|

For Immediate Release

Office of the Press Secretary

April 29, 2005

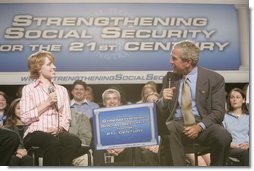

President Discusses Social Security for Future Generations in Virginia

James Lee Community Center

Falls Church, Virginia

|

|||||

![]() In Focus: Social Security for Future Generations

In Focus: Social Security for Future Generations

10:29 A.M. EDT

THE PRESIDENT: Thank you all, very much. Thanks for the warm welcome. Thanks for coming today. I want to thank the Northern Virginia Technology Council for hosting this event. (Applause.) Sudhaker Shenoy is the Chairman. Thank you, Sudhaker, I appreciate it, very much. (Applause.) Bobby Kilberg is the President. (Applause.) Obviously, you've stacked the audience with -- (laughter.) I appreciate you coming.

We're here to talk about an important subject, and that's going to

be the future of -- what the future holds for younger Americans, you

know, is whether or not we've got the will and courage to make sure the

Social Security system works for a younger generation.

We're here to talk about an important subject, and that's going to

be the future of -- what the future holds for younger Americans, you

know, is whether or not we've got the will and courage to make sure the

Social Security system works for a younger generation.

Before we get there, I do want to say a couple of things. One, I'm sorry Laura is not with me. She is -- she's doing a fabulous job as the First Lady. I'm proud of her. I love her dearly. (Applause.)

I appreciate Bill Howell, who is the Speaker of the House from the great Commonwealth of Virginia. Mr. Speaker, thank you for coming. I appreciate you being here. (Applause.) Where's the Speaker? There he is. Thanks for coming, Speaker. Appreciate you serving.

I want to thank Tony Griffin, the Fairfax County Executive. I'm honored you're here, Tony. Thank you for coming. I want to thank the local and state officials who are here. I appreciate you're willing to serve your community and your state. I want to thank the Department of Community and Recreation Services, Pat Franckewitz and Joyce White, for opening up this beautiful facility. (Applause.) And I want to thank our panelists for joining us here to have a discussion about Social Security.

Look, I -- a lot of people have said, why did you bring this up, you know? Why do you want to talk about the issue of Social Security when you don't have to. After all, the problem is down the road. I think the job of a President is to recognize reality, and if a President sees a problem, have the willingness to step up in front of the American people and say, we have a problem, explain the problem, and then go to the United States Congress and say, let's work together to fix the problem. The job of the President is to confront problems. (Applause.)

I think the American people -- I know the American people expect those of us who have been elected to hold office to have set aside party politics and focus on solutions to problems confronting our country. That's what I know they expect. And that's the spirit in which I enter this debate. On one hand, my job is to confront problems, on the other hand, it's to call people together to solve them. And here's the problem with Social Security.

First, I want to praise one of my predecessors, Franklin Delano Roosevelt. He did a very smart thing when it came to creating a retirement system to help people have dignity in their final years of life. And Social Security has worked for a lot of folks.

The problem is the math is changing on Social Security. And the

reason the math is changing is because there are a bunch of baby

boomers, like me, getting ready to retire. I reach retirement age in

four years. That's a convenient time. (Laughter.) Do you realize

today there are 40 million retirees, and when the baby boomers fully

retire, there's going to be 72 million retirees. In other words,

there's a baby boomer bulge. And the groups of folks here, very soon,

will be getting ready to count on a younger generation to pay its

benefits that we've been promised.

The problem is the math is changing on Social Security. And the

reason the math is changing is because there are a bunch of baby

boomers, like me, getting ready to retire. I reach retirement age in

four years. That's a convenient time. (Laughter.) Do you realize

today there are 40 million retirees, and when the baby boomers fully

retire, there's going to be 72 million retirees. In other words,

there's a baby boomer bulge. And the groups of folks here, very soon,

will be getting ready to count on a younger generation to pay its

benefits that we've been promised.

The problem is, the benefits we've been promised are greater than the benefits promised to a previous generation, and those benefits rise faster than the rate of inflation. And to compound the problem is, we're going to live longer. You got a lot of people, living longer, getting greater benefits.

I'm sitting up here with some folks who are going to be paying into the system. What has changed about the payers into the system is that the number of payers are shrinking relative to those who are going to receive benefits. In 1950, 16 workers were paying into the system for every beneficiary. In other words, the load was pretty light. Today, there are 3.3 workers per beneficiary. Soon there's going to be two workers per beneficiary. Fewer workers, paying greater benefits to more people living longer -- that's the change in the math, that is what has changed from the time Franklin Roosevelt set up the program.

