- Afghanistan

- Africa

- Budget Management

- Defense

- Economy

- Education

- Energy

- Environment

- Global Diplomacy

- Health Care

- Homeland Security

- Immigration

- International Trade

- Iraq

- Judicial Nominations

- Middle East

- National Security

- Veterans

|

Home >

News & Policies >

April 2005

|

For Immediate Release

Office of the Press Secretary

April 15, 2005

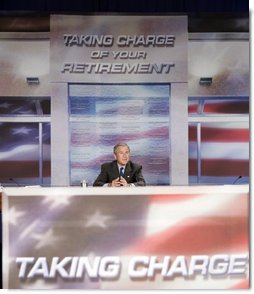

President Participates in Social Security Roundtable in Ohio

Lakeland Community College

Kirtland, Ohio

1:03 P.M. EDT

THE PRESIDENT: Thank you all for coming. Please be seated. I appreciate you coming, Steve, thanks. Glad to give you a ride home on Air Force One. (Laughter.) I really do like working with Steve. He's a thoughtful fellow who cares about issues, and this is -- what we're going to talk about is an important issue, which is Social Security.

Before I do, I want to thank the community college for hosting us.

I'm a big believer in community colleges. Community colleges have got

the capacity to change curriculum to meet the needs of a local work

force, for example. And one of the real challenges of the 21st century

is to make sure people have got the skills necessary to fill the jobs

of the 21st century. And a fabulous place to find those skills is our

community colleges.

Before I do, I want to thank the community college for hosting us.

I'm a big believer in community colleges. Community colleges have got

the capacity to change curriculum to meet the needs of a local work

force, for example. And one of the real challenges of the 21st century

is to make sure people have got the skills necessary to fill the jobs

of the 21st century. And a fabulous place to find those skills is our

community colleges.

So, thanks for what you do; thanks for being a host; thanks for letting us come and have a -- what I think you'll find to be a really interesting educational experience about a vital issue confronting the country.

I want to thank Lt. Governor Bruce Johnson for joining us. I appreciate State Treasurer Jennette Bradley for joining us today. I want to thank the Mayor, Ed Podojil, who is here. I appreciate you, Mr. Mayor. And I want to thank Dave Anderson. The last time I saw Dave, I said to Dave, I said, "Dave, fill the potholes." (Laughter.) That's just a piece of advice. (Laughter.) And so I saw him in line coming in. He said, "I'm just here to report for duty Mr. President. I did fill the potholes." (Laughter.) You'd get reelected if you want to run again. (Laughter.)

Anyway, I want to thank Anita Isom, who's with us. Anita is a young lady I met when we landed there at the airport in Cleveland. She is a volunteer and she has helped, and been awarded because of her reading-related activities that benefit others. The reason I like to mention a soul like Anita is that, no matter what your age, no matter where you live, you can help this country by becoming a volunteer, by helping somebody who hurts, by teaching somebody to read, or feed somebody who's hungry, or put your arm around somebody who needs love.

I like to remind people that the greatest strength of this country is the heart and souls of our fellow citizens, and the great compassion of our people. And so if you're interested in serving America, do so by becoming a volunteer in the community in which you live, and help change this country one heart and one soul at a time.

So, Anita, thanks for coming. Thanks for meeting me at the airport.

Let me talk about Social Security. I could be talking about a lot of things -- peace and freedom. The world is changing right now because societies are becoming more free. And as societies become more free, more democratic, the world will become more peaceful.

Today I went to a little restaurant, and the owner happens to be Lebanese American. And he said, thank you, Mr. President, for staying focused on a country like Lebanon and insisting that Lebanon be allowed to have free elections. And I assured him, like I'll assure you, that when America speaks, we mean what we say; when we say free elections to the Syrians, we mean free elections. Get out of Lebanon and let this good country have a free election, as scheduled. When I say, get out of Lebanon, I mean out of Lebanon with all your troops and all your security services and all the people trying to influence that government. It is in the world's interest that Lebanon be allowed to have free elections, because a free society will help spread the peace. (Applause.)

We're dealing with a lot of issues, and in Washington, D.C. I've

submitted a tough budget and expect the Congress to be wise about how

you spend your money. I also know that Congress needs to stop debating

and get an energy bill to my desk -- now, during this session.

