- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

|

Home >

News & Policies >

February 2007

|

For Immediate Release

Office of the Press Secretary

February 6, 2007

President Bush Discusses Fiscal Responsibility

Micron Technology Virginia

Manassas, Virginia

![]() Fact Sheet: Balancing the Budget Without Raising Taxes

Fact Sheet: Balancing the Budget Without Raising Taxes

![]() In Focus: Budget 2008

In Focus: Budget 2008

![]() In Focus: Jobs & Economy

In Focus: Jobs & Economy

10:23 A.M. EST

THE PRESIDENT: Thank you all. Thank you for your warm welcome. It's good to be here at Micron Technologies. I'm going to spend a little time with you talking about the state of our economy and the budget I submitted to the United States Congress. It should interest you. After all, it's your money. (Laughter.)

One thing about Micron is that it is clear that the role of government is to encourage investment and enhance educational opportunities. I mean, when you walk through the halls of this innovative company, it's pretty clear to me that you need to know what you're doing in order to make this -- (laughter) -- company survive and thrive like it is.

The other day I was in New York, and I talked about what we need to do to keep the economy growing. In other words, things are fine right now; what do you do to make it even better in the future? And coming to a company like this reminds me about some of the basic things we need to do. One, we need to make sure that we educate kids so that they can become employees in companies like this -- basic, fundamental education -- and encourage additional education for folks so they gain skills to fill the jobs of the 21st century.

The other day I was in New York, and I talked about what we need to do to keep the economy growing. In other words, things are fine right now; what do you do to make it even better in the future? And coming to a company like this reminds me about some of the basic things we need to do. One, we need to make sure that we educate kids so that they can become employees in companies like this -- basic, fundamental education -- and encourage additional education for folks so they gain skills to fill the jobs of the 21st century.

Secondly, trade. Like, if you're confident in what you make, you ought to be for trade, because people are going to want to buy what you make. Ninety-five percent of the customers in the world live outside the United States. I mean, we're 5 percent of the population; 95 percent is elsewhere. This company relies upon trade. So you've got the smart people back there making the products that people want, and you want to be in a position to sell it if you want your company to continue to grow.

I appreciate very much the fact that companies like Micron actually have a budget. It's a concept that the government needs to get used to, too. (Laughter.) And I'm going to spend a little time talking about the budget. I submitted a budget yesterday that says we can balance the budget by 2012 without raising your taxes. I'm going to explain how it works.

It's probably counterintuitive to some, particularly those who tend to trust government, but, see, I believe it is not only possible, we have proven it through a document, that by keeping taxes low and being wise about how we spend your money, we actually achieve balance in the budget. That's not to say we won't have other challenges, but this budget can work if Congress resists the temptation to raise your taxes.

Now I do want to thank Steve and the good folk from Idaho for joining us. Virginia is a good part of the world, or obviously you wouldn't be here. But you understand that there's some really fine folks that live here and work here. I appreciate Pat, the site director who gave me a tour. He tried to explain all the big machines that were there to a history major. (Laughter.) I played like I understood. (Laughter.) It's a really interesting place you work in.

I appreciate Mike Simpson. He's the Congressman from Idaho. This innovative company is headquartered in his district. And so he wanted to come by and see this part of Micron's operations. I appreciate the Mayor. Mayor, are you here somewhere? Oh, Mayor, good to see you. Thank you for serving. Appreciate it -- just fill the potholes, that's all I can tell you. (Laughter.) And I'm sure you are. (Laughter.)

I appreciate Mike Simpson. He's the Congressman from Idaho. This innovative company is headquartered in his district. And so he wanted to come by and see this part of Micron's operations. I appreciate the Mayor. Mayor, are you here somewhere? Oh, Mayor, good to see you. Thank you for serving. Appreciate it -- just fill the potholes, that's all I can tell you. (Laughter.) And I'm sure you are. (Laughter.)

I want to thank you all for giving me a chance to visit with you. First thing that's for sure, this economy is strong. I hope you feel it. After all, the company is investing billions of dollars to make sure that your product is competitive in a world economy, and one reason why the company feels confident about investing billions of dollars is because the nature of this economy is strong and the statistics bear it out.