And what it means in terms of budgetary terms is that in 2017 the pay-as-you-go system goes into the red. Pay-as-you-go means, by the way, money comes in and it goes out; you pay, and we go ahead and spend. And we spend not only on retiree benefits, but we spend on every other program. And all that's left is file cabinets full of IOUs. You know, people think, well, the government has collected our money and they're going to hold it for us, and then when we retire, we'll give it back to you. That's just not the way it works. It is a pay-as-you-go system. And therefore, when you have a lot of baby boomers living longer, getting greater benefits, in a pay-as-you-go -- and more and more of us are getting what the government said, the system goes into the red, because you've got fewer payers.

In 2027 the obligations of the federal government to retirees will be $200 billion greater than the payroll tax receipts. See, starting in 2017, the system goes into the red, and it gets worse every year -- 2027, $200 billion; about 2030-something it's $300 billion, and eventually 2041 it's broke.

And the temptation, by the way, in Washington is to say, well,

gosh, that seems like a long way down the road. But 2017 is not very

far down the road. And if you're a younger worker, and you start

paying into the payroll system today, and 2041 is about the time you

start retiring, I'm telling you, the system is going to be bankrupt

unless we do something about it. In other words, you're working all

your life, you're putting money in, and by the time it comes for you to

get ready to retire, there's nothing there. That's a problem, folks,

and it requires a solution, requires people to come together to make

this work.

And the temptation, by the way, in Washington is to say, well,

gosh, that seems like a long way down the road. But 2017 is not very

far down the road. And if you're a younger worker, and you start

paying into the payroll system today, and 2041 is about the time you

start retiring, I'm telling you, the system is going to be bankrupt

unless we do something about it. In other words, you're working all

your life, you're putting money in, and by the time it comes for you to

get ready to retire, there's nothing there. That's a problem, folks,

and it requires a solution, requires people to come together to make

this work.

And so my strategy has been, one, travel around the country, explain to the American people we have a problem. And they now understand we have a problem. The debate in Washington has shifted, by the way. Early on this year, people were saying, it's not really a problem. You know, we don't have a problem in America. I don't think you hear that anymore. Oh, there may be a few isolated voices saying, it's not a problem. Most people now understand we've got a problem.

My mission early on in this -- in the debate was to make it clear to seniors, you're going to get your check. There are a lot of people in this country counting on their Social Security check. And a lot of people are saying -- as a matter of fact, I went to the computer class and a lady said, you make sure I get my check. She's counting on it. And I recognize there's been a lot of propaganda. There's been propaganda in political campaigns saying, if, oh, so and so is elected, you're not going to get your check. And I'm sure there's some propaganda out there working its way through the system now, trying to frighten seniors.

But our seniors have got to understand the system is solvent for them. Nothing changes for people who were born prior to 1950. It's those born after 1950 that need to ask our elected representatives, there is a problem, and what you going to do about it?

I want to tell you what I think we ought to do about it. I think we ought to come together in good faith and discuss good ideas. I laid out some ideas -- I have been laying out ideas about what I think we ought to do. First, I know that we ought to be able to say in a new system, as we fix the safety net for future generations, that you must receive benefits equal to or greater than the benefits enjoyed by today's seniors. In other words, any reform has got to say that to those who are paying into the system.

Secondly, I think the country needs to set this goal for future generations: that if you've worked all your life and paid in the Social Security system, you will not retire into poverty. And there's a way to make that happen, and that is to have the benefits for low-income workers in a future system grow faster than benefits for those who are better off.

If Congress were to enact that, that would go a long way toward making the system solvent for a younger generation of Americans. I have a duty to put ideas on the table -- I'm putting them on the table. And I expect Republicans and Democrats to do the same kind of thing, and so do the American people.

The American people expect us in Washington, D.C. to do our duty and not play politics as usual with an issue as important as Social Security. When Congress comes together to discuss this issue, it's important for us to permanently fix Social Security. The reason I say that is because some of us were around in 1983 when Ronald Reagan called Tip O'Neill and said, we got a problem, and they came together and put together a 75-year fix. That's what they said. We got us a 75-year fix.

The problem is 25 years -- or 22 years after 1983, we're still talking about it. The 75-year fix lasted about 22 years. And so now is the time to permanently fix Social Security. Any solution that comes forth out of Congress must permanently fix it.

As we permanently fix it, we have a great opportunity to make the system a better deal for younger workers. And here's how: Younger workers should be allowed to take some of their own money, some of their own payroll taxes they pay into the system, and set it aside in a personal savings account. Now, this isn't the government telling you what to do, the government saying you must set aside a personal savings account. This is the government saying, you should have the option, if you so choose, to take some of your own money, some of the money that you've earned, and put it aside in a personal savings account.