(Applause.)

We're dealing with a lot of issues, and in Washington, D.C. I've

submitted a tough budget and expect the Congress to be wise about how

you spend your money. I also know that Congress needs to stop debating

and get an energy bill to my desk -- now, during this session.

(Applause.)

Congress also needs to take serious this issue about Social Security. People say, well, why did you bring it up? I said, I brought it up because I see a serious problem that needs to be fixed now before it's too late. I also brought it up because the job of a President is to confront problems, and not pass them on. The easy route in politics is to say, well, we got us a problem, we'll just let the next person handle it. The easy route for a member of the United States Senate is to say, there is a problem, but it perhaps can wait. We'll just let another United States Senate fix it, or send it to the House. That's not the way I think. I think I got elected because people expect me, when I see a problem, to bring it to the fore and to work with people to get it solved.

And here's the problem in Social Security. There's a lot of people like me getting ready to retire. (Laughter.) As a matter of fact, I'm retiring in four years -- at least I hit retirement age in four years -- which is convenient -- (laughter) -- in my case. I turn 62 in 2008. And I'm not the only one turning 62 in 2008. As a matter of fact, there's a lot of us. We're called the baby boomer generation. And not only is my generation fixing to retire, we are living longer than previous generations. And not only are we living longer than previous generations, we have been promised greater benefits than the previous generation. In other words, people running for office say, put me in office and I'll increase your Social Security benefits for you. And guess what -- they did.

And so a lot of us are getting ready to retire. And the problem comes because there's not a lot of people paying into the system. See, in 1950, there were 16 workers for every beneficiary. So you can imagine the load was somewhat lighter than today, when there's now 3.3 workers for every beneficiary. And soon there's going to be two workers for every beneficiary. You've got fewer workers paying into a system that is going to require more and more out-flow, because a lot of us are retiring, living longer, and been promised greater benefits. And the math just doesn't work.

It's a pay-as-you-go system, by the way. That means, when the money goes in, it comes right out. It's not a trust. I mean, some people in America I suspect think that the federal government all these years has been collecting your payroll taxes and we're holding it for you. And then when you get ready to retire, we give it back to you. That's not the way it works. The way it works is, is that we collect your payroll taxes and we pay the current retirees their benefits, and then with leftover money we spend it on other things. That's the way the system works. It's pay-as-you-go.

And in 2017, the pay-as-you-go system is going to go negative. In other words, more money goes out than comes in through payroll taxes. And every year thereafter, if we don't do something, it gets worse and worse and worse and worse. To give you an example of how bad it gets, in 2027, the federal government is going to have to come up with $200 billion more a year just to make good on the payments. And it gets worse the next year, and the next year, and the next year.

I also want to assure those of you who are on Social Security, you will get your check. See, nothing changes for somebody born prior to 1950. And that's very important for people in Ohio to hear, because I fully understand a lot of people count on that Social Security check. That Social Security check means a lot to a lot of people in America, and they're counting on it. That's why, for example, in some political campaigns people try to say to seniors, you know, if so-and-so gets into office, he's going to take your check away from you. That's the old scare tactics. Sometimes during this debate it seems like people are resorting to those scare tactics. They're telling seniors, really what they're talking about is taking your check away. Let me just tell you, point-blank: If you're receiving a Social Security check in Ohio, this government of ours will continue to honor you, honor that commitment.

This issue isn't about you. This issue is about your grandchildren. The issue confronting the Social Security system is an issue for young workers, young people coming up. One time I was having a discussion and the person said, I saw a survey -- I said, oh, yeah, what did it say? It said young workers like me are more likely to see -- think we're more likely to see a UFO than get a Social Security check. (Laughter.) That may be pretty close to accurate.

I'll tell you this: If this federal government doesn't act, your bill, your payroll taxed are going to have to go up a lot in order to pay the promises made to me. Or the government is going to have to slash the benefits. Or the government is going to have to make dramatic cuts in other programs. And so I see a problem. I think the math is clear. And so now is the time to get something done.

