you do with just a little over -- under a thousand dollars? That's Christmas, you know? (Laughter.)

THE PRESIDENT: Well, why don't you think about saving it? (Laughter.)

MR. JONES: Yes, well, I got a gigantic family and I got a godchild who, buy me, buy me that.

THE PRESIDENT: Anyway, there are plenty of people who feel like they're doing just fine when it comes to health insurance, particularly those work for big corporate America, which is fine. It's just that the system discriminates against the Dan Joneses because the tax code that has evolved over time has made it harder for him, relative to other people in our society, to purchase insurance.

And this is exactly what this plan is designed to do. We're trying to move somebody, like Dan, from being a statistic, an uninsured person, into insurance. And here is a logical way for the government to do so. And if people in Washington are serious about dealing with the uninsured, here is a serious idea for them to consider. They're just dismissing things because of pure politics; we have put forth ideas that are worthy of debate, and we believe will work. And I know that our citizens, fellow citizens, regardless of their political party, expect there to be a serious dialogue on constructive ideas that are put forward to make sure people like Dan Jones have got private insurance. And I thank you for coming and sharing -- how many people work in your firm?

MR. JONES: Three full-time employees right now, but hopefully more.

THE PRESIDENT: But you're growing.

MR. JONES: Absolutely.

THE PRESIDENT: There you are.

MR. JONES: Small businesses, they grow. And the more money you save along the way, the more you can grow.

THE PRESIDENT: There you go. Well, thank you for coming.

MR. JONES: Thank you, Mr. President.

THE PRESIDENT: Tom. Appreciate you coming, Tom.

MR. BEAUREGARD: Sure.

THE PRESIDENT: Tom Beauregard. What do you do?

MR. BEAUREGARD: I lead a business within United Health Care that's focused on extending access to the uninsured.

THE PRESIDENT: Oh, really?

MR. BEAUREGARD: So we see your tax parity proposal as important. There really is a need to kind of level the playing field between the employer market and the individual market. So we're seeing the small employers who are having a hard time staying in the game, because of affordability. We see more and more workers in an independent status; about 20 percent of the population now is working in an independent contractor consultant environment where traditional health insurance isn't available.

And then the other thing we see is just changes in the labor market, where you've got people moving from job to job. So the average individual will have about 10 jobs across their career now.

THE PRESIDENT: That's right.

MR. BEAUREGARD: So there really is a need for --

THE PRESIDENT: That's an interesting point -- excuse me. A lot of people in America probably know this, but just in case they don't, most -- people change jobs, like, seven or eight times before they're 35 years old in America these days.

MR. BEAUREGARD: And it's accelerating.

THE PRESIDENT: That means you better have a portable health care plan.

MR. BEAUREGARD: So it's affordability and it's portability. And those are two categories that are really important to focus on. And if we look at the tax proposal, it's your point if that could be coupled with state initiatives -- so funding for low-income individuals -- and then to your point, essential benefit plans. We've got to get down to private sector innovation that's -- that has designs that, in fact, are reasonable and affordable.

So I think partnership between federal, state and the private sector, we can extend health insurance on an affordable basis.

THE PRESIDENT: I appreciate your studying it. You may need to come up to Washington to testify. (Laughter.) Thank you very much.

Why don't we end with Esmerelda? Esmerelda, welcome.

MS. WERGIN: Thank you.

THE PRESIDENT: You are a -- where do you work?

MS. WERGIN: I work at my grandmother's restaurant, Ninfa's Tortillas. I'm a waitress there.

THE PRESIDENT: Ninfa's? You recommend it?

MS. WERGIN: Well, yes. (Laughter.)

THE PRESIDENT: How are your cheese enchiladas?

MS. WERGIN: Perfect. (Laughter.) And she makes them herself.

THE PRESIDENT: Does she really?

MS. WERGIN: Yes, she's back there.

THE PRESIDENT: What's her name? Ninfa?

MS. WERGIN: Ninfa.

THE PRESIDENT: That's what I thought. Good. Married?

MS. WERGIN: Yes, married with two children.

THE PRESIDENT: And how old?

MS. WERGIN: I have a two-year-old and a seven-year-old. Both boys.

THE PRESIDENT: Fabulous, fabulous. And so give us your health insurance story.

MS. WERGIN: Well, I think more or less, some jobs offer you health insurance plans, but they cover nothing. And you're paying so much a month for this insurance policy but yet it really covers nothing that you need.

Right now my husband and I are kind of doing our homework on different insurance plans and policies and things like that. But it's really hard to find one that's going to suit your family's needs. And then once you finally find that, just the X amount of dollars you're paying out of your pocket a month is very difficult to do, especially with two little boys who like to run into walls and hurt themselves all the time. (Laughter.)

THE PRESIDENT: This plan we've outlined would save Esmerelda and her family $3,500 a year. Does it make sense to level the playing field and have a rational tax code and enable her to be able to purchase health insurance? I think it does. Rather than having your family sit outside the system, grinding away on trying to find a health care system that they can afford, why not help them afford a health care system through making the tax code fair? That's all we're asking.

Isn't that right?

MS. WERGIN: Oh, whatever you say, Mr. President. (Laughter.)

THE PRESIDENT: Esmerelda, thanks for coming.

I hope people got a flavor of what we're trying to get done, that this plan helps people be able to afford private health insurance, and that is really the crux of good health care. Good health care is a health care system where government helps people who need help like the poor, those who are hard to insure. Part of what we recognize is that Mike needs to give states flexibilities to help set up risk pools, to be able to add selection when it comes to individualized markets. But, ultimately, the best health care plan is one that trusts people like Esmerelda and her family, or Jones -- Dan Jones -- to make decisions, and is one that enables our small business sector to remain economically viable.

We thought long and hard about what to propose. We proposed a bold initiative, an initiative that takes equities [sic] out of the system, so people are treated fairly. And I know Americans expect that the United States Congress will take a good look at all ideas to determine how best to make this health care system run well.

And I thank you all for coming and giving us a chance to talk with you. I appreciate your candor, and appreciate what you do for the country. Thank you. Good job.

END 12:58 P.M. CST