Last quarter we grew at 3.5 percent growth. In a big economy, that is a substantial growth. Last year we grew by 3.4 percent for the year. That's up from 3.1 percent. That's positive news if you're working in America. It's positive news if you're looking for a job. In other words, it's hard to find good work unless this economy is growing. And the economy is strong. The Dow Jones Industrial Average reached an all-time high for the 27th time in the past four months. In other words, people are confident. People feel good about the future.

Real wages are up. That's positive if you rely upon a wage. It's up by 1.7 percent. Real wages is that beyond the cost of living. The average family of four making $1,000 more this year than they were last year, and that helps a lot.

Three months ago, we've added -- over the last three months, we added a million jobs*. It's all due to the entrepreneurial spirit. See, government doesn't create wealth. Government creates an environment that encourages capital flows and investment. I really believe the most important aspect of government is to react to problems and encourage the entrepreneurial spirit. I really want it to be said, America is entrepreneurial heaven. It's a great place to take risk and to realize your dreams, and I believe it is. And the question is, how do we keep it that way?

I want you to remember a little bit of the economic history of the recent years. It will help justify why I submitted the budget I submitted. You might remember that we were in a recession in 2001. I don't know if you were working here then, but that recession was being felt all throughout our economy. And then the enemy attacked us, and it hurt a lot. You know, a huge attack like that not only shakes the psychology of the country, it hurt the economy.

And so I decided to do something about it, and cut taxes -- worked with Congress to cut taxes. I believe that if you have more money in your pocket to save or spend or invest, that is what was required to create a condition where people would feel more comfortable about making investments. In other words, the entrepreneurial spirit is enhanced when you have more money, when consumers have more money to spend, or businesses have more money to invest.

And so we cut taxes. We cut taxes on everybody who pays income taxes. I believe the best -- fairest policy in Washington is not to play favorite in the tax code, but say, if you pay income taxes, you ought to get a tax cut. And that's what we did.

We also doubled the child tax credit. We reduced the marriage penalty. We cut taxes on dividends and capital gains in 2003. And the reason why is we want to encourage investment. You cannot spend billions of dollars inside this plant unless somebody is willing to make that investment.

And by cutting capital gains taxes and taxes on dividends, it encourages capital flow; it makes it easier for Micron to attract capital to buy new equipment to expand your business and to remain competitive.

Our economy expanded -- so there's a big debate. There's always somebody -- do tax cuts work? They work. I understand the politics of cutting taxes. Some like it, some don't. I just asked the American people to look at the facts. Since we cut taxes a second time in 2003, we've added 7.4 million new jobs. Tax cuts equaled new jobs. Our economy expanded by 13 percent since we cut taxes in 2003. In other words, we dealt with the recession, we dealt with the attacks, we laid the conditions for economic vitality, and the American people took hold and made it work.

Government didn't grow the economy. The hard working people of our country grew the economy. And so coming into this budget session, I felt like we we're in a good opportunity to balance this budget because of the economic vitality. In other words, if you got a weak economy, it's really hard to stand up with credibility and say to Congress, join me in balancing the budget without raising taxes. We got a strong economy.

One of the things that happens when you have a strong economy, when you have vitality in the private sector, is it turns out you get more tax revenues than you anticipate. See, cutting taxes created the incentives for people to save, invest and consume, which caused the economy to grow; and as the economy grows, the pie gets bigger, the tax revenues to the Treasury increase. And that's what happened.

In 2004, I said, we can cut the deficit in half in five years. There was a lot of skepticism. Washington occasionally has skepticism. They said, you can't do that unless you raise taxes. Well, sure enough, we did do it by not raising taxes. As a matter of fact, we did so three years ahead of schedule.

See, low taxes means economic vitality, which means more tax revenues. And so the fundamental question is, what do you need to do to keep the economy growing, in order to make sure the tax revenues keep coming in to the Treasury? Step one is to keep the taxes low. A lot of people saying, you've got to raise it. I don't believe so. I think raising taxes hurts the economy. I think raising taxes makes it harder to sustain economic growth. I think if we raise taxes, it makes it harder for this company to invest billions of dollars in new equipment. And if this company decides not to invest billions of dollars in new equipment, it makes it harder for your wages to go up; it means somebody is not making that equipment, which will have an effect on the economy.

And so step one for a good budget, step one to balancing the budget is to keep taxes low. As a matter of fact, not only do I think we ought not to raise them, I think we ought to make every tax cut we passed permanent.