And so I stood up in front of the United States at my State of the Union address and said to the Congress, here's the problem. And I'm going to put some ideas on the table, ideas that I didn't necessarily think of; ideas that President Clinton had thought of, or Senator Moynihan, a great member of the United States Senate from New York, who, unfortunately, has passed away -- or former congressman Tim Penny -- good ideas about different ways to permanently fix the problem. And that's what Congress must do; it must permanently fix the problem.

In 1983, one of my predecessors, President Ronald Reagan, got together with Speaker O'Neill from Massachusetts, and they said, we got a problem, let's fix it. See, the math wasn't working then either. It was called a 75-year fix. They signed a bill -- I love the spirit, by the way, of Republicans and Democrats setting aside their political parties and focusing on getting something done for the American people. And the President did that, the Speaker did that for the 75-year fix. The only problem is, 22 years later we're still talking about it. And so now is the time to bring people together from both parties to have a permanent fix. And all ideas are on the table. And I'm looking forward to discussing any good idea with a Democrat or a Republican.

I imagine there's some people fearful in Washington, D.C. about maybe laying out an interesting idea and that one of the political parties will get all over them for laying it out. If I had anything to do with it, it would be political amnesty for people bringing good ideas forward. Now is not the time to play political "gotcha" with a member of any political party, for stepping up and bringing forth ideas to do what they think is right to help solve this problem permanently for generations of Americans to come.

Now, one of the ideas that I think is important for the Congress to consider is to allow a younger worker to be able to set aside some of her, or his own money in a personal savings account, as a part of a Social Security solution. See, I think government ought to say, we'll give you an opportunity, if you want to -- your choice. We're not saying, you must set aside money. We're saying you ought to have the opportunity to, it ought to be voluntary to set aside some money so that you can earn a better rate of return on your money. People ought to be given a chance to invest in a conservative mix of bonds and stocks.

In other words, it's part of a permanent solution in order to make sure the younger worker gets a better deal. The younger worker ought to be allowed to set aside some of the payroll taxes. And this is a concept, by the way, that has been tried before. I haven't invented the idea. As a matter of fact, the federal -- Congress before has said, we ought to allow people working in the United States Congress, and congressman and United States senators to do just what I described. The Federal Employee Thrift Savings plan allows members of Congress and the United States Senate to take some of their money and set it aside in a personal savings account. Why? Because they know they'll get a better rate of return on their money than if the federal government held it. And it seems fair to me that if setting aside money in a personal savings account is good enough for a member of the United States Congress, it's good enough for workers all across America. (Applause.)

Okay, so I went to school with a guy who made all A's. It's probably recognized by now I didn't do all that well in college at times. (Laughter.) And I brought him with me. He's an expert. He's my National Economic Advisor. But I want you to notice, you students out there, who's the President and who's the advisor. (Laughter and applause.)

I've got a fabulous staff. People need to judge the President based upon who he listens to. And as you know in foreign policy matters, I listen to some really capable people -- Condi -- Condoleezza Rice, the Secretary of State; Secretary Rumsfeld. And on the domestic side, I've got great people working with me. One of them is Al Hubbard, a business guy out of Indiana, started businesses, ran businesses, entrepreneur. He's agreed the come and serve as the National Economic Advisor to the President. He briefs me on a regular basis. And one of the big issues that I've got him working on is Social Security.

I want to thank for coming, Al. And if you got something to say, now is your opportunity. (Laughter.) Please don't try to defend yourself because the President always has the last word. (Laughter.)

MR. HUBBARD: Yes, sir, I've learned that very quickly. Thanks for giving me this opportunity.

* * * * *

THE PRESIDENT: You're the guy who authored the bill?

MR. SINES: I had the first bill in 1994.

THE PRESIDENT: Really.

MR. SINES: Introduced it.

THE PRESIDENT: If you got any spare time, you might want to come up to Washington and work the issue with me. (Laughter.)

MR. SINES: Well, Mr. President -- I really like Lake County. (Laughter.)

* * * * *

MR. SINES: I have three daughters, and kind of in the same mode as you, we're in a special club when you raise daughters.

THE PRESIDENT: Yes. Your hair is about as white as mine. (Laughter.)

MR. SINES: Yes, it is and it's getting whiter. And it's getting whiter.