And here's the benefit from such an idea. One, the government does not -- doesn't get a very good return on your money when we take it from you. If you were to put your money in a conservative mix of stocks and bonds, you would get a better rate of return. And that rate of return over time will make an enormous difference to somebody who wants to build a nest egg. Do you realize that stock investments have returned about 9 percent more than inflation per year since 1983, while the Social Security real return is only about 2 percent. That means if you were to invest a dollar in the market in '83, it would be worth $11 today, while your dollar in Social Security is worth $3. Think about what that means if you put a fair amount of money aside over time. It means your own money would grow better than that which the government can make it grow. And that's important.

It's an important part of being a part of a vibrant -- a retirement system. You're going to get a check from the government. The question is how big. If you're allowed to take some of your own money and watch it grow faster than the rate at which government can grow it, it means you've got a bigger nest egg.

Secondly, I like the idea of people owning something. We want more people owning their assets in America. There's kind of a concept around that says maybe only a certain kind of people should own assets, an investor class, maybe only the rich. I firmly reject that idea. That's not how I view America. I want more people owning things, owning their own home, owning their own business, owning their own retirement account, owning assets that they can pass one from one generation to the next. The more people that are able to do that, the better off America is.

Thirdly, the system today is patently unfair for families if a spouse is to die earlier than expected. Think about this kind of system we have today. You work all your life, your husband or wife works all their life, and one of you dies before 62 years old, or after 62 -- if they die before 62, you get no survivor benefits, you get a little stipend to help bury your spouse, period. All the money goes in, waits until you reach retirement age. When you reach retirement age, if you have worked, as well, you get either your spouse's benefits or your benefits, which are ever higher, but not both.

So if one of the two of you have worked all your life, or worked your life and put money in, you don't get anything as result of your labor. I think it will make sense to allow people to set aside some of their own money in a personal account so they have their own assets, and if they happen to die early, they can pass it on to their wife or husband. In other words, your assets just don't disappear like the current system encourages.

But you've got something you call your own, finally. I like an idea -- remember, this is a pay-as-you-go system. People are going to be counting on future Congresses to make decisions what to do with your money. I like the idea of you being able to have an asset base that the Congress can't take away. The Congress doesn't get to spend on your behalf, because it's your asset. You own it. It is your nest egg.

Personal -- personal savings accounts make a lot of sense to me. They also make a lot of sense to a generation of Americans that are used to investing. I was telling the folks up here that when I was in the 20s, I don't remember spending a lot of time thinking about my 401(k). It's because they didn't exist. Think about what's happened in our society. A lot of people are becoming accustomed to watching their money grow. There's a new and -- a group of investors from all walks of life that are comfortable with watching their assets grow and expect to be able to manage their own assets. The culture has changed when it comes to investing.

Now, people often ask me, you know, can I -- are there going to be wise ways to set up these savings accounts? Of course there will be. I'm not going to say, you can -- we want you to have a retirement fund; you can take your money and put it in the lottery. In other words, there's a conservative mix of bonds and stocks that will be available. If you're risk adverse, you can buy Treasury bonds, as far as I'm concerned.

You know, people say, well, you know, what happens if I'm getting close to retirement and there's a market swing? Well, when you get close to retirement, there are ways to diversify out of a mix of bonds and stocks and get into -- get into strictly bonds -- government-backed bonds. People can manage your money in smart ways. And the role of -- it seems like to me a proper role for the government is to say, here are the guidelines in which you can -- should be allowed to invest, but there's a lot of flexibility so you can choose how best to manage your own assets.

So this makes sense, and Congress needs to hear the voices of people who believe it is right and fair to give them the option to watch their own money grow. And we've got some people up here today that have got a pretty good idea about what they want to do with their own money.

Oh, by the way, just as an aside, I think it'll interest you to know that this isn't a new idea I'm discussing. As a matter of fact, Congress has given themselves the same opportunity that I think ought to be available for younger workers. There's what they call a thrift savings plan in Washington, D.C. It's available for federal workers. It says if you're unhappy with the government's rate of return, you ought to be able to set aside some of your own money -- manage your own money in a retirement account. Seems like to me that if a member of the United States Congress thinks it's okay to manage his or her money, that same privilege and opportunity ought to be extended to workers all across America. What's good for the Congress ought to be good for the working people in the United States. (Applause.)

Doctor Olivia Mitchell is with us. She's an expert on the subject. PhD?

DR. MITCHELL: Yes, sir.

