|

For Immediate Release

Office of the Press Secretary

September 4, 2003

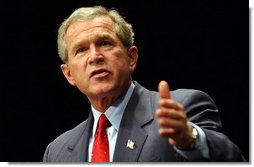

President Bush Outlines Six Point Plan for the Economy

Kansas City Convention Center

Kansas City, Missouri

|

|||||

![]() Fact Sheet: President Bush Outlines Six Point Plan for the Economy

Fact Sheet: President Bush Outlines Six Point Plan for the Economy

![]() In Focus: Jobs and Economy

In Focus: Jobs and Economy

![]()

![]()

11:31 A.M. CDT

THE PRESIDENT: Thank you all. I appreciate the warm welcome. It's nice to be back here in Kansas City. I feel comfortable here. After all, it's a place of good baseball -- (applause) -- pretty good football -- (applause) -- and really good barbecue. (Applause.)

I have come to this important city, right here in the heart of America, to speak about the future of our nation's economy. I want to talk about jobs and job creation. Kansas City in many ways symbolizes the incredible energy and ingenuity and flexibility of our economy. It wasn't all that long ago that Kansas City was known for rail lines and stockyards. Now, the economy is a more modern economy because of the spirit of enterprise that exists here, and because of the willingness for the people to work hard, because of the optimism of the people in this part of the world. And I share your optimism about the future of this nation.

America's economy today is showing signs of promise. We're

emerging from a period of national challenge and economic uncertainty.

The hard work of our people and the good policies of our government are

paying off. Our economy is starting to grow again. Americans are

feeling more confident. I am determined to work with the United States

Congress to turn these hopeful signs into lasting growth and greater

prosperity and more jobs. (Applause.)

America's economy today is showing signs of promise. We're

emerging from a period of national challenge and economic uncertainty.

The hard work of our people and the good policies of our government are

paying off. Our economy is starting to grow again. Americans are

feeling more confident. I am determined to work with the United States

Congress to turn these hopeful signs into lasting growth and greater

prosperity and more jobs. (Applause.)

I want to thank Terry Dunn for his kind introduction. I like a good short introduction. (Laughter.) I appreciate Pete Levi, the President of the Greater Chamber. I flew from Washington here today with two fine Americans: Senator Jim Talent is doing a great job for the people of Missouri -- (applause) -- and Congressman Sam Graves. (Applause.)

On the plane ride down, Sam told me that his mother was going to be here today. And I said, I hope you're still listening to your mother. (Laughter.) I'm still listening to mine -- (laughter) -- most of the time. (Laughter.)

I want to thank Paul Rodriquez and CiCi Rojas from the Hispanic Chamber of Commerce for -- (applause). I also want to thank the Board of Directors and the members of the Chamber for allowing me to come to discuss with you the future of this country.

Before I do so, though, I had the honor of meeting Tom Holcom. He's a Missouri native who was out there at Air Force One when -- at the airport when we landed, to greet me at Air Force One. He started Angel Flight Central. He is a -- it's a non-profit organization that provides free air transportation to those in need due to a crisis.

The reason I bring this up is that I know the great strength of America is the heart and soul of the American people. And everywhere I go, I like to herald those quiet heroes who are making a difference in people's lives by volunteering time. I like to tell people that it's important for this nation to usher in a period of personal responsibility. And part of that -- (applause) -- and part of a responsibility society is to love a neighbor just like you'd like to be loved yourself. (Applause.)

I want to thank Tom for using his time and talent to help somebody

in need. I want to thank you all, if you're a member of the army of

compassion in this United States of America, for serving your community

by helping somebody who hurts, by reaching out a hand to a neighbor in

need. Now, government can help. We can pass out money. But

government cannot put hope in people's hearts or sense of purpose in

people's lives. That is done when a kind soul puts their arm around a

brother and sister in need and says, I love you, what can I do to

help? (Applause.)

I want to thank Tom for using his time and talent to help somebody

in need. I want to thank you all, if you're a member of the army of

compassion in this United States of America, for serving your community

by helping somebody who hurts, by reaching out a hand to a neighbor in

need. Now, government can help. We can pass out money. But

government cannot put hope in people's hearts or sense of purpose in

people's lives. That is done when a kind soul puts their arm around a

brother and sister in need and says, I love you, what can I do to

help? (Applause.)