* * * * *

THE PRESIDENT: It must make you feel good to be able to sit here in front of all these TV cameras and say, I saw a problem, I worked with people from both sides of the aisle to fix it, and it's working. That's the spirit the people in the United States Congress must hear. It's not time to play politics, it's time to fix the problem. It's time to set aside all this business about, my party may look good, or so-and-so may look good, and so-and-so may look bad -- we've really got an opportunity, a need to fix it.

And secondly, I am -- I just want you to know that like you went through, there were some moments as to whether or not you thought the thing would pass. Yes, well, you know something -- I'm going to be relentless on the subject because I believe the American people, once they understand there's a problem, once they understand the math, and once seniors understand that nothing is going to change, the next question to members who have been elected is why aren't you doing something about it? See, if there's a problem, you saw the problem, and people begin to recognize the nature of the problem and the size of the problem and the cost of inactivity, and senior citizens understand that the propaganda they may have heard about somebody taking away their check simply isn't true, the next logical extension of the debate and the discussion is, say, if we got a problem, and I'm going to get my check, what are you going to do about my grandkids? It's a generational issue.

And we're just starting. So don't worry about me, Ray. I'm feeling pretty good about -- feeling pretty good about where we stand. The American people are wise. They just need to know the facts.

Part of the facts is understanding we have a problem, and part of the facts is what you're going to do about it. And today, this is an interesting opportunity for people to see a system that is -- I bet most people in America don't understand what happens here in Ohio when it comes to the retirement system. And so, thank you, for being an innovator, and thank you for being a leader.

Now, who's next, Hubs.

MR. HUBBARD: Mr. Scott Johnson, who is very involved with the Ohio Public Employees Retirement System. And he can describe this new innovation that Ray provided through the legislature.

THE PRESIDENT: Good, tell us what you do.

MR. JOHNSON: Thank you, Mr. President. I'm Scott Johnson, I'm Governor Taft's director of administrative services. That's a central services organization similar to your General Services Administration, only added human resources and personnel.

* * * * *

THE PRESIDENT: By the way, I went to West Virginia the other day and saw the asset base of the so-called Social Security trust: You know what, it was about four or five file cabinets full of paper. (Laughter.) It was the IOU left behind from one hand of government to the other hand of government.

MR. JOHNSON: We've been operating since 1935, but of course, society has changed a bit over that period of time.

* * * * *

THE PRESIDENT: Sorry to interrupt you. Presidents do that sometimes. (Laughter.) Portability -- so if somebody is listening and they're not exactly sure what that means and why that would be important to them --

MR. JOHNSON: University professors typically move around.

THE PRESIDENT: Right.

MR. JOHNSON: And in mid-career may move from one university to another. And so they've already gotten some sort of retirement system underway and would like to move that from where they are, to where they're going.

THE PRESIDENT: If they change jobs they could take their retirement account with them.

MR. JOHNSON: Exactly.

THE PRESIDENT: Yes. That's important for people to know. That's a concept that's an important part of any good plan, would be to recognize the needs of the person that is receiving a part of their retirement. They can move.

Go ahead.

* * * * *

THE PRESIDENT: I think that's a reasonable concept, don't you, folks? Government says to the people you have a choice to make, you know? (Applause.)

MR. JOHNSON: So what you, therefore, have with that combined program is a system where the portion that the employer -- the state, or the county, or the city -- contributes is administered by the professionals at the system. And the amount that the employee himself or herself contributes could be managed by that employee.

* * * * *

THE PRESIDENT: Yes, I guess, you can't take the money and put it in the lottery?

MR. JOHNSON: Well, even though we run a lottery --

THE PRESIDENT: Or on the trotting jockey -- trotters or whatever it is next door here.

MR. JOHNSON: No, sir, you can't do that.

THE PRESIDENT: The point is that there is a relatively conservative, or conservative mix of what's available for people to invest in. Is that an accurate assessment of the choices people have to make?

MR. JOHNSON: The choices are all responsible ones, Mr. President.

THE PRESIDENT: I don't know about the lottery being irresponsible -- (Laughter.)

MR. JOHNSON: But there is a great deal of variety and individual ability to be aggressive or not so aggressive as one chooses.