THE PRESIDENT: For those of you who are younger, I just want you to look at the examples being set here. Olivia is a PhD. I was a C student. (Laughter.) Olivia is the expert. I'm the President. (Laughter.) Anyway, thanks for coming. (Applause.) A couple of B's, a couple of B's, yes. (Laughter.)

Tell us what you do, Olivia.

DR. MITCHELL: Yes, sir, thank you. It's a great pleasure to be here with you today. I teach pensions in Social Security at the Wharton School at the University of Pennsylvania. I've been teaching in this area for 25 years, and the one thing that I've noticed is this year the students are paying attention, finally, and I thank you for that. You're a great educator. (Applause.)

THE PRESIDENT: They ought to be paying attention. The Social Security trustees estimate that for every year we wait it costs another $600 billion. It is conceivable that if we do nothing, that the payroll tax will get up to 18 percent for younger Americans.

Anyway, go ahead.

DR. MITCHELL: So it's absolutely correct: the system is running into trouble. Within 13 years the payroll tax coming in will not be sufficient to pay benefits.

* * * * *

DR. MITCHELL: As a former member of your Commission to Strengthen Social Security, I watched with great attention to the press conference last night, and I was very encouraged, because I heard several things -- one, that you're going to try to reduce the rate of growth of benefits to restore solvency, that's essential. Two, that benefits will never fall below today's benefits. I think that's key. And third, the thing you've spent a lot of effort focusing on, personal retirement accounts. Those, to my mind, are a central element -- diversified, low cost, and offer people the opportunity to manage their money. So I congratulate you for it.

THE PRESIDENT: Yes, I asked Olivia to join a council headed by Daniel Patrick Moynihan. Unfortunately, he has gone on. But he ran a bipartisan commission in 2001.

DR. MITCHELL: He and Dick Parsons.

THE PRESIDENT: Yes, Dick Parsons. And they took a look at this in a very sober way, in a nonpolitical way and came up with some serious recommendations, many of which are now being discussed in Congress. And I want to thank you for serving on that.

The commission shows what is possible when people set aside partisan politics and focus on solving America's problems. And that's what we need to do in Washington. There's too much kind of "gotcha" politics -- we can't work here because somebody may look good. But eventually what's going to happen in this debate is that if -- those who block meaningful reform are going to be held to account in the polls. See, the more people understand the problem, the more young people who understand inaction by this government is going to saddle them with enormous taxes -- will be going to the polls, they're going to be saying to the people running for office, how come you didn't do anything about it? Where were you when it came time to come up with fair reform that take care of the poor, that make sure that younger workers have got a better deal. And so I want to thank you for your hard work on that issue, Olivia. And thank you for joining me again.

Kristin Seitz is with us. Kristin welcome?

MS. SEITZ: Thank you.

THE PRESIDENT: Do you make a living?

MS. SEITZ: I do. My name is Kristin Seitz. I'm 23-years- old, and I'm actually the executive coordinator at the Northern Virginia Technology Council.

THE PRESIDENT: Good.

MS. SEITZ: I graduated in 2004 from the Ohio State University, and NVTC is my first job since graduating.

THE PRESIDENT: Great, yes. Are you concerned about the fact that the mighty Texas Longhorns will be playing at Ohio State this year? (Laughter.)

MS. SEITZ: I actually got my alumni tickets yesterday in the mail.

THE PRESIDENT: You did, good.

MS. SEITZ: And unfortunately, I will not be at the Texas game, which is a real shame.

THE PRESIDENT: Anyway -- (laughter) -- back to the subject at hand. You told me that you contribute to a 401(k)?

MS. SEITZ: I do. I contribute up to 3 percent. We get matched at NVTC --

THE PRESIDENT: Right.

MS. SEITZ: -- for up to 3 percent. I actually invest up to 4 percent.

THE PRESIDENT: Good.

MS. SEITZ: I'm also looking at --

THE PRESIDENT: Why are you doing that? Why did you decide to do more?

MS. SEITZ: Because I like the idea that I'm able to grow my money, I can invest it, and the faster it grows, the more money I'm going to have, the better I'm going to be in the future.

THE PRESIDENT: Yes. And at age 23, that seems like an awfully young age for people to be investing. Investing is kind of a powerful word for a lot of people in America. They wonder, can I possibly figure out how to invest? And I'm just curious, have you found it to be a burdensome experience --

MS. SEITZ: I have not.

THE PRESIDENT: -- a nerve-wracking experience, an easy experience?

MS. SEITZ: I very much enjoy it. I like being able to go through and see what is doing well, what is not. My boyfriend, George, who is actually from Texas --

THE PRESIDENT: Boyfriend, George?