Events of the last few years have revealed the amazing resilience of our nation's economy. In our country's history, recessions have typically resulted from single, unexpected shocks, such as spikes in energy prices or sudden shifts in markets. Since 2000, our economy has been dealt not just one shock, but three -- a set of challenges with few parallels in American history.

First, the stock market began a steady decline in March, 2000, as investors realized that the economy was not healthy. Businesses faced over-capacity during that period of time and cut their budgets for new investment in technology or equipment. And by early 2001, this economy was in recession.

And secondly, we were attacked on a fateful day, September the 11th, 2001. An enemy which hates America attacked us and killed a lot of our citizens. It brought our nation great grief and shock, and it disrupted our economy. The stock market shut down for days; commercial airlines were devastated. Travel and the tourism industry has struggled since, and the costs of higher security are still being paid.

The economic impact of those attacks is estimated at $80 billion in economic damage and lost output, which is nearly equivalent to wiping out the entire economy of Kansas for one year. The economic impact of September the 11th continued because of the uncertainty from the war on terror -- from operations in Afghanistan, or war on terror in Iraq, or relentless hunt for the killers.

In times of conflict, decision-makers are hesitant to make major purchases, businesses are hesitant to hire new people. The march to war is not conducive for hopeful investment. Our military campaigns in the war on terror have cost our treasury and our economy. Yet, they have prevented greater costs. (Applause.)

We will protect this nation from further attack, and therefore, protecting our economy from major disruption. The safety of our people, the security of the American people is of paramount concern to me. With a broad coalition, we are taking, and will continue to take, action around the globe. We will remain on the offensive against terrorist killers. We will stay on the offensive. And this nation will prevail. (Applause.)

As we fought this war, our nation's economy was dealt a third major blow. We discovered corporate malfeasance in boardrooms across America. The scandals -- corporate scandals -- erased savings of Americans -- of some Americans; it forced the layoffs of thousands, and it undermined the confidence of investors. We took action; I signed tough new laws. In an era of personal responsibility, if you're a CEO in corporate America, we expect you to tell the truth to your shareholders and employees alike. (Applause.) And if you don't, there's going to be serious consequence. (Applause.)

In each case, this administration did not stand by and hope that the problem would solve itself. We acted, with a strong belief in the spirit of the American people and in free markets. We acted to keep the entrepreneurial spirit alive and well. I based decisions on a fundamental principle -- when our economy is struggling, the best thing that government can do to stimulate growth is to let people keep more of their own money. (Applause.)

So I asked for, and the Congress passed, major reductions in federal taxes. We lowered taxes of every American who pays taxes. (Applause.) We raised the child credit to $1,000 per child. We reduced the marriage penalty. It seemed like to me the tax code ought to encourage marriage, not discourage marriage. (Applause.)

These actions have brought substantial savings to the taxpayers, and have been critical in fighting the effects of recession. Under the tax relief we passed in 2001 and 2003, a married couple with two children and a household income of $40,000 have seen their federal income tax bill fall this year from $1,978 to $45. (Applause.)

Thanks in part to the reductions we passed, real disposable personal income -- that which is left in paychecks and other income after taxes are taken out -- has increased at 3.4 percent rate in the first two-and-a-half years of my administration. That's a faster increase than the pace set in the 1990s. People are keeping more of their own money. (Applause.)

That tax relief is taking pressure off of families and is adding momentum to economic growth. Tax relief came at the exact right time. (Applause.) I say that, because during the first year of a typical recession, consumer spending rises only at .3 percent. That's a typical recession. The most recent recession -- thanks in part to the tax cuts -- consumer spending rose by nearly ten times that rate. When people have more money in their pocket, consumer spending will stay strong. And that spending has continued.

Throughout this recession, consumers have shown a belief in America's future by buying homes. In the typical recession, housing investment falls by 10 percent and doesn't recover for nearly two years. Thanks to tax relief and low interest rates, housing investment dropped by only one percent in this recession, and then began to rise above pre-recession levels within only one year.

This July, housing starts reached their highest level since 1986. (Applause.) Homeownership in America is now at 68 percent, one of the highest levels ever recorded. And many Americans have refinanced their homes, saving themselves billions of dollars. And that helps our economy grow, as well.

As Americans grow more confident and make more purchases, small and large businesses around the country are seeing the benefits. Purchasing managers have reported rising new orders for both goods and services in each month since May. Order for high-tech equipment have been declining -- had been declining since 2000; they have risen steadily since April.