Now, it also means we're going to have to set priorities with your money. See, the temptation in Washington is to spend your money on everything that sounds good. That's not how you run your family budget, that's not how this company runs its company budget, and that's certainly how the government ought not to run its budget, which means you have to do the hard work and set priorities.

And so the budget I submitted to Congress sets clear priorities. The number one priority, as far as I'm concerned, for the federal government, is to protect the American people. The number one priority is to spend monies necessary to defeat an enemy that wants to -- wants to cause us harm. One of the lessons of September the 11th is that chaos and safe haven overseas could cause an enemy to come and harm us, and I'm never going to forget the lesson.

Secondly, a priority is when we ask an American to wear the uniform, volunteers to wear the uniform to go into harm's way, that person deserves the full support of the United States government.

And so the priority in this budget is to make sure that those who are on the front lines of protecting you, in a war which I wish wasn't waging, in a war that came home to us on September the 11th, is to make sure they have the tools necessary to do the job. If government's job is to protect the American people from harm, then we better make sure those we've charged with protecting you have what it takes to do so.

There's something called discretionary spending in the budget. I don't want to get to be too much of a budget expert for you, but we've got what's called mandatory spending -- in other words, it's going to happen based upon formula -- and discretionary spending, where the government gets to decide on an annual basis how much is spent.

And so therefore, if you're trying to balance the budget after you've set your priority and funded it, then the Congress has to be wise about other aspects of discretionary spending. And so the budget I've submitted says that we can meet our obligations but don't have to spend up to the rate of inflation. In other words, you have to have some fiscal discipline if you want to balance the federal budget, and that's what I'm asking Congress to do.

One of the things I presume you expect us to do is analyze programs. In other words, if they say, this is going to do this, and the results aren't there, I think the American people expect us to eliminate those programs or cut the programs back or not fund them, and that's exactly what we do. It's a little hard sometimes to say to a person, a member of Congress, by the way, the program that you think is a good program is not working. But we spend a lot of time doing that in Washington, D.C. And we got a pretty good record about eliminating programs that don't work. And we'll continue to work with Congress to hold people to account. That's what happens here at Micron. If your product line is not meeting expectations, you don't keep funding something that's not working. That's what government ought to do, as well.

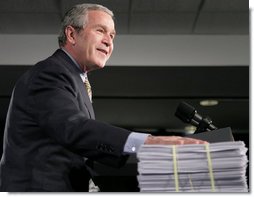

I want to talk about an interesting topic that tends to dominate Washington, and one that is necessary to make sure that we spend your money wisely and balance the budget, and that's the issue of earmarks. I'm sure you've heard about them. Earmarks are special interest items that get slipped into spending bills a lot of times at the last minute. In other words, they're moving a piece of appropriations out, and then somebody shows up and says, well, I need this for my district, or I need this for my district.

In 2005, we had more than 13,000 earmarks. More than 90 percent of the earmarks never make it to the floor of the House or the Senate. Isn't that interesting? In other words, they're never voted on. They're just dropped into a committee report. And these committee reports are not even a part of the bill that arrives on my desk. And here's what they look like.

These things didn't get voted on, and yet they have the force of law. And they provide taxpayers' dollars from a lot of things -- researching wool, swimming pools in here. They didn't vote them into law. In other words, Congress didn't vote these things into law. I didn't sign them into law, yet they have the force of law.

And therefore, it's important for Congress to continue -- to reform the process, and we want to work with them. In other words, as a taxpayer, I presume you expect that every single appropriation has been looked at and analyzed and debated. In other words, let that sun shine in. It's called transparency. And if the members of Congress think it's a good idea, then they ought to vote it up or down and then send it to my desk so I know full well that there's been full scrutiny in Congress. We can do a better job with your money. And one way to do so is to reform the earmark process.

Another way to do a better job with your money is to give me the line-item veto so I can work with Congress. In other words, what happens is, is that we have -- we debate the size of the pie. In other words, in order to balance the budget, we need this much top line spending. But a lot of times, we don't -- it makes it different to deal with the slices of the pie. And I believe there needs to be a process where the President has got the capacity to work with Congress to say well, maybe this slice of the pie doesn't meet a national priority; where I'm able to red-line projects, for example, and send them back to Congress for an up or down vote.

In other words, if Congress is genuinely concerned about spending your money wisely, and I believe most members are, then, one, they got to do something about earmarks. And secondly, they need to work with the executive branch in order to have a tool necessary to let spending be given the full light of day. Most states have line-item vetoes. I believe it to be a necessary reform for the federal government to have the same opportunity to work together.