MS. SEITZ: My boyfriend, George, who is from Texas -- (laughter.)

THE PRESIDENT: Where is he? Big George? Where is George from in Texas, do you know?

MS. SEITZ: He's in San Antonio.

THE PRESIDENT: San Antonio. Awesome, George. You got a little notoriety here. (Laughter.) Maybe the folks back home are watching C-SPAN, you never know. (Laughter.)

MS. SEITZ: He just started a career recently in personal finance and sells mutual funds --so I was looking into investing in a mutual fund, as well.

THE PRESIDENT: Yes, good. But you're paying attention to it. It's a subject that is -- you're comfortable in talking about investment, which is an important thing for people to understand. Sometimes you hear what these personal accounts -- I mean, asking people to do something they're not capable of doing. Frankly, it's kind of an elitist point of view, isn't it? Plenty of people are capable of learning how to watch their money, particularly since it's their money.

Give me your views on Social Security. Have you got any thoughts on that?

MS. SEITZ: I have noticed, since this is my first full-time job out of college, how much money is taken out of my paycheck each pay period for Social Security that I may not see when it comes to my retirement.

THE PRESIDENT: Yes, see, it's interesting, it's the biggest tax a lot of people pay. And younger Americans are saying, I'm not so sure I'm going to see it. The benefits of putting into it -- and I appreciate that. A lot of -- I like to quote the -- some youngster told me about the survey that said, many young people are -- think it's more likely they're going to see a UFO than get a Social Security check. (Laughter.) I don't know if you're one or not. (Laughter.)

But it's an interesting dynamic, isn't it? A lot of young people are beginning to say, it's taking a big bite out of my check, and I'm putting into a system I'm not sure I'm going to see anything back from, which says to me that people who have been elected to office better be wary of not taking care of the system, because when a lot of young people -- see, when their grandparents realize they're going to get the check, nothing changes, and a lot of young people are starting to say, I'm putting something into the system that may not be around when I retire, it creates an interesting set of dynamics, doesn't it. A lot of young people are beginning to pay attention to the issue, a lot of young people are comfortable with investing.

Do you get a -- how do you pay attention to what you invest in?

MS. SEITZ: I can go online and check my -- what each of my investments are doing and I can change them at that time if I feel it's necessary.

THE PRESIDENT: Yes. It's great, isn't it? It's an interesting system, it's an interesting cultural change, people going online to watch her investments grow. And if she doesn't like what's happening, she can change. And, to me, I like the idea of Americans opening up a statement on a regular basis, watching their assets. It may make people pay attention closer to tax policy in Washington, D.C., for example, or decisions made by elected officials.

Thanks for coming. Well done. Good job on hanging out with a Texan. (Laughter.)

Yuctan Hodge.

MR. HODGE: Good morning, Mr. President.

THE PRESIDENT: Yuctan -- it's a really interesting first name.

MR. HODGE: Yes, it is. My dad is Anguillan. It's a small Virgin Island off the coast of St. Martin. And the name means "forever young."

THE PRESIDENT: Forever young? Yuctan, I've got bad news for you. (Laughter.)

MR. HODGE: In spirit, sir, in spirit.

THE PRESIDENT: Yes, in spirit. That's good. If you can stay forever young, the Social Security issue wouldn't matter. (Laughter.)

MR. HODGE: Not at all.

THE PRESIDENT: Someday, you're going to be counting on the check. Tell me what you do.

MR. HODGE: I started a web-development company in 2000 while I was undergrad at the University of Virginia, studying economics.

THE PRESIDENT: How about that? Entrepreneur, somebody who is taking risk, somebody in college. It's fantastic. (Applause.) How's it doing?

MR. HODGE: It's doing very well. I'm actually getting ready to -- I actually closed it down because in the fall, I'll be returning to UVA to attend the Darden MBA program.

THE PRESIDENT: Fabulous. Congratulations.

MR. HODGE: I'm very excited.

THE PRESIDENT: Yes, you ought to be. You ought to be. It says here, like, you're about to get married. You're going to go back to school and get married.

MR. HODGE: I have a very busy summer coming up. I'm getting married in July. My fianc is here in the audience.

THE PRESIDENT: Oh, there she is. Fantastic. Congratulations. When -- what's the date?

MR. HODGE: July 3rd.

THE PRESIDENT: Tied up, but -- (laughter.)

MR. HODGE: Well, it's here in the city if you can make it.

THE PRESIDENT: It is, well -- (laughter.) Send me an invitation, at least you'll get a gift. (Laughter.) Give me your thoughts on investments. Obviously, you're a smart guy, started your own business prior to graduating from college. You've got ambitions, dreams, hopes.