THE PRESIDENT: That's right. See, it's an interesting concept that the people of Ohio have put in place. And the government basically said, hey, why don't we trust people. After all it's their own money. Why don't we give them a chance to -- (applause.) But you just can't go -- there is a certain set of parameters, I presume, Scott, that -- just like there is for the federal employees, by the way. In other words, here's some options for you.

Some people think about whether or not people ought to be allowed to invest. They call it risky. I don't think it's risky to let people earn a better rate of return on their money, but obviously there's some parameters, there's some go-bys. And as you said I think there's eight different options -- nine different options.

MR. JOHNSON: Nine, yes.

THE PRESIDENT: In other words, the government says -- the government does play a role and says here's nine different opportunities for you to have a mix of stocks and bonds, or it can go totally bonds, totally stocks, or is it generally a mixture? How does it --

MR. JOHNSON: Mr. President, there are layers of choices you can make. You could if you wish choose one of three pre-mixed options.

THE PRESIDENT: Got it.

MR. JOHNSON: One would be conservative, one less conservative, and one, frankly, aggressive. Or you could if you wish develop your own asset mixture. You could have some bonds. You could have some equities. You could have TIPS. Conceivably, you could invest it all in bonds.

THE PRESIDENT: Yes.

MR. JOHNSON: You could do that if you wish to do so.

THE PRESIDENT: Okay, you got any average rate of return on these programs? Or is that impossible to do?

MR. JOHNSON: It's not impossible to do, but it's beyond my level of expertise. (Laughter.)

THE PRESIDENT: Okay. Well, I was talking with Senator McCain who told me that he thought his rate of return I think was over 7 percent, in his employee retirement Thrift Savings Plan, over time. In other words, a conservative mix of stocks and bonds that the government -- federal government allows federal employees to make, a rate of return over 7 percent. You see, if you're keeping you money in the Social Security system, it's about 1.8 percent. And the difference for a younger worker between 7 percent and 1.8 percent over time is a lot of money because interest compounds. It grows. Money grows over time.

And I think that's one of the reasons why the employees said if it's good enough for professors, why don't you let me have a taste of this, too? Why don't you give me a chance to watch my money grow and let me control it, and let me own it.

So, I appreciate you bringing that forward, Scott, thank you.

MR. JOHNSON: Yes, sir.

THE PRESIDENT: Very good job. (Applause.)

Betty Young, welcome. What do you do, Betty?

MS. YOUNG: Thank you, Mr. President, and it's an honor and a pleasure to be here. I'm the executive director of Human Resource Services for the University of Cincinnati.

* * * * *

THE PRESIDENT: First, you notice that Betty talked about 401(k)s and IRAs. I don't remember 401(k)s when I was growing up. In other words, there is a new culture in America when it comes to people managing their own assets -- 401(k)s encourage management of your own assets -- IRAs. In other words, more and more people in America are now becoming used to controlling their -- managing their own money.

I presume you find a certain reticence initially, when -- that says I'm not so sure I can do this.

MS. YOUNG: But you don't have to be a Wall Street wiz.

THE PRESIDENT: Right.

MS. YOUNG: For example, the university requires that the different providers that offer these programs, that they provide educational materials.

* * * * *

THE PRESIDENT: That's good. You know interesting thing that Betty talked about was encouraging people to open up a quarterly statement, or if you so choose, you can look at your wealth on a daily basis. I think that's an interesting concept. It seems like to me we'd like all of America doing that, watching their assets grow. Not just Wall Street wizzes, but everybody. I mean, if more people owned something -- (applause.) I like the idea of having a program in Ohio where it encourages ownership. Not just one type of person, but all people have got access to ownership.

It seems like to me a more hopeful America is going to be one in which people say, I'm watching my assets grow and I'm more -- let me just say, politicians will be -- their actions will be a lot more scrutinized when somebody is watching whether or not the decisions made in Washington is affecting their work, on a daily or quarterly basis. In other words, the more people paying attention to their assets, the more people will be paying attention to what happens in Washington, D.C., or in Columbus, Ohio.

So thanks for bringing that to my mind. Let me ask you this: Obviously, there's a certain role for the state, and that is the state has chosen the providers -- is that right -- screened and chosen the providers?