Investors are showing greater confidence in the stock market. Thanks to our efforts to reduce taxes on stock dividends, dozens of major companies have announced plans to either increase their existing dividend payout, or pay dividends for the first time, which will put billions of dollars in cash into the pockets of American shareholders. And that is good for our economy. (Applause.) For small businesses -- and I know we've got some business owners here today -- the outlook is improving.

I found it interesting that Americans are starting sole proprietorships at a faster rate than they did in the 1990s. The tax relief we passed helps small businesses. Most small businesses are either sole proprietorships or sub-chapter S corporations, which means they pay tax at the individual income tax level. And therefore, when you reduce individual income taxes, you're providing much needed capital for small businesses all across America. (Applause.)

Since small businesses create most of the new jobs in America, we recognized we needed to do more. And so, we gave further encouragement to small businesses by raising the annual expense deduction from $25,000 to $100,000. By helping small businesses, by creating the environment for capital accumulation and capital investment at the small business level, not only are we sustaining the entrepreneurial spirit in America, but we're helping Americans find work. (Applause.)

The recession was hard on a lot of Americans. Over the past two-and-a-half years, I've met with dozens of our fellow citizens -- families who have struggled to meet emergency bills, seniors who saw their savings hurt by stock market declines, small business owners who had to put in a lot of work just to keep their dream alive. These Americans were helped by tax relief. Had we not taken action, this economy would have been in a deeper recession. It would have been longer, and as many as 1.5 million Americans who went to work this morning would have been out of a job.

Instead, because we did act, the recession was one of the shallowest in modern economic history. Some critics, who opposed tax relief to start with are still opposing it. They argue we should return to the way things were in 2001. What they're really saying is they want to raise taxes. Higher taxes will not create one job in America. Raising taxes would hurt economic growth. Tax relief is putting this nation on the path to prosperity, and I intend to keep it on the path to prosperity. (Applause.)

I was told of a story of the Nebraska Furniture Mart. It's an interesting American story. It's a story of a family that started this company in Omaha, Nebraska, and they wanted to build a store right here in Kansas City, Kansas. It wasn't the best time to open up a store, but the people running the company thought it was a good risk, a good market. They planned on bringing -- or hiring 550 new workers for their new store, because the tax relief we passed put more money in people's pockets, and the demand for the goods they sold in that store was greater than they expected. So Furniture Mart hired 1,000 people instead of 550.

Robert Batt and his family, they run the company. He said this; he said, "We just believe in America and we do what we excel at, selling furniture. The customers are out there. We've never had a layoff in 67 years." Not only have they not had a layoff in 67 years, they had enough confidence and the policies of the administration were working such that they were able to provide work for 1,000 of our fellow citizens. (Applause.)

Even as this economy is looking up, it's hard to feel confidence if you're somebody looking for a job. People who have been hit hard in the manufacturing sector know what I'm talking about. Parts of this country are not doing as well as they should -- regions like the Pacific Northwest and parts of the Midwest. Part of the current problem is that job creation lags behind improvements in the overall economy. Of course, it takes awhile for job creation to catch up. Usually when the economy comes out of a recession, jobs are the last thing to arrive. Employers tend to rely on overtime until they're sure it makes sense to hire another worker.

Yet, there's another basic reason for lagging employment, and that is increases in worker productivity. Over the long-term, higher productivity lifts workers wages and standards of living, and it helps the economy. We've got the most productive workers in the world right here in America. And that's good for the long-term economic prospects. You see, higher levels of productivity means that we'll see better-paying jobs for the American worker. But there is a down side in the short-term. When a business can produce more per employee -- in other words, productivity has gone up per person -- it does not hire new people right away to meet rising demand.

So therefore, the agenda that I've got, and I'm going to describe to you, to build on what we have done already, has one thing in mind, and that is, our economy must grow faster than productivity increases to make sure that people can find a job. I'm interested in Americans going to work. That's what I'm interested in. (Applause.)

And we will continue to help individuals get through the tough times and to prepare for better times. My administration supported the extensions of the unemployment benefits so that people that have been laid off get the help they need. Our economy demands new and different skills. We are a changing economy. And therefore, we must constantly educate workers to be able to fill the jobs of the 21st century. And so, therefore, I went to Congress and asked for increased funding for Pell Grants for higher education scholarships.