MR. HODGE: Well, the same year I started my company, I also opened a Roth IRA with Fidelity and started capping it out each year because I realized --

THE PRESIDENT: Tell people what a Roth IRA is. Some people listening may not understand what a Roth IRA is.

MR. HODGE: It's basically another retirement account that you can set aside. I believe it's your $3,500 a year tax-free. And you could return that money to you at around 55, I believe.

THE PRESIDENT: Right. In other words it's a savings account. It's a way for an individual to set aside some of his own money in this case, and watch it grow.

MR. HODGE: Definitely.

THE PRESIDENT: Yes.

MR. HODGE: And again, I check it online and get monthly statements so I always know what's going on with my money.

THE PRESIDENT: So you're paying attention. Sure.

MR. HODGE: I'm definitely paying attention.

THE PRESIDENT: Yes. Don't you like the idea of people paying attention to their assets and watching them grow? I think it's an incredibly fantastic opportunity to spread that opportunity throughout our entire society. So Social Security, yes, this is the subject here. (Laughter.)

MR. HODGE: Well, I know that Social Security won't be around, and yet your plan for personalized accounts takes advantage of one of the principles I learned in economics, was compound interest and amortization, the fact that I could have an account that I have control over that makes -- turns my money and allows it to make more money is far better than any alternative.

THE PRESIDENT: Yes, compound interest for some may be a concept they're not familiar with. Money grows exponentially?

MR. HODGE: That's correct.

THE PRESIDENT: How would you describe compound interest?

MR. HODGE: Your money grows depending on how you have it quarterly or yearly. And every year --

THE PRESIDENT: Tends to accumulate and get bigger and bigger and bigger.

MR. HODGE: Definitely.

THE PRESIDENT: Do you realize that if you're a person who's made $35,000 over your lifetime, and the government allowed you to take a third of your payroll taxes over that period of time and set it aside in a conservative mix of stocks and bonds, that over time, when it came time to retire, that money you set aside would grow to be $250,000. That's the compounding rate -- that's what, when you keep investing your money, keep reinvesting and interest -- the compounding rate of interest allows for that kind of growth.

Think about that. A person who has made $35,000 over their life allowed to take a third of the payroll taxes, set it aside in the personal savings account they call their own. That person has got a nest egg, tangible assets that they can then pass on to whomever they choose. That's the power of compound -- of compounding interest. We don't have that power if we hold your money in government to the extent that you can have if you hold it yourself. And that's what -- that's what Yuctan is talking about. He said -- I think he's saying, just give me the chance. He wants --

Some people may not choose, by the way, to set aside their money. That's okay. The great thing about America is we ought to be giving people the opportunity to make that decision. Government ought not to make it for people, particularly since -- the interesting thing is that, as I said earlier, Congress has already made that decision for themselves. Don't you find that ironic?

MR. HODGE: I do.

THE PRESIDENT: Yes. (Laughter.) It's called leading the witness. (Laughter.) Good luck on the wedding, July 3rd, gosh, you're awesome.

MR. HODGE: Thank you very much.

THE PRESIDENT: Yes. And I'm looking forward to meeting the fianc after the event.

MR. HODGE: And the in-laws are here, too. (Laughter.) My mother-in-law and two sisters-in-law.

THE PRESIDENT: Yes, that's a smart move -- (laughter) -- a really smart move.

MR. HODGE: Thank you, Mr. President. (Applause.)

THE PRESIDENT: Didn't need an MBA to figure that out. That's good. (Laughter.)

Colleen and Justin Rummel, welcome.

MS. RUMMEL: Good morning.

THE PRESIDENT: Thanks for coming. What do you all do?

MS. RUMMEL: My name is Colleen Rummel and I graduated from Ball State in 2000. And we came out here and began working at Verizon right away. And I'm an analyst there.

THE PRESIDENT: You two work together?

MS. RUMMEL: Yes, we do, two floors apart. (Laughter.)

THE PRESIDENT: Really, interesting.

MS. RUMMEL: Yes, it's interesting. It's fun, and it's -- it's nice to be able to see him all the time.

THE PRESIDENT: Yes. (Laughter.)

MS. RUMMEL: We do drive separately, though.

THE PRESIDENT: The definition of a newlywed. That's great. How is work?

MS. RUMMEL: It's good. I have actually contributed to the 401(k) right away --

THE PRESIDENT: Got a 401(k)?

MS. RUMMEL: Yes, yes, and they have a great matching program, so we take advantage of that because we wanted to make sure that we had something, because I've never felt that Social Security really would be available for us.