MS. YOUNG: Yes. The Ohio Department of Insurance screens and chooses the providers that participate in the Ohio Alternative Retirement Program.

THE PRESIDENT: So the charge that somehow a fly-by-night is going to get a hold of somebody's retirement account and fritter it away is frivolous.

MS. YOUNG: Correct, because if there's ever a problem, for example, with one of the providers, then as the person that manages the program at the University of Cincinnati, then I can contact the Department of Insurance, or go directly to that company about any issues that we may have.

THE PRESIDENT: One of the other things that Betty talked about was mixing risk. And people need to understand that you can constantly change the risk of your asset base -- that, for example, if you're 20 years old, you can take a little more risk. And when it comes time for fixing to retire, you switch from, perhaps, stocks -- mix up stocks and bonds to a greater mix of bonds to stocks, so that you're able to decide for yourself what kind of asset base you have, relative to where you are in the retirement -- how close you are to retirement age. And I presume people are doing that, constantly switching in and out all the time to manage their assets.

* * * * *

MS. YOUNG: I have funds in a portion that is guaranteed 6 percent -- that won't change during the life of the account.

THE PRESIDENT: About 6 percent. It's a lot better than 1.8 percent in the Social Security system. And the difference between the 6 percent and the 1.8 percent over Betty's lifetime is a significant amount of money. And that's important for people to understand. What we're trying to do is to learn lessons from a state like Ohio, apply it at the federal level, so workers get a better deal. And part of a better deal is a better rate of return. And part of a better deal, by the way, is saying, I own it.

You listen to Betty's language -- she's talking about her assets. She's not relying upon the government, she says, these are my assets and I own these assets. And that's important. The more people own an asset, and the more people are able to say, I'm going to pass it on to my son or daughter, whoever I choose, the better off America is. You see, being able to spread wealth. (Applause.)

Thank you, Betty. Good job.

Let me say one thing about the Social Security system before we get to Rick. Do you realize the system today is structured so that if you die early and you leave behind a spouse -- say, you started working and contributing to the system at age 21, and you died at 51, 30 years of work, and you leave behind a spouse, and the spouse works, like many families in America, there's two spouses working -- that the -- and the spouse is the same age as the husband or wife, there are no death benefits if you're younger than 62 years old. And secondly, when the surviving spouse retires, he or she will get to choose between the survivor benefits or the contributions that he or she has made -- is owed by the government, whichever is greater, but not both.

Now, think about that. That's a system in which the person who's worked for 30 years, put in the money and it's just gone. I don't think that makes sense for a good retirement system. The system here in Ohio essentially says that, if the principle were applied to the federal government, you have an asset. It grows. You watch it, you manage it, and if you pass away you can leave it to your spouse to help that person transition, then help that person live life. It's an asset. This asset doesn't exist in a file cabinet in West Virginia, it's yours. It's an asset that you call your own, that can help you.

Now, when people retire here, I presume you can't spend all your asset base at once.

MS. YOUNG: You could take a withdrawal on a lump-sum basis, but normally, again, your AARP provider is going to work with you to design how you should now start drawing down on your money to ensure a level of income throughout your remaining lifetime.

THE PRESIDENT: That's what the -- that's the vision at the federal level for a personal account, is that there will be a draw-down to help complement the check, however big it's going to be from the federal government. All I'm telling you is we made promises to younger workers we can't keep. In other words, we've said we can pay you; we can't. Do you realize that in order to make sure that the payments that we promised to retirees are kept, that a younger worker may have to pay upwards of an 18-percent payroll tax. Try that on if you're a small business owner. Try that on if you're struggling to get ahead. We need to fix it now, and one way to -- a part of making sure the retirement system works well is to listen to the example right here in the state of Ohio.

Rick, ready to roll?

MR. STENGER: I certainly am.

THE PRESIDENT: Okay. What do you do?

MR. STENGER: I'm currently one of the directors of the Lake Metropark System. We want to welcome you back to Lake County. The last time you were here --

THE PRESIDENT: Yes, I know -- thank you.

MR. STENGER: You and 20,000 friends came and had a good day. (Laughter.)

THE PRESIDENT: I hope LaTourette stayed behind to clean up. (Laughter.)