Now, more than 1.9 million community college students receive those grants. Community colleges are great places for people to learn new skills so they can fill the new jobs of the 21st century. And that's why the Department of Labor has begun a high-tech job training initiative to create partnerships between employers -- those people who know what kind of jobs are needed -- community colleges and career centers, so that those looking for work can match education and the skills they learn with the jobs that actually exist.

And for those who are having the hardest time finding work, I proposed to the Congress a new idea called reemployment accounts. These accounts will provide a job seeker with up to $3,000 to pay for training, day care, transportation, relocation expenses, whatever it takes to find a new job. And if they find a job quicker than the allotted time for the $3,000, they get to keep the difference between what they've spent and the $3,000 as a reemployment bonus. These accounts, if Congress will act, it will help more than 1 million of our fellow citizen receive the training necessary to become employable, to be able to fill the new jobs of the 21st century.

What's interesting is, right now, is that as the economy is getting a little better, employers are now beginning to decide whether to hire more workers. Hiring is a big decision, especially big for a small company. After all, when you take on a new employee, you not only show confidence in the person, you've got to have confidence in your company's future. And there are six specific actions we can take to help build that confidence, so that people can find a job.

First, people are more likely to find work if health care costs are reasonable and predictable. Adding an employee often requires more than paying a wage -- you know that -- it means providing benefits, such as health insurance. But company costs for health benefits have been rising nearly 10 percent a year since 2000. These increases cut the capacity to create jobs, and we've got to deal with them. We've got to take this issue straight on.

We can help small businesses by allowing them to join together to shop for health insurance, allowing them to pool their risks in what's called associated health care plans. (Applause.) It makes sense to give small businesses the same bargaining power that big companies enjoy, so they can reduce their health care costs. (Applause.) The House of Representatives has passed a good bill. It is time for the Senate to act. I thank Senator Talent for his important leadership. (Applause.)

In order to address another cost of rising health care, we must fix the problem of frivolous lawsuits against our doctors and hospitals. (Applause.) Litigation or the fear of litigation is causing doctors to quit the practice of medicine. Medicine is becoming less accessible because of the frivolous lawsuits. And the doctors that continue to practice who fear lawsuit will try to protect themselves from the lawsuit by over-prescribing, by covering themselves, by practicing defensive medicine, which drives up the cost of health care for everybody. And it drives up the cost of health care to the federal budget. Frivolous lawsuits increase the cost to the federal budget because of increases in Medicaid costs and Medicare costs and veterans' costs. Therefore, medical liability reform is a national issue that requires a national solution.

I proposed to the United States Congress a reasonable reform for medical liability. Any patient that has been harmed should recover all economic damages. We should have a cap of $250,000 on non-economic damages. If harm is caused by serious misconduct, we ought to have reasonable punitive damages. The House passed the bill; it is stuck in the Senate. It is time for the United States Senate to pass medical liability reform, for the sake of job creation in America. (Applause.)

Secondly, we ought to take action on a lawsuit culture that affects the workers in every business, not just the docs. Industry estimates show that litigation is a #200 billion a year burden on the U.S. economy. Obviously when big money goes to trial lawyers, it doesn't go to workers. So I proposed, and the House has approved, and it's stuck in the Senate, an idea to help relieve the cost of lawsuits. And that is class action reform. We ought to make it easier to move class action and mass tort lawsuits into the federal courts, so that trial lawyers won't be able to shop around our country to find a favorable court. (Applause.)

And as we are reforming class action, it also makes sense to make sure that when a verdict is handed down, that the money actually goes to the people who have been harmed. (Applause.)

Thirdly, a growing economy depends on steady, affordable, reliable supplies of energy. And yet, as we've seen recently, businesses have had to cope with constant uncertainty -- uncertainty because of shortages and energy price spikes or blackouts. It is hard to be able to plan for the future when you're worried about energy supply. And this is especially true for manufacturing companies, which use about a third of the nation's energy.

And so we needed a comprehensive national energy plan, one that seeks to upgrade the electricity grid, that makes reliability standards by those who deliver electricity mandatory, not voluntary. (Applause.) We need to promote new technologies and alternative sources of energy. Someday we may just be growing our energy right here in the state of Missouri. (Applause.) But in the meantime, we've got to find more sources of energy here at home in an environmentally friendly way. I've been calling for Congress to pass a comprehensive energy plan for two years. For the sake of national security, for the sake of economic security, we need to be less reliant on foreign sources of energy. (Applause.)