THE PRESIDENT: Isn't that interesting? A lot of people feel that way your age?

MS. RUMMEL: Seems like it.

THE PRESIDENT: Yes. Well, I'm going to keep talking about it. See, I think it's really important for people your age to understand the truth. The best thing the President can do is just out lay the truth. Just put the facts out there. People can make up their own mind about whether or not they feel comfortable about Social Security. You're -- I guess, you're getting the message.

401(k)s, again, so people fully understand what that is?

MS. RUMMEL: We get to set aside up to a certain percentage of our paycheck pre-tax, per pay period. And some companies offer a matching program where they will match up to the next percentage to help affect your growth --

THE PRESIDENT: Right.

MRS. RUMMEL: -- and grow your investment.

THE PRESIDENT: You and old Justin there, figure out what you're going to invest in.

MRS. RUMMEL: Actually, our son. We have an almost 11-month-old son, and once he was born, we realized with all the costs that come with raising children, just child care and braces and college, and gosh, he just started almost walking, so now we're thinking, oh my gosh, he's just going to get into everything in.

THE PRESIDENT: She is, yes.

MRS. RUMMEL: We realized that we need the -- we need to make sure we have some money set aside so that way, you know, if something happens to us, he's taken care of besides -- especially if he's above the age of getting death benefits from the parents.

THE PRESIDENT: Yes, I appreciate that. Justin, you got anything to add to that? Mom's doing a heck of a job. (Laughter.)

MR. RUMMEL: She's talking for me, as usual. The program is actually set aside mainly for our son, Gavin. He's the main focus with that, the idea of being able to take money, set it aside, and also bring it back, is definitely a key factor. But along with that -- alongside of that, the idea that Social Security won't be there for us when we retire and we're taking the steps for it, what I'm really concerned about is what's going to happen to him and what he's going to have to deal with at the point where Social Security becomes bankrupt.

THE PRESIDENT: That's a great question. First of all, I've always said Social Security is a generational issue. Once the grandparents here in America understand they're going to get their check, then they start saying, what about my grandkids. Here you've got young parents wondering about their child -- their child, Gavin. And it's a natural question for people from one generation to ask.

You know, we -- those of us who are baby boomers were very fortunate to have a generation before us make huge sacrifices for the country. They confronted problems. They confronted big problems. It's now our obligation to confront the same problems so that the next generation coming up will say, thankfully, thankfully the generation ahead of us did the right thing.

There's a lot of parents, you know, beginning to -- when they figure out what's going on, are beginning to say, gosh, we've got a serious problem for my child and I expect the government to do something about it.

Here we've got a young couple, used to managing their own money. Mom says she's not sure her Social Security is going to be there. Dad said, if it's not there for us, it's definitely going to be a burden for my kid.

See, the issue here is, once you see the problem, whether or not we've got the political will to deal with it, otherwise we strap a -- younger generations with enormous financial burdens. And I appreciate you worrying about your kid, you need to worry about yourself, too, because you're going to be paying into a system that is bankrupt in 2041.

Thanks for coming. Good luck.

MRS. RUMMEL: Thank you.

MR. RUMMEL: Thank you.

THE PRESIDENT: Good. I appreciate you being here. Paul Sanchez.

MR. SANCHEZ: How are you doing?

THE PRESIDENT: Pretty cool. (Laughter.) So, so. (Laughter.) Feeling great, thank you. How are you doing? (Laughter.)

MR. SANCHEZ: I'm doing great.

THE PRESIDENT: You're looking good.

MR. SANCHEZ: This is fun. This is new for me.

THE PRESIDENT: Well, welcome. Are you employed?

MR. SANCHEZ: Yes, sir, I am. I'm a certified financial planner. I work for Sullivan, Bruyette, Speros, and Blayney in Tyson's Corner, Virginia.

THE PRESIDENT: Yes, here's your chance. Looking for some customers?

MR. SANCHEZ: Absolutely. (Laughter.) Can never have too many of those, right?

THE PRESIDENT: That's right. Where were you raised?

MR. SANCHEZ: San Antonio, Texas. (Laughter.)

THE PRESIDENT: Did you know George? (Laughter.)

MR. SANCHEZ: No, I don't.

THE PRESIDENT: High school? Yes, where did you go to high school?

MR. SANCHEZ: John Jay High School in San Antonio.

THE PRESIDENT: John Jay, very good.

MR. SANCHEZ: You know that school?

THE PRESIDENT: Yes, of course. I was, remember, the governor. (Laughter and applause.) How quickly they forget.

MR. SANCHEZ: I could really test you and ask if you know the mascot, but I won't do that.