MR. STENGER: Steve got busy. He was there, but he was watching us. (Laughter.)

THE PRESIDENT: Okay. He was an executive. (Laughter.)

* * * * *

THE PRESIDENT: How did your money do in the Social Security system?

MR. STENGER: Yes, 1.8, I think, right?

THE PRESIDENT: Yes. You take a 6-percent differential, or 5.2 percent differential over a number of years, and you're going to see some serious money. And it ought to grow. The government ought to give opportunities to our fellow citizens to have their money grow in a conservative mix of stocks and bonds just like they did. It seems to make sense to me. (Applause.)

MR. STENGER: Mr. President, one of the things that I found very helpful and interesting is the system does a good job of educating, because you come in and you're not sure what to do, and many people are afraid of change -- they had a battery of questions to answer, I think 20-some questions, and it sort of guided you as to where you fit on the investment scale. If you answered the questions, it would give you a score, and the score would sort of catagorized you into you're okay to aggressively do it, conservatively do it, moderately do it. So people who are afraid of it don't know -- you answer this batter of questions and it gives you a pretty neat answer.

THE PRESIDENT: Yes. See, that's an interesting point. I think some people are fearful of the obligation, I guess is what it -- of investing their own money. They're not exactly sure what the words mean. It's kind of an interesting assumption here in America, the investor class is only a certain type of person. I don't buy into that. I think all people are capable of learning what investment means. People from all walks of life, all neighborhoods have got the capacity to manage their own money. And you say the system helps people learn the words and learn what all this means. I mean, it's kind of fancy -- rate of return, bonds and stocks.

MR. STENGER: And the nice thing about it, too, as Betty mentioned earlier, you can change. If you realize, well, I went real aggressive and your lifestyle changes for whatever reason and you want to change, you can get on-line. You can do it daily, if you so desire. You can take your quarterly statement, analyze it, make changes appropriately if you so desire. It's not like you're stuck with the choice you made.

THE PRESIDENT: How do you make sure like these firms don't gouge you when it comes to fee? They've got a captive audience, they've got you pretty well roped in once you make the decision. How does Ohio make sure that these fees aren't going up, that they're reasonable?

MR. STENGER: Scott would know more than I do, but if I read right, the fees are defined, depending on the plan you chose. I think the plan I chose they're about .24, if I'm not mistaken.

THE PRESIDENT: -- .24, sounds reasonable.

* * * * *

THE PRESIDENT: I appreciate that. Listen, thanks for sharing this with us.

I got on the airplane, I started paying attention to what I was going to hear today, and I was amazed at the willingness of the great state of Ohio to think differently on behalf of the people who live here. And it struck me about how relevant this conversation was going to be, for others to listen to what is possible for Social Security.

Now, look, we need to come together in Washington and we need to work on a permanent fix, all options are on the table. But part of that solution, in order to make it a better deal for younger workers, is for people of both parties to trust people with their own money, to devise a system that would work similar to the state of Ohio, that would say, we're going to let you earn a better rate of return for your money, that would enable a mom or a dad to pass on their assets to whomever they chose, that would encourage portability, but that makes sense. It makes sense. The more somebody owns something in America, the more they're going to have a vital stake in the future of this country.

The state of Ohio has incorporated a lot of really important principles in this bill, Ray, and I want to thank you for that. One of the key principles is government has got to trust people. The more government trust people, trust people with their own money, the more content, the more prosperous our society will be.

And so I want to thank you all for sharing with us. I hope you found it as educational as I have. I look forward -- (applause.) I look forward to continuing to take this message to the people of the United States of America. I have great faith in the wisdom of the people of this country, and I fully understand that when the people of this country understand the depth of the problem that a young generation of Americans is going to face, and when senior citizens understand that they're going to get their check, the question is going to start to be to members of Congress of both political parties, how come you're not fixing it. Because America is going to realize that every year we wait it's going to cost the young generation of Americans $600 billion to make this right.

And here's a fascinating idea, started right here in the great state of Ohio, sponsored by both Republicans and Democrats, that's working. And Congress needs to pay attention to things that work.

Thank you all for coming, and God bless. (Applause.)

END 1:55 P.M. EDT