People are more likely to find work if the resources of businesses are not spent complying with endless and unreasonable government regulation from Washington, D.C. (Applause.) We will meet our duty to enforce laws, whether it be environmental protection laws or worker safety laws. But we want to simplify regulations in this administration. And we're working hard to do so.

I'll just give you one example. We streamlined tax reporting requirements for small businesses, helping 2.6 million small businesses save what is estimated to be 61 million hours of unproductive work. By streamlining regulations, by making regulations more simple, the small businesses that were affected by this change have now got more money to invest in their businesses, which means it's more likely they will hire somebody. Easing the burden of excessive regulation on all businesses is important for job creation all across our country.

Fifth, people are more likely to find work if we continue to expand trading opportunities for our goods and services. My administration is opening up new markets around the world for products that carry the international mark of quality, a label that says, made or produced in the United States of America. (Applause.)

Yesterday I signed legislation creating free trade agreements with Singapore and Chile. These agreements will lower tariffs on American-made goods and make our goods more competitive abroad.

Let me give you an example of what I'm talking about. American-made heavy machinery, such as motor grader, costs $11,200 more when sold in Chile because of extra tariffs. If that machinery were made in Canada or the European Union, it would carry no tariff. Therefore, an American product, because of the tariffs that existed, were priced out of the reach of the buyer in Chile. Because of bill I signed, because of my desire to make sure the playing field is level around the world, manufacturers will be able to compete on a level playing field. And there's no doubt in my mind that when the playing field is level, American workers can compete with anybody in the world. (Applause.)

Finally, people are more likely to find work if businesses and their workers can be certain that the lower tax rates of the last years will stay in place. Today you don't have that confidence they'll stay in place, and there's a good reason -- because under the laws that were passed, tax relief is set to expire.

The death tax -- which is being phased out and will disappear in 2010, but comes back to life, because of a quirk in Senate rules -- will be revived in 2011. That doesn't make any sense to say to the small business owner or the farmer or the rancher, we're going to phase out the death tax -- which is a bad tax to begin with -- and then let it pop back to life. But that's reality.

Or how about this: The capital gains tax reductions, a vital part of encouraging capital formation, will rise by a third in 2008. The incentives for small businesses will vanish in 2006. At midnight on December 31, 2004, the $1,000 child credit is set to fall back to $700 per child; the marriage penalty will take a bigger bite. That's the way the Congress did it.

What Congress needs to do is to get this message: When we threw out the old taxes, Americans didn't expect to see them sneaking in through the back door. (Applause.) For the sake of growth -- for the sake of economic growth, for the sake of job creation, the United States Congress must make these tax cuts permanent. (Applause.)

I know there's talk about the deficit. The deficit is caused when less revenues come into the treasury relative to expenditures. And when you have a recession, less revenues come into the treasury. But also remember, that time we're at war. My attitude is, any time we put one of our soldiers in harm's way, we're going to spend whatever is necessary to make sure they have the best training, the best support, and the best possible equipment. (Applause.)

And the tax relief, which is stimulating economic growth, is a part of the deficit. It's about a quarter of the deficit. But this economy, as it grows, will yield more money to the treasury. And I've laid out a five-year plan to reduce the deficit in half. That assumes I have a willing partner in the Congress. Congress must hold the line on unnecessary spending. (Applause.)

I have proposed a 4-percent increase in discretionary spending for this year's budget. It's about equal to the increase of the average family budget. If it's good enough for American families, it ought to be good enough for the appetite of some of the congressmen. They need to stick with that agreement. They need to understand that in order to cut the deficits in half, we must have spending discipline in Washington, D.C., and I will insist upon spending discipline in Washington, D.C. (Applause.)

There's a lot we can do now that the Congress is back in town. And I look forward to working with both Republicans and Democrats to set the framework for continued economic prosperity and growth.

I mentioned earlier, I'm optimistic about our future in this country. If you've seen what I've seen, you'd be optimistic, too. I've seen the great spirit of the country. I know the attitude of the American people. I know the determination and will, the willingness to work hard, the willingness to place family above self, the willingness to serve something greater than yourself -- that's the American spirit. And it is strong, and it is alive, and it is great. (Applause.)

I have confidence in the future of America. I have confidence in our economy, because I have great confidence in the creativity and the enterprise of the American people.

Thank you for coming. May God bless you, and may continue to bless America. (Applause.)

END 12:13 P.M. CDT