- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

|

Home >

News & Policies >

December 2007

|

For Immediate Release

Office of the Press Secretary

December 20, 2007

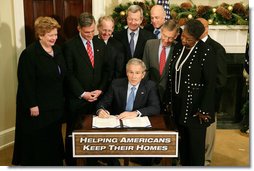

President Bush Signs H.R. 3648, The Mortgage Forgiveness Debt Relief Act of 2007

Roosevelt Room

![]() Fact Sheet: The Mortgage Forgiveness Debt Relief Act of 2007

Fact Sheet: The Mortgage Forgiveness Debt Relief Act of 2007

1:05 P.M. EST

THE PRESIDENT: Thank you all for coming. Welcome to the White House. I'm pleased to sign a bill that will help homeowners who are struggling with rising mortgage payments. The Mortgage Forgiveness Debt Relief Act of 2007 will protect families from higher taxes when they refinance their homes. It will help hardworking Americans take steps to avoid foreclosure during a period of uncertainty in the housing market. I want to thank members of Congress for getting this bill passed. I appreciate it very much. It's been a joy working with you.

I thank my Secretary of the Treasury, Hank Paulson; and the Secretary of

Housing and Urban Development, Alphonso Jackson, for taking the lead in

helping people stay in their homes. I particularly want to thank the

Chairman of the Finance Committee, Max Baucus; Senator Debbie Stabenow of

Michigan; and Senator George Voinovich of Ohio, for sponsoring this

legislation.

I thank my Secretary of the Treasury, Hank Paulson; and the Secretary of

Housing and Urban Development, Alphonso Jackson, for taking the lead in

helping people stay in their homes. I particularly want to thank the

Chairman of the Finance Committee, Max Baucus; Senator Debbie Stabenow of

Michigan; and Senator George Voinovich of Ohio, for sponsoring this

legislation.

I remember calling you on the phone, telling you that I'm going to propose the same thing you are -- talked to George, as well -- and it's been a joy to work with you.

I want to thank Jim McCrery of the House, Stephanie Tubbs Jones and Rob Andrews. Appreciate you all being here.

I want to thank the staff who works hard at the Treasury and HUD to make this deal work. Appreciate your hard work.

In recent months, our nation's housing market has faced serious strains. Home values have fallen in many parts of our country. At the same time, many homeowners with adjustable rate mortgages have seen their monthly payments increase faster than their ability to pay. And now some homeowners face the prospect of foreclosure.

My administration has taken strong steps to help homeowners avoid foreclosure by making it easier to refinance loans. We gave the Federal Housing Administration greater flexibility to refinance loans for struggling homeowners. We helped assemble a private sector group of lenders, loan servicers, investors, and mortgage counselors called the HOPE NOW Alliance. This group has agreed on a set of industry-wide standards to help those with subprime loans refinance or modify their mortgages, so more families can stay in their homes.

The bill I sign today will help this effort by ensuring that refinancing a mortgage does not result in a higher tax bill. Under current law, if the value of your house declines and your bank or lender forgives a portion of your mortgage, the tax code treats the amount forgiven as money that can be taxed. And of course, this makes a difficult situation even worse. When you're worried about making your payments, higher taxes are the last thing you need to worry about. So this bill will create a three-year window for homeowners to refinance their mortgage and pay no taxes on any debt forgiveness that they receive. And it's a really good piece of legislation. The provision will increase the incentive for borrowers and lenders to work together to refinance loans -- and it will allow American families to secure lower mortgage payments without facing higher taxes.

With this bill, Congress has taken a strong step to address the turbulence in the housing market. Yet there's more work to be done. The Congress needs to pass legislation permitting state and local governments to issue tax-exempt bonds for refinancing existing home loans. Congress needs to pass legislation strengthening the independent regulator of government sponsored enterprises like Freddie Mac and Fannie Mae, so we can keep them focused on the mission to expand home ownership. Congress needs, as well, to complete work on responsible legislation modernizing the Federal Housing Administration, so that we can give the FHA the necessary flexibility to help hundreds of thousands of additional families qualify for prime-rate financing.

By taking these steps, we can help our homeowners -- and we'll help more Americans become home owners. We want people to have a place they can call their own. After all, it's an essential part of the American Dream. And we want that dream to extend throughout our nation.

I want to thank the members for joining us. I wish you all happy holidays. And this is going to make a happy holiday for many home owners. Thanks for coming.

END 1:10 P.M. EST