THE PRESIDENT: No. (Laughter.) So, like, why did you sign up for this panel, just out of curiosity?

* * * * *

THE PRESIDENT: Isn't it interesting to hear people sit up here and say, I'm not so sure Social Security is going to be there for me. I don't remember saying that when I was 20-years-old. As a matter of fact, I was pretty confident that when I thought about it, the promise government had made -- had made to me and others would be kept. And here, we've got citizens sitting up here saying, I don't think the system is going to be there for me. It's an interesting dynamic that people in Washington must pay attention to. In other words, they're saying, we've got a problem.

And the sad thing is, we've got folks who are just beginning to pay into the system. It must be a little discouraging to be paying into a system that you're not sure is going to be there.

MR. SANCHEZ: Well, I try to put a positive spin on it. My dad is 60, so he's counting down the days to where he gets it, so I figure, he'll get some of what I'm paying in.

THE PRESIDENT: No, that's -- I appreciate that. And --

MR. SANCHEZ: He does, too.

THE PRESIDENT: Yes, that's right. (Laughter.) No, I'm supposed to be the funny guy. (Laughter and applause.)

MR. SANCHEZ: I figured I was from Texas, we could share a little bit.

THE PRESIDENT: Compadre. (Laughter.) You know, you -- first of all, you hear these stories about people saying, gosh, well, if I were in the stock market and the market declined, I'd lose everything. Give people a sense, as a planner, of how you help people at the end of their life prepare for a different risk portfolio.

MR. SANCHEZ: When I started investing, it was in 1997, right out of college. So I've seen two extremes. I've seen a bull market that has just taken off, and I've seen a bear market just go way down. But what that brings you back to is fundamentals. When you see extremes, you've got to go back to fundamentals. When you look long-term -- we're always showing clients the power of investing over 20, 25, 30 years, and there's a lot of power there. So you've just got to pick a strategy, be disciplined with it, understand your risk tolerance, and like you're saying, you can go to Treasury bonds if you're so risk adverse. But if you're someone like myself, who is willing to take a little risk, put half or 70 percent in stocks, and watch it grow and work for you.

THE PRESIDENT: I suspect your risk portfolio will change as you get a little older, don't you?

MR. SANCHEZ: Absolutely, it will change. But for now, I'm still pretty --

THE PRESIDENT: And that's important for people to understand. In other words, there's flexibility, where you can decide to match your -- you put your money where you're comfortable. As you get older, you can transfer from, say, a mix of bonds and stocks to only bonds, relatively risk-free bonds, so that there's more security the closer you come to retirement. You're not stuck in one type of investment vehicle.

Secondly, one of the things that you hear about -- well, you know, Wall Street is going to gouge these people. Do you realize, there's a lot of folks around the country who work for local governments that enable their -- local governments enable their people to invest in private accounts, put their own money in a personal savings account. That happens a lot. I was in Galveston, Texas. That happens in Galveston. Yes, it's hard to believe -- (laughter) -- but it happens in Ohio, it happens in the state of Ohio. And people need to know that fees can be managed properly, so you're not gouged. The government is going to make sure you're not gouged. If we're wise enough to create these accounts for people, there's going to be government oversight to make sure that people are treated fairly. And that's what you've got to know.

MR. SANCHEZ: Index, index funds.

THE PRESIDENT: Yes, see, index funds. Whatever the heck that means. (Laughter.) No, just kidding. (Laughter.)

I do want to thank you all for coming. I hope you have found this to be an interesting dialogue. Most particularly, I hope you have -- if you're a younger American, I hope you pay attention to this issue like these good folks have done. There's a lot at stake for you. It may not seem like it now -- 22-years-old, got a lot of life ahead of me. I'm telling you, if the government doesn't act, you're going to be saddled with a big burden. When you get old enough, you're going to be saying, how come they didn't act? How come the United States Congress is so focused on their parties, political parties, that they didn't have the courage to make sure the system was solvent for me. The Social Security system is solvent for people who were born prior to 1950. You don't have a thing to worry about. But if you've got a child or a grandchild coming up, and working hard, you'd better be worried about whether or not this Congress can do its duty.

I'm confident we're going to get something done. I believe the more the people understand the nature of the problem, the more they're going to speak out to their elected representatives. The more they understand the nature of the problem, the more they're going to be saying to those of us who are serving, go get it fixed. And I'm fully prepared to help in the process. I put forth ideas to move the process along; anybody who has got a good idea, bring it forward. And then we'll be able to say, when we solve it, we did our duty for a generation of Americans coming up.

Thanks for giving us a chance to visit with you. God bless. (Applause.)

END 11:13 A.M. EDT