I want to talk a little bit about entitlement programs. I told you there's discretionary spending. There's also mandatory spending, non-discretionary spending. And the biggest programs, of course, are Social Security and Medicare. I submitted in my budget some reform for Medicare by slowing down the rate of growth from 7.4 percent per year to 6.7 percent per year. And that saves billions of dollars in doing that.

In other words, instead of spending -- instead of saying these mandatory programs will grow at the rate of nearly 7.5 percent, why don't we just be reasonable and see if we can slow it down a little bit. You'll hear people say, well, he's cutting spending. No. That may be Washington, D.C. definition of cut, but slowing the rate of spending saves you a lot of money.

Now, mandatory spending requires more than that as far I'm concerned. We have a fundamental problem when it comes to, say, a program like Social Security. Why? Baby boomers like me are getting ready to retire. Like my retirement date and my Social Security date happen to be the same, 2008. It's convenient. (Laughter.) Sixty-two years old in 2008. And by the way, if you're not 60, it's not as old as it sounds. (Laughter.) And yet there are fewer people paying into the system necessary to support the promises that have been made to me and other baby boomers. Our benefits are growing quite dramatically.

In other words, previous Congresses have said, vote for me, I promise you to raise the benefits inherent in Social Security, without considering the fact that the number of workers paying into the system relative to the number of beneficiaries is shrinking. And the mathematics isn't going to work. And if we don't do something quite rapidly, in my judgment, we're going to saddle a younger generation of Americans, a younger generation of workers, with unbelievably difficult choices -- raising taxes significantly to pay for the promises, slashing benefits, or slashing other programs.

Now is the time for members of the Congress in both political parties to bring their best ideas to the table as to how to solve the problems involved with entitlement programs. And yet, it's really hard to do in Washington, I must confess. There's a lot of politics in the nation's capital, too much, as far as I'm concerned.

And one of my jobs, and I believe the jobs of the leadership of the Congress, is to say, let us look at this problem in a sober light; let us come and address the significant deficiencies inherent in two really important programs -- Medicare and Social Security -- and let us do it for the sake of a future generation of workers. Every year we wait, the problem becomes more acute.

And so I'm hopeful, genuinely hopeful, that I can get Democrats and Republicans in Congress to come to the table. I'll lay out, like I have done over the past years, how I think we all can solve the problems. By the way, I've got an idea how to do so without raising your taxes. And I expect -- would hope other members would come and say, well here's how we think we can solve it, and hopefully we can find some common ground to do our duty.

See, I like to remind people that the job for those of us in Washington is to confront problems now and not pass them on to other people, is to do the hard work necessary to say to America, look, we know your problems, and we're going to do our best to solve them, whether it be on the domestic front or on foreign policy.

I really am upbeat about the future of the country. I feel great about it. All you've got to do is come to Micron and feel good about life. I didn't see a lot of smiles on people's faces because they had those masks on -- (laughter) -- but I detected a bounce in people's step, I detected the fact that I'm here in an exciting place for people to work. I appreciated when the plant manager and the CEO tells me that they spend a lot of time educating people, adding added value so that people will be able to be able to find those jobs that are necessary in the 21st century.

I'll tell you this, that if government and private sector doesn't continue to work together to make sure people have a skill set, the jobs will go somewhere else. And therefore, now is the time to educate our people. We live in a global economy, and therefore, lawsuits matter. If you get sued all the time in America, it's going to make it harder for you to compete with people elsewhere. The amount of taxes you pay matters if you're going to be a competitive company and provide good jobs for people.

And the budget I've submitted to the United States Congress reflects all this. It says we can balance the budget without raising your taxes. We're just going to have to be smart about how we spend your money. It also recognizes that the decisions made in the budget will affect how this company does business.

So you've got two things to pay attention to. One, will Micron remain competitive as a result of government policy, and two, will you have more money so you get to make the decisions? And my fundamental question to the American people is, who do you want making the decisions with your money? Do you want to make it yourself, or do you want the government making those decisions? The budget I've submitted says we can meet our priorities and let you make the decisions with the hard money -- with the money you've earned through your hard work.

So I'm honored to be here. I appreciate you giving me a chance to come and express my views on an important subject. And I ask for God's blessings on you all. Thank you very much. (Applause.)

END 10:45 A.M. EST

